-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How to include ETFs in your portfolio?

Aug 23, 2022

5 min

3 Rating

Passive investments modes have been significantly in the limelight over the last few years. Globally passive investments have grown over 4 times over the last decade1. India too is witnessing this growth; passive investments AUM having seen a record CAGR of 69% over the last 5 years1.

1 - Finity Report 2021

Globally ETF(Exchange Traded Fund) assets have doubled since 2018, projected to grow almost 50% more till 20242. In India too, ETF AUMs have grown at a CAGR of 57% over the last 5 years3.

2 - Blackrock, Global Business intelligence as of June 2021

3 - AMFI data – March 2017 – INR 52,368cr to March 2022 – INR 4.99lac cr

As it's popularly said – ‘there is no smoke without fire!’. So, what is causing this increased interest in passive investments and how can you join the ride?

Also Check - What are Index Funds?

What's making passive investing popular:

Passive investing as the name suggests, invests passively i.e.: its investment strategy centres around tracking or replicating an existing, underlying index. Index mutual funds and Ex-change traded funds (ETFs) are the offered passive investing tools.

This passive investing strategy gives investors certain features which have made them popu-lar in recent times:

● Requiring limited fund manager intervention means they are offered at low costs = may have the potential for returns to investors, especially when compounded over time

● Relatively managed risks – follow natural selection principle minimising active stock selection risk

● Transparency for investors – as they follow a defined investing strategy linked to a specific index

Also Read - What are Passive Funds?

How can you give your portfolio the flavour of passive investments?

ETFs are a popular passive investment type for this purpose. They are mutual funds whose portfolio seeks to track and replicate an underlying index. Yet they have trade characteris-tics of stocks whereby they can be easily bought and sold over the stock exchange.

A NIFTY 50 ETF for example tracks the NIFTY 50 Index and thus its portfolio invests in the top 50 large cap stocks that are listed on the NSE.

Click here to Visit - Index Funds

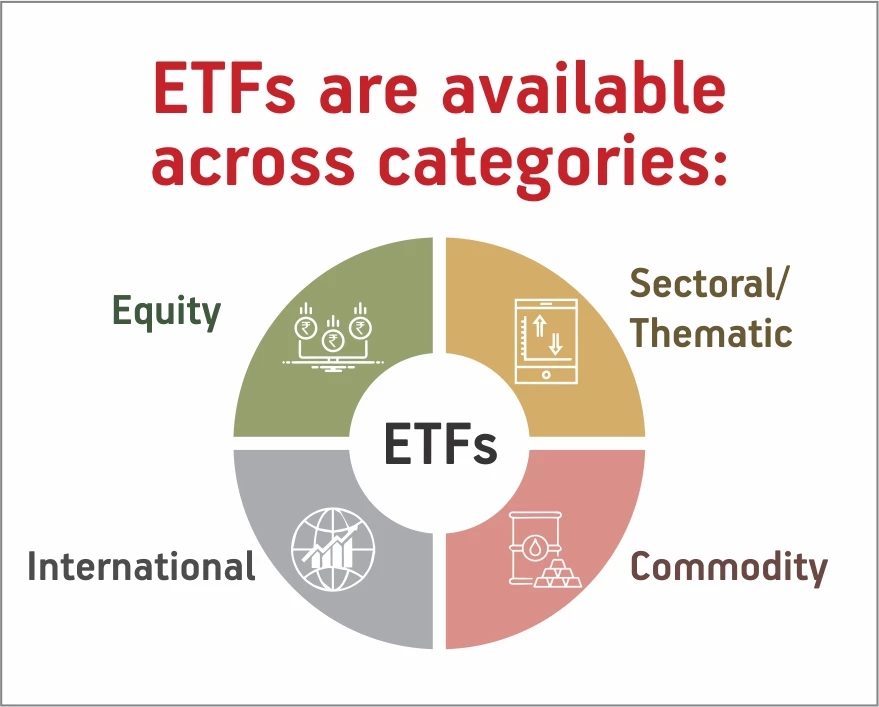

ETFs are available across the board!

ETFs today are available across categories - making it a low-cost way to build your portfolio while maintaining diversification.

Equity ETFs

These are equity-based ETFs which track broad based equity indices such as NIFTY 50, NIFTY 100, NIFTY Next 50 etc.

You can consider these ETFs for your long-term investing goals. Basis your risk appetite you can choose amongst the wide variety of Equity ETFs. For example, if you have a good risk appetite you can choose ETFs based on mid or small cap indices. On the other hand, if you are looking for relative you can choose large cap index-based ETFs such as NIFTY 50, NIFTY Next 50 etc.

Sectoral/Thematic ETFs

These ETFs look to track the performance of a particular sector by replicating sectoral indi-ces such as NIFTY Healthcare, NIFTY IT etc.

Being based on equity, these ETFs too can be considered for your long-term goals. If you have a positive outlook for a specific sector’s future performance, you can participate in them through these sectoral ETFs.

International ETFs

These ETFs aim to access global stock markets by tracking international indices. The inten-tion is to access global investment opportunities, otherwise unavailable in India. Indices tracked can be NASDAQ 100, World Index, NYSE FANG etc.

If you are looking to give your portfolio an international touch, you can consider including International ETFs in your portfolio.

Commodity ETFs

These ETFs track the price of bullion in the market. Currently in India, Commodity ETFs are available for gold and silver.

Commodity ETFs are suited for you if you are looking to add bullion to your portfolio but wish to do so digitally rather than investing in physical gold or silver.

Must read - All you need to know about Silver Mutual Fund

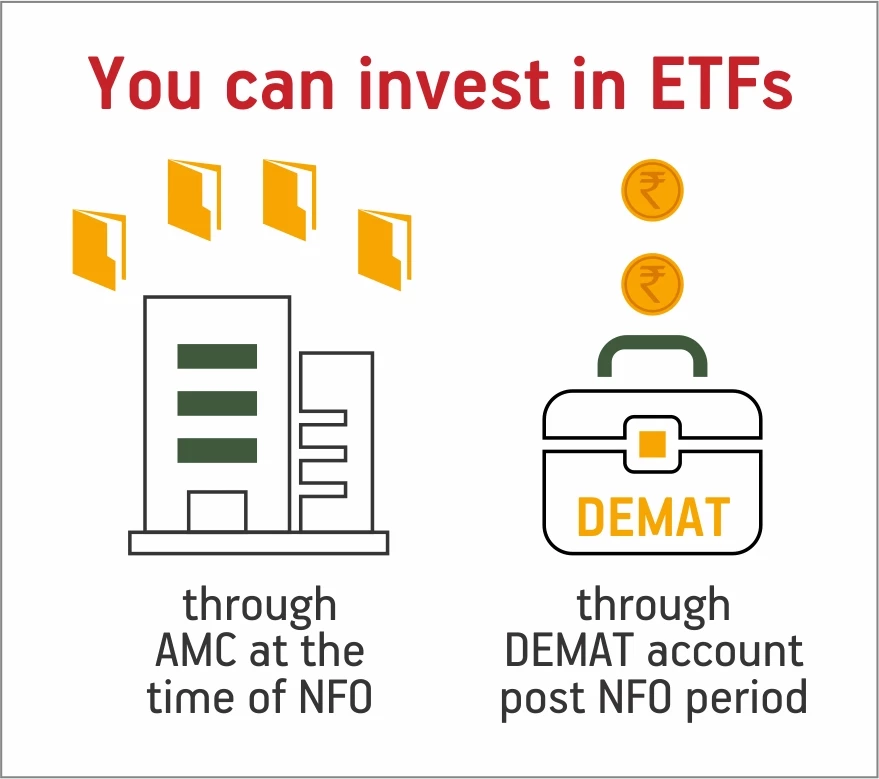

Where can you find these ETFs ?

ETFs are available through both primary and secondary market offering.

ETFs in Primary market are available directly from the issuing AMC at the time of new fund offer of the ETF

ETFs are also available in the secondary market. Being listed, units of ETFs can be easily purchased and sold through recognised stock exchanges after closing of NFO and listing of the units.

Why ETFs ?

ETFs offer a plethora of benefits. Primarily they combine select advantages of both mutual funds and stocks. These include:

Diversification benefit of mutual funds at low minimum investments

Passive investing strategy lends it lower active stock selection risk

Being listed on stock exchanges lends ETFs high liquidity as well as the complete ease of trading akin to stocks

Examples of popular ETFs in India

ETFs are offered across categories and by several AMCs in India today. Aditya Birla Sun Life’s diversified ETF product portfolio has helped the overall ETF’s market in India to grow. Aditya Birla Sun Life offers commodity and equity ETFs across Indices and sectors.

How to invest in the picked ETFs?

As we have seen above, you can invest in an ETF through primary market offerings. Look out for ETF NFOs by your preferred AMC. These you can invest in directly with the AMC, online from their website.

Once listed, it is very simple to invest in ETFs through the secondary market.

Get a DEMAT account…

ETF investments are traded on the stock exchanges. Thus, you must have an active demat account to invest.

…And invest on real-time basis

They are available on the stock market at real-time NAVs. You can subscribe to these units either at the time of the NFO of the ETF or subsequently from the stock exchange

So, gear up, pick your ETFs and get the diversification benefit of mutual funds along with the ease of investing of stocks!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000