-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Recapping Interim Union Budget, 2019-20

Jul 05, 2019

6 mins

4 Rating

Direct Tax Reforms - For Salaried Persons, Senior Citizens & Professionals

We saw the interim budget presented in February this year, brought a wave of tax reforms. Departing from the convention of a typical interim budget, yet as anticipated, it was packed with a bunch of tax policy changes.

Let’s look at how each of the changes could affect your individual tax outflows:

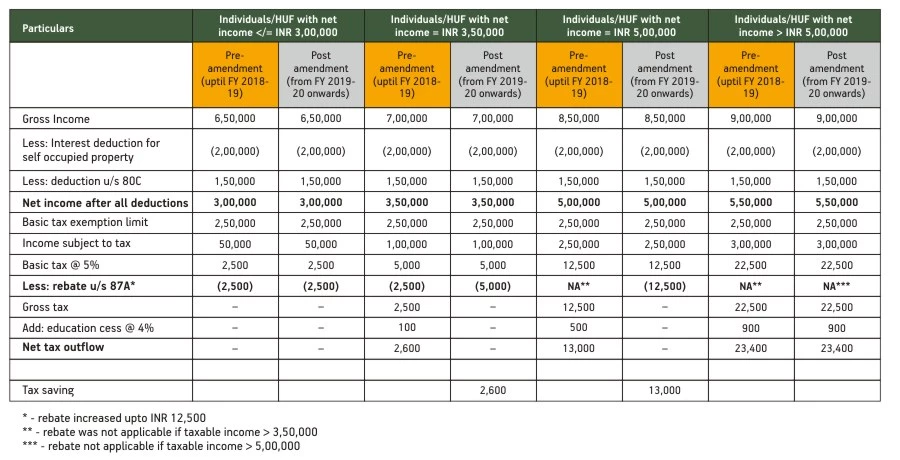

Increase in tax rebate for income up to INR 3,50,000 to INR 5,00,000

Rebate u/s 87A increased from up to INR 2,500 to INR 12,500

Rebate available to those having taxable income (after deductions) up to INR 5,00,000 (increased from INR 3,50,000)

What does this mean for you?

Basis the example mentioned above, Potential tax savings ranging from INR 2,600 to INR 13,000 for the year if net income is between INR 3,50,000 to INR 5,00,000

If you are a salaried individual, then it means a lower tax deduction and higher in hand payment to you each month.

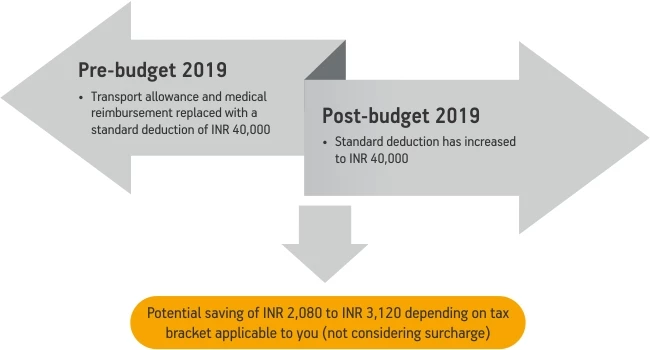

Increase in standard deduction from INR 40,000 to INR 50,000 per year for salaried persons

Calculation of potential savings depicted above is made assuming net taxable income more than Rs. 5,00,000/-

Increase in limit for deduction of tax at source (TDS) on bank interest from INR 10,000 to INR 40,000

Welcome move, especially for senior citizens for who majority of income is from bank interest

Increase in in-hand periodic interest payments, to the extent of INR 3,000 per year (10% TDS on increase in limit of INR 30,000)

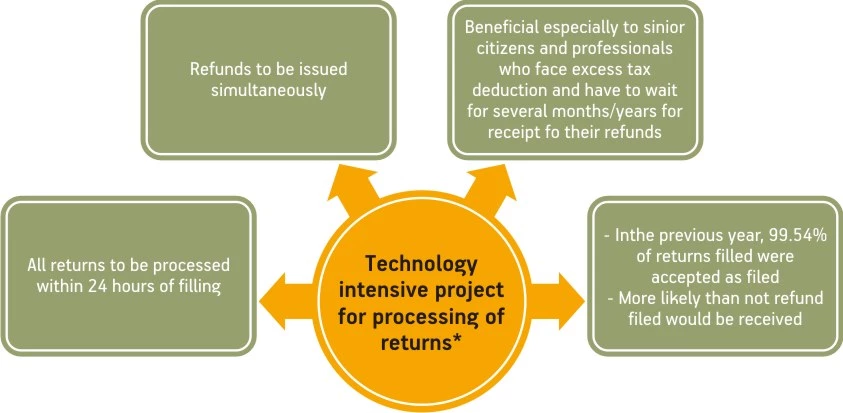

Announcement of technology intensive project to revolutionize system of processing returns

*Effective date for implementation of this project yet to be announced

The final budget arrives this week and it would be interesting to watch what would be retained and what would be changed.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000