-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

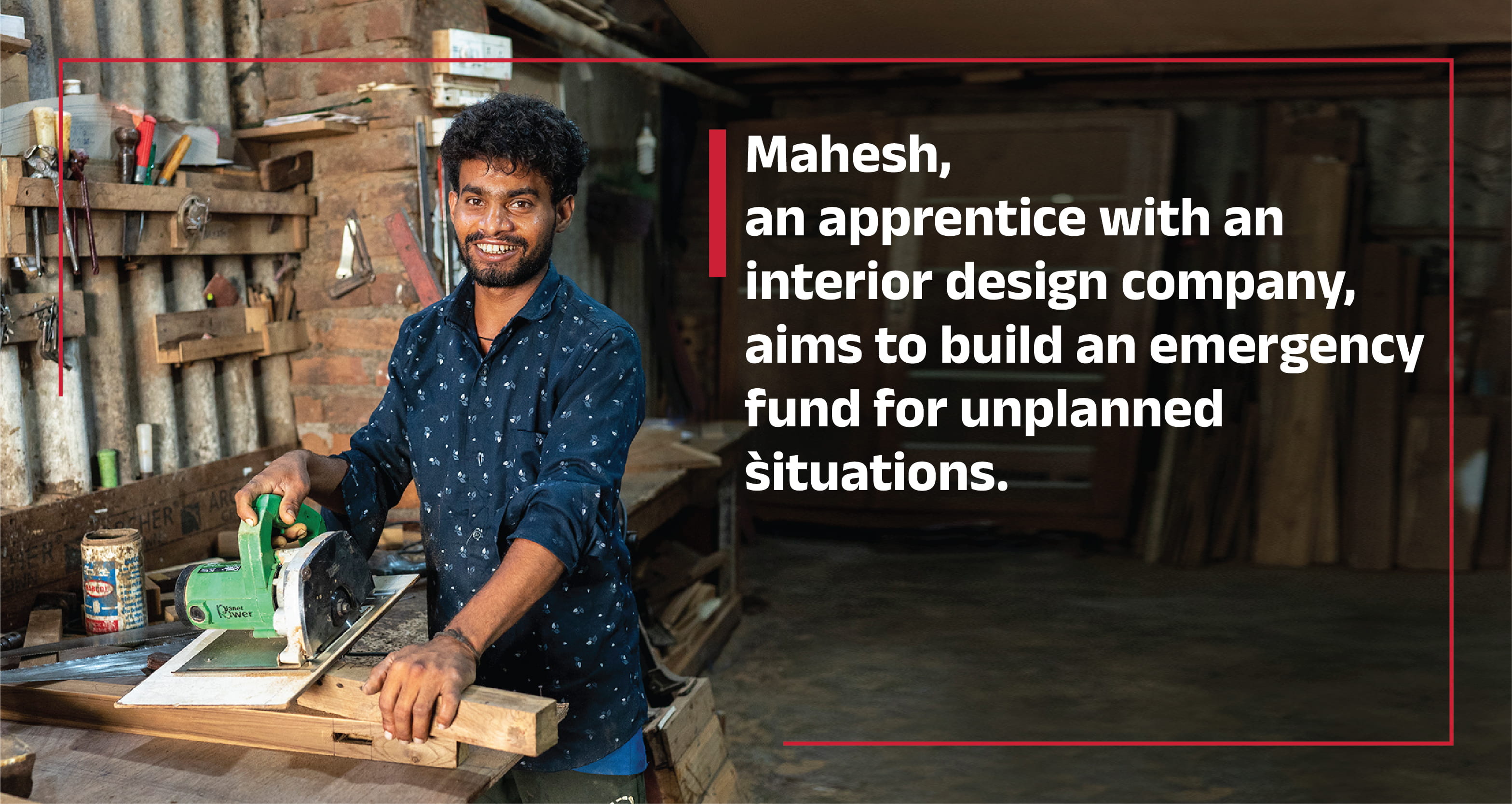

Meet Meena, Ravi, and Mahesh – people with big dreams and life goals, but limited savings to make them come true.

Just like Meena, Ravi, and Mahesh, you may also have dreams—whether it's planning for your child's education, expanding your work, or preparing for unexpected expenses. But with everyday costs, saving money can feel difficult. What if there was an easy way to start—one that requires just ₹250 a month?

Presenting Birla ki Choti SIP – a simple way to turn your dreams into reality.

It’s a simple way to start investing in mutual funds with a small, affordable amount of ₹250 per month, helping your money grow over time—without straining your budget.

If Meena, Ravi, and Mahesh can do it, so can you!

How easy is it to start?

Choose a mutual fund that aligns with your goal

Set up auto-payment for a hassle-free experience.

Watch your investment grow over the long term.

Why invest in mutual funds through Choti SIP?

Choti SIP, a big step towards your goals!

Suitable for those new to mutual fund investing

Easy and convenient transactions via NACH and UPI

Work towards your goals with a minimum of 60 SIP instalments for a brighter future.

You can choose from a range of ABSLMF funds for starting your Choti SIP. Click here to see the list of available funds.

Your small step today can bring a big change tomorrow. Take that first step towards your dreams now!

An easy and hassle-free way to invest!

Take the first step towards your dreams with Birla’s Choti SIP

Investors can start Choti SIP in up to three different mutual fund schemes. However, they can invest in only one scheme per mutual fund company (AMC).

While additional ₹250 SIPs can be started beyond the first three, only the first three will receive the benefit of lower transaction costs or discounts. Any SIPs started beyond this limit will not be eligible for these discounts.

The minimum number of instalments for availing Choti SIP shall be 60 instalments, however, early withdrawal of the instalments is not restricted.

Choti SIP shall be offered only under Growth option of the Schemes.

The mode of payment/investment for Choti SIP shall be restricted to NACH and UPI auto pay only.

Any investor having investments in the schemes of any Mutual Funds or any SIP investment other than Choti SIP or a lumpsum investment across any Mutual Funds, in that case, the said investor shall be considered ineligible under Choti SIP.

Please refer to the terms and conditions / Application form for more details - Click Here

1800-270-7000

1800-270-7000