-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

Monthly Fixed Income Update - May 2018

Jun 28, 2018

5 mins

4 Rating

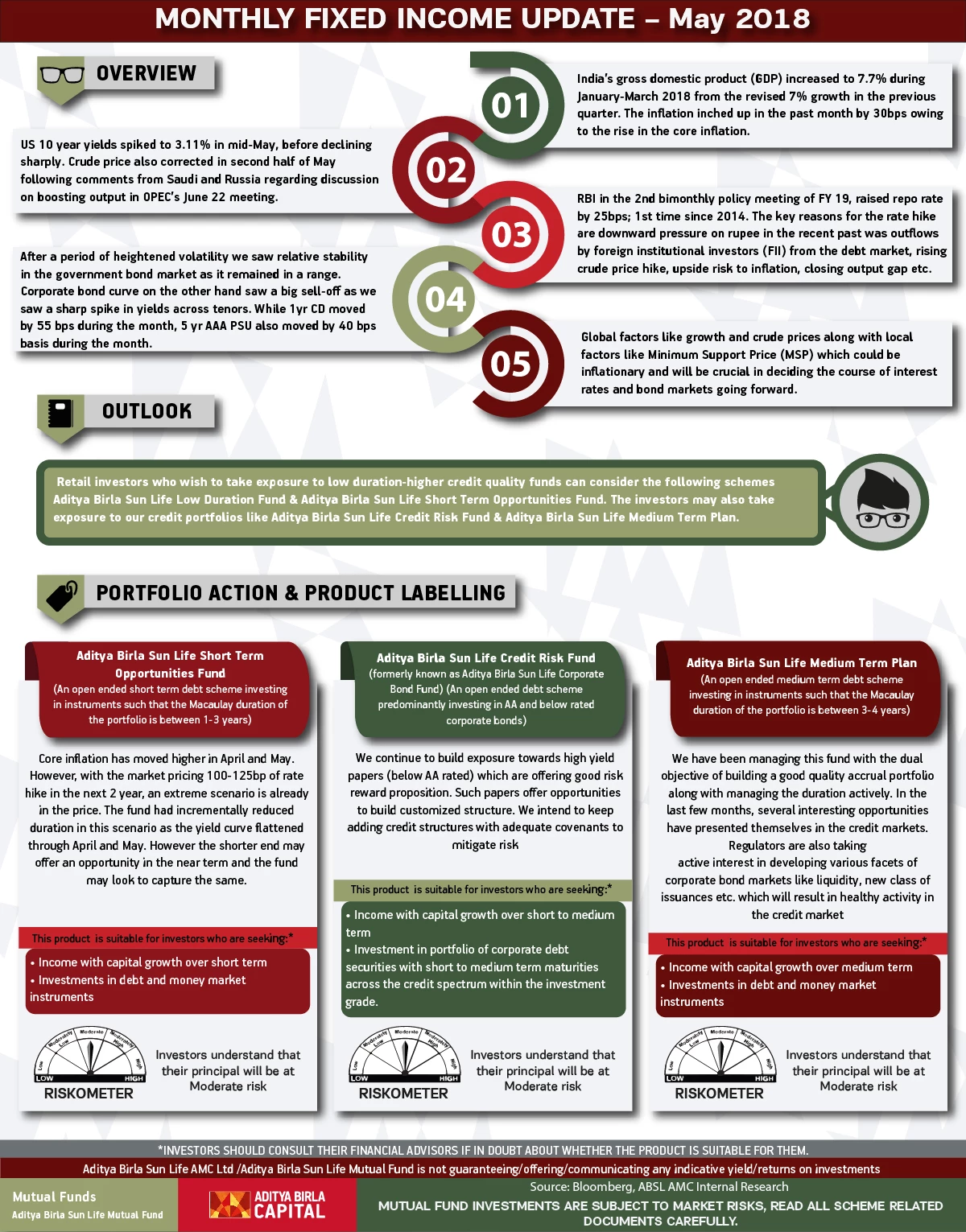

- India’s gross domestic product (GDP) increased to 7.7% during January-March 2018 from the revised 7% growth in the previous quarter. The inflation inched up in the past month by 30bps owing to the rise in the core inflation.

- US 10 year yields spiked to 3.11% in mid-May, before declining sharply. Crude price also corrected in second half of May following comments from Saudi and Russia regarding discussion on boosting output in OPEC’s June 22 meeting.

- RBI in the 2nd bimonthly policy meeting of FY 19, raised repo rate by 25bps; 1st time since 2014. The key reasons for the rate hike are downward pressure on rupee in the recent past was outflows by foreign institutional investors (FII) from the debt market, rising crude price hike, upside risk to inflation, closing output gap etc.

- After a period of heightened volatility we saw relative stability in the government bond market as it remained in a range. Corporate bond curve on the other hand saw a big sell-off as we saw a sharp spike in yields across tenors. While 1yr CD moved by 55 bps during the month, 5 yr AAA PSU also moved by 40 bps basis during the month.

- Global factors like growth and crude prices along with local factors like Minimum Support Price (MSP) which could be inflationary and will be crucial in deciding the course of interest rates and bond markets going forward.

Outlook

- Retails investors who wish to take exposure to low duration-higher credit quality funds can consider the following schemes Aditya Birla Sun Life Low Duration Fund & Aditya Birla Sun Life Short Term Opportunities Fund. The investors may also take exposure to our credit portfolios like Aditya Birla Sun Life Credit Risk Fund & Aditya Birla Sun Life Medium Term Plan.

Source: Bloomberg, ABSL AMC Internal Research

Portfolio Action

- Aditya Birla Sun Life Short Term Opportunities Fund (An open ended

short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1-3 years):

Core inflation has moved higher in April and May. However, with the market pricing 100-125bp of rate hike in the next 2 year, an extreme scenario is already in the price. The fund had incrementally reduced duration in this scenario as the yield curve flattened through April and May. However the shorter end may offer an opportunity in the near term and the fund may look to capture the same. - Aditya Birla Sun Life Credit Risk Fund (formerly known as Aditya Birla

Sun Life Corporate Bond Fund) (An open ended debt scheme predominantly investing in AA and below rated corporate bonds):

We continue to build exposure towards high yield papers (below AA rated) which are offering good risk reward proposition. Such papers offer opportunities to build customized structure. We intend to keep adding credit structures with adequate covenants to mitigate risk - Aditya Birla Sun Life Medium Term Plan (An open ended medium term debt

scheme investing in instruments such that the Macaulay duration of the portfolio is between 3-4 years):

We have been managing this fund with the dual objective of building a good quality accrual portfolio along with managing the duration actively. In the last few months, several interesting opportunities have presented themselves in the credit markets. Regulators are also taking active interest in developing various facets of corporate bond markets like liquidity, new class of issuances etc. which will result in healthy activity in the credit market.

Aditya Birla Sun Life AMC Ltd /Aditya Birla Sun Life Mutual Fund is not

guaranteeing/offering/communicating any indicative yield/returns on investments

Mutual Fund investments are subject to market risks, read all

scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000