-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

How Are SIP Returns Calculated? Formula & Examples Explained

Jan 21, 2026

5 min

0 Rating

Systematic Investment Plans are a popular way to invest in mutual funds in a disciplined manner. Despite a challenging phase for Indian equity markets, SIP investors highlighted the strength of disciplined investing.

In a volatile market environment in 2025, 97% of equity mutual fund schemes delivered positive outcomes for SIP investors ,

underscoring how systematic investing can help navigate market uncertainty effectively than short-term timing,

depending on market conditions.

What is a SIP? How Does it Work?

A SIP allows you to save and invest a fixed amount into a mutual fund scheme for a longer time interval. Instead of investing a large sum at once, you can invest as you earn . Each contribution buys fund units at the prevailing market price, which changes depending on market conditions.

When markets are high, your investment buys fewer units, and when markets are low, it buys more units. Over time, this averaging effect may help smooth out market fluctuations, depending on market movement and fund performance. SIPs do not remove market risk, but they encourage consistency and long-term investing discipline.

How are SIP Returns Calculated?

SIP return calculation is different from lump sum return calculation because investments are made at different times and at different market levels. Each instalment has a different holding period and a different cost.

This is why looking only at the total invested amount versus the current value does not give an accurate picture. To understand the average return on SIP, the timing of each investment and the duration it stayed invested must be considered. This is where specialised return calculation methods are used.

There are different ways to measure mutual fund returns, but not all of them are suitable for SIPs.

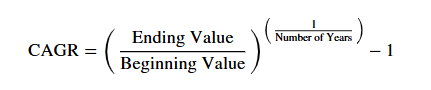

CAGR

The compounded annual growth rate (CAGR) assumes that the entire investment was made at one time and grew at a steady rate. This works well for lump-sum investments but does not accurately reflect SIP investing, where money goes in at different intervals.

Formula for CAGR calculation:

XIRR

It stands for the extended internal rate of return. It is designed to handle multiple investments made on different dates. It considers both the amount invested and the time each instalment remained invested, making it more suitable for SIPs.

Formula:

XIRR = (NPV (Cash Flows, rate of return)/ Initial Investment) x 100

Absolute Returns

It simply shows how much the investment value has increased or decreased from the invested amount. It does not consider time, making it less meaningful for long-term or periodic investments.

Formula:

Absolute return = [(Final value – Initial value) / Initial value] x 100

Why XIRR is the Most Accurate Measure

XIRR is considered the most appropriate method for SIP return calculation because it reflects the real experience of the investor. Since SIP contributions happen regularly, each instalment faces different market conditions and remains invested for a different duration.

By accounting for these variations, XIRR gives a more realistic picture of performance, depending on market movements and fund behaviour.

When investors search for how to calculate SIP returns, XIRR is usually the method used by platforms and statements to show performance.

However, XIRR is not a guaranteed indicator of future performance. It only reflects past cash flows and outcomes, which may change with market conditions.

Factors that Impact SIP Returns

Several factors influence SIP returns, and understanding them helps set realistic expectations:

Market performance plays a major role. Equity-oriented SIPs are directly linked to market movements, while debt-oriented SIPs are influenced by interest rate trends and credit conditions.

Investment duration also matters. Longer holding periods may allow investments to ride out short-term volatility, depending on market cycles.

Fund selection is another important factor. Different funds follow different strategies and invest in different asset classes, which affects outcomes.

Consistency in investing impacts results as well. Pausing or stopping SIPs during volatile phases may affect long-term outcomes.

Expense ratios and portfolio management decisions also influence returns over time. These factors work together and can affect both the minimum and maximum returns in SIP scenarios, depending on market behaviour.

Building Realistic Expectations as an Investor

Understanding how SIP returns are calculated helps investors avoid unrealistic expectations. SIPs are not designed to deliver fixed outcomes. They are market-linked investments, and returns can vary over time.

Instead of focusing only on short-term performance, investors may benefit from aligning SIPs with long-term financial goals and risk tolerance. Periodic review is important, but frequent reactions to market movements may not always be beneficial.

A clear understanding of return calculation methods helps investors interpret statements correctly and stay disciplined during market ups and downs.

Disclaimers:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision.

Source:

https://m.economictimes.com/mf/mf-news/sip-sahi-hai-mutual-fund-investors-win-big-with-97-success-rate-in-treacherous-2025/articleshow/126263316.cms

https://www.sebi.gov.in/sebi_data/faqfiles/sep-2024/1727242783639.pdf - Page 12

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

XIRR is a method used to calculate SIP returns by considering the timing and amount of each investment. It provides an annualised return that reflects how the investment performed over time, depending on market conditions.

SIP returns differ because investments are made at multiple points in time, each facing different market levels. Lump sum investments are made at one time, so their returns are calculated differently.

SIP performance can be reviewed periodically to ensure it aligns with financial goals. Checking too frequently may lead to emotional decisions influenced by short-term market movements.

Yes, SIP returns can change with market volatility. Market ups and downs affect the value of investments, especially in equity-oriented funds, depending on overall market conditions.

Yes, SIPs can show negative returns over certain periods, especially during market downturns. Since SIPs are market-linked, returns depend on market performance and are not guaranteed.

1800-270-7000

1800-270-7000