-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

Investment Objective

The primary objective of the Scheme is to generate capital appreciation by

investing in passively managed instruments such as ETFs and Index Funds of

equity and equity related instruments (domestic index funds & ETFs as well as

overseas ETFs), fixed income securities, Gold / Silver.

The Scheme does not guarantee/indicate any returns. There can be no

assurance or guarantee that the investment objective of the Scheme will be

achieved.

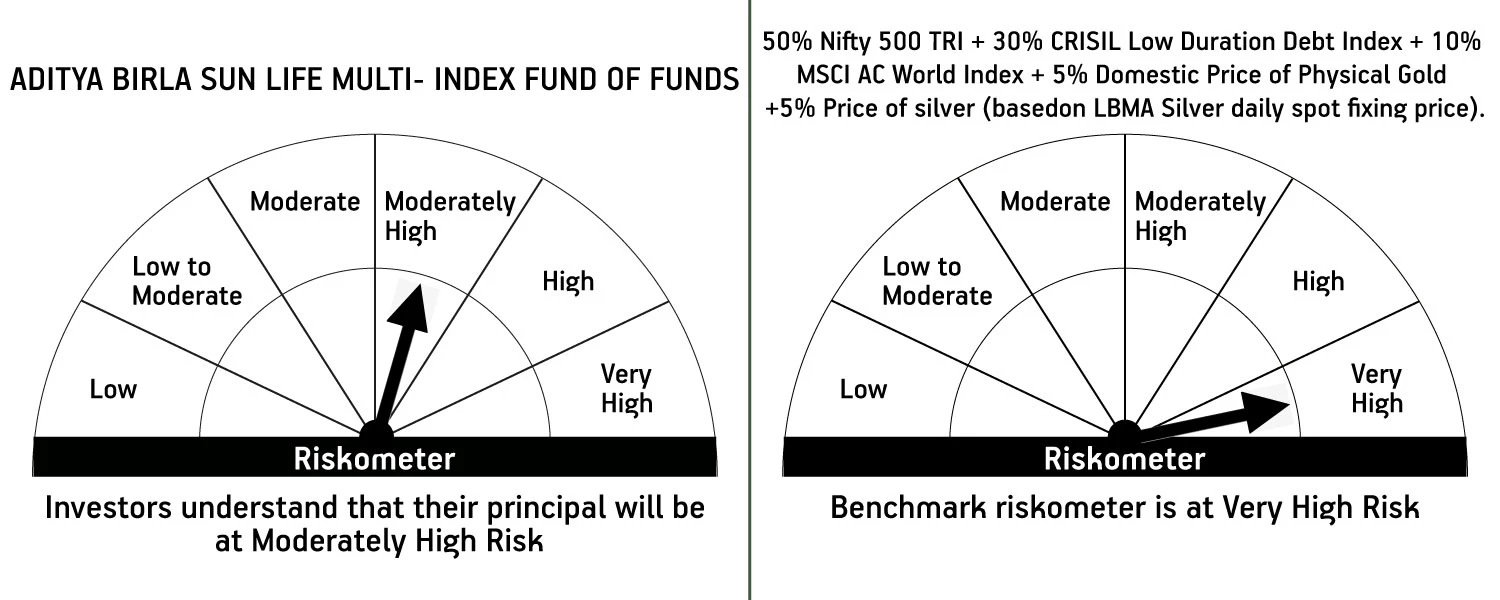

This product is suitable for investors who are seeking

- Long term capital appreciation

- Investment in passively managed instruments such as ETFs and Index Funds of equity and equity related instruments (domestic index funds & ETFs as well as overseas ETFs), fixed income securities, Gold / Silver

Fund Details

- Fund Type - (An Open ended Equity Scheme)

- Category - Other-FOF

- Sub-Category - FoF-Domestic-

- Min Investment - Rs. 500/-

- Fund Manager - Mr. Dhaval Joshi & Mr. Vinod Bhat & Mr. Haresh Mehta

- Latest NAV - 15.155 (as on 05-Jul-2024)

- Inception Date - Oct 14, 2022

View Full Details

Fund Management

-

Mr. Dhaval Joshi

Total Experience : 15 years

View Full ProfileDhaval Joshi has an overall experience of 15 years in equity research and investments. Prior to joining Aditya Birla Sun Life AMC Limited, he was associated with Sundaram Mutual Fund (India) Ltd. for around 5 years. He has also worked as a research analyst with Emkay Global Financial Services and Asit C Mehta Investment Intermediates Ltd. -

Mr. Vinod Bhat

Total Experience : 20 Years

View Full ProfileVinod Bhat is a Portfolio Manager and Equity Strategist at Aditya Birla Sun Life AMC Limited (ABSLAMC). Vinod comes with an overall experience of two decades with close to 15 years in the financial markets and investment banking space. He has been associated with ABSLAMC since July 2018.

Prior to joining ABSLAMC, he was the Vice President - Corporate Strategy and Business Development with Aditya Birla Management Corporation Pvt. Ltd. Previously he was an Investment Banker at Credit Suisse and Ocean Park Advisors in the USA.

Vinod is a CFA (USA) and has done his MBA in Finance from The Wharton School, University of Pennsylvania (USA). He holds an M.S. in Industrial Engineering from Pennsylvania State University (USA) and B.Tech in Mechanical Engineering from IIT Bombay. -

Mr. Haresh Mehta

Total Experience : 15 Years

View Full ProfileMr. Haresh Mehta has a total work experience of around 15 years in dealing related activities. Prior to joining Aditya Birla Sun Life AMC Limited, he was associated with Baroda BNP Paribas Asset Management India Pvt. Ltd for over 4 years as a Dealer and Investment Support. He has also worked for over 11 years as a Trader in Institutional equities with First Global Stockbroking Pvt. Ltd.

View Fund Managed by

Load More

Total Schemes managed by {fundmanagername} is {fundmanagerfundcount}

Different plans shall have a different expense structure. The performance details provided herein are of (regular / direct) plan.

Different plans shall have a different expense structure. The performance details provided herein are of (regular / direct) plan.

To check an all-time best return rate for equity funds, check how they've performed in the last 3 or 5 years.

Check your investment performance

Use this tool by entering any amount you would have invested to calculate how much it would be worth today.

I had invested

as an

CALCULATE RETURN

Rs

Minimum Amount is Rs 500

in

Select the type of Fund

Fund

Select the Fund name

as an

Select Lumpsum or frequency of SIP

starting on

Select the date invested

Your Investment Summary

- Investment AmountRs 5000

- Initial units per month 29.5

- Current valueRs 50,000

- Current NAV value 260

- Current Units 30

-

XIRR

5.10%

Internal rate of return or annualized yield for a schedule of cash flows occurring at irregular intervals.

-

Benchmark XIRR

8%

Internal Rate of return or annualized yield for a schedule of cash flows occurring at irregular intervals for respective benchmark index.

Fund Summary

Entry Load

Exit Load

Load Comments

NIL

For redemption / switch-out of units on or before 15 days from the date of allotment: 0.5% of applicable NAV.

For redemption / switch-out of units after 15 days from the date of allotment – Nil

Highlights

- Multiple needs of an Investor

- Multiple Dilemmas

- One solution to multiple problems

Multi-asset Passive Fund - An all-weather investment solution!

Multiple needs of an Investor

Investors look for – reasonable & consistent returns, risk management, investing convenience, low cost of investment, tax efficiency etc.Multiple Dilemmas

Where to invest? How much to invest? Timing of investment? How to optimise returns? How & when to rebalance investment portfolio? etc.Aditya Birla Sun Multi-Index Fund of Funds - One solution to multiple problems

Invests in passively managed instruments scheme with an aim to achieve portfolio diversification while ensuring tax efficiency.

- Diversification :

Invests in Index funds & ETFs across asset classes - domestic & international equity for long term capital growth; debt for relative stability and gold/silver for risk management. - Rule-based model for Asset Allocation:

Aims to achieve dynamic asset allocation to capitalise on evolving market cycles while still managing downside risk. - Professional Management – Research, Monitoring & Rebalancing:

Managed by expert and professional fund managers. - Tax Efficiency:

Save tax costs on constant portfolio churns by investing in a single fund. - Low-Cost Investing:

Being a passive fund, this fund has significantly lower expense ratios translating to better returns for investors. - Flexible Investing Modes :

Investors can start investing in this fund with as little as Rs.500 through the SIP/STP route. .

Aditya Birla Sun Life Multi - Index Fund of Funds

(An open-ended fund of funds scheme investing in Exchange Traded Funds and Index Funds)

This product is specially designed for investors seeking*

- Long term capital appreciation

- Investment in passively managed instruments such as ETFs and Index Funds of equity and equity related instruments (domestic index funds & ETFs as well as overseas ETFs), fixed income securities, Gold / Silver

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Show More

Similar Funds

-

View Details

Aditya Birla Sun Life Gold Fund

Nav

21.5870.06(0.26%)

-

View Details

Aditya Birla Sun Life Financial Planning FoF - Aggresive Plan

Nav

51.0670.14(0.27%)

-

View Details

Aditya Birla Sun Life Silver ETF Fund of Fund

Nav

14.3490.11(0.78%)

-

View Details

Aditya Birla Sun Life Financial Planning FoF - Moderate Plan

Nav

39.7160.08(0.21%)

-

View Details

Aditya Birla Sun Life Active Debt Multi Manager FOF

Nav

34.5390(-0.01%)

-

View Details

Aditya Birla Sun Life Financial Planning FoF - Conservative Plan

Nav

31.8550.05(0.15%)

Disclaimer

For further details on the Scheme, refer Scheme Information Document and Key Information Memorandum.

1800-270-7000

1800-270-7000