-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Pulse From the Ground: A Fund Manager’s Perspective

Jul 03, 2024

5 Mins Read

Vinod Bhat

Vinod Bhat

Listen to Article

India is projected to become the third-largest economy by FY30. Typically, discussions about India's economic growth focus on major cities like Bengaluru, the tech hub, or Mumbai, the financial centre. However, achieving the ambitious goal of Viksit Bharat, or developed country status by 2047, which implies a per capita GDP of $14,000, requires broad-based growth. This necessitates that all 28 states be capable of competing for economic opportunities. Encouragingly, signs of such progress are emerging. Many states' expenditures and nominal GDP have grown to match the size of India's entire GDP from two decades ago.

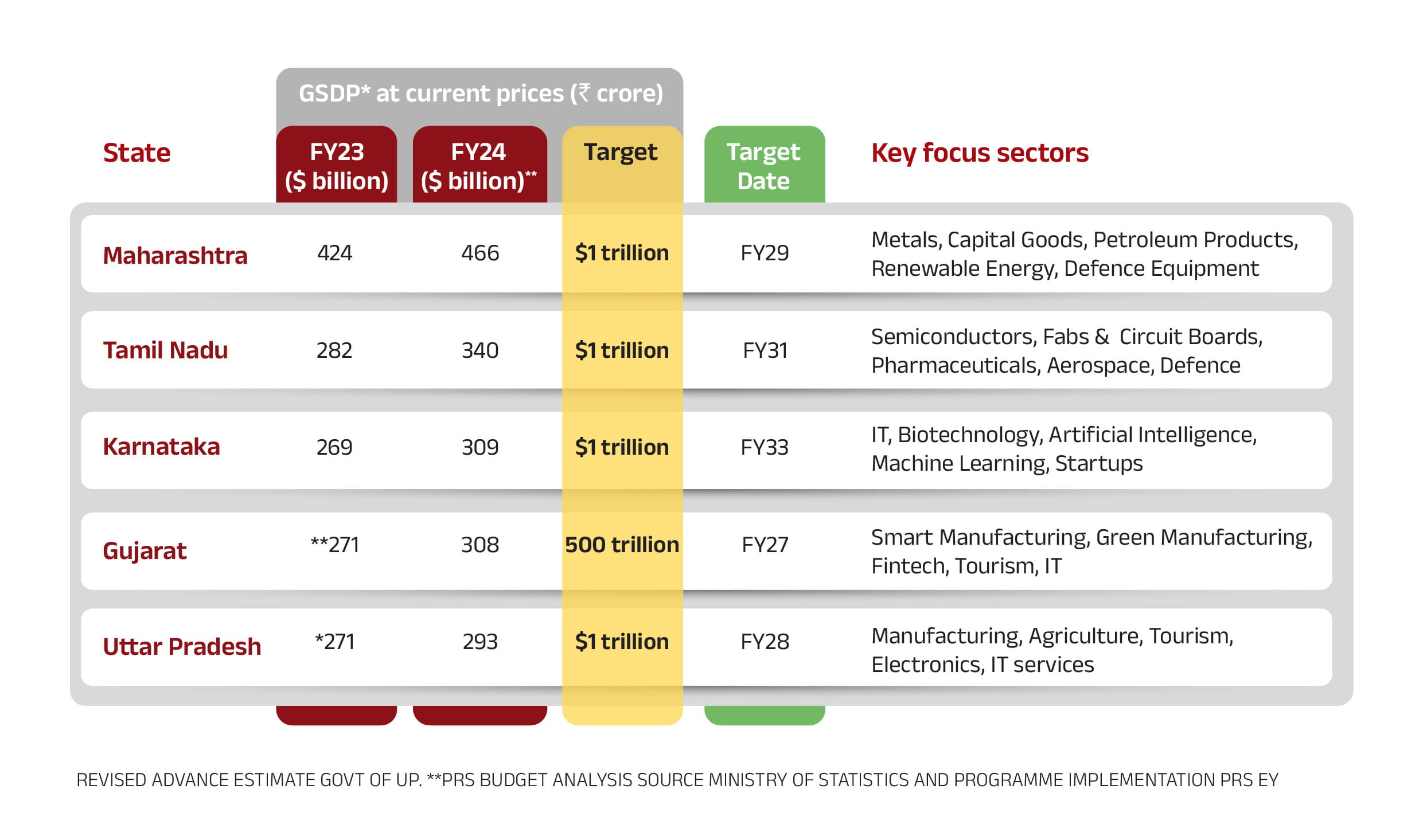

Five states in India are currently at the forefront of this growth. Each has set ambitious targets to become $500 billion to $1 trillion economies by FY27-FY33. These targets, though challenging, are beginning to look achievable. * GSDP: Gross State Domestic Product Infact, I came across an interesting data point shared on X (Formerly Twitter). Source: https://x.com/abhymurarka/

More SIPs are getting registered from Patna, Lucknow, Jaipur, Dehradun, Guwahati currently than Bangalore or Kolkata did in January 2020. This is an indication of the growing wealth effect across states and especially smaller towns as a result of the growing trend of a broad-based growth. Couple of months back I embarked on one such macro tour and road trip to Uttar Pradesh (UP) with a group of foreign institutional investors (FIIs) and domestic investors.

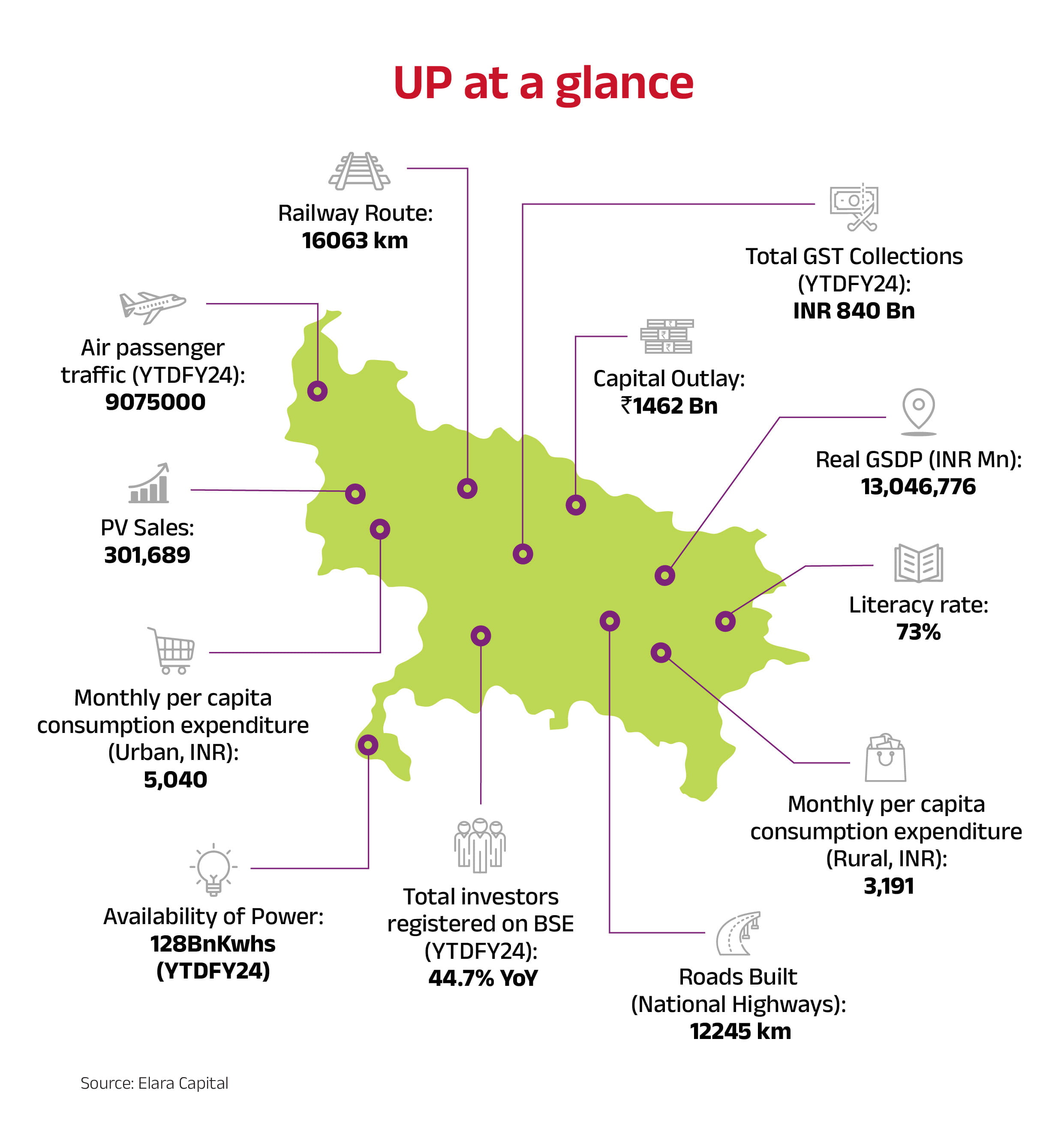

UP is bit of a conundrum. Had UP been a country, with a population of 240 million, it would have been the fifth largest country in the world. However, despite its size, it remains one of India's poorest states, with a per capita GDP of only $1,000, less than half the national average.

Key Insights from the Visit

Under a zero-tolerance model, UP has significantly improved its law and order situation, creating a more business-friendly environment. With the largest police force in the world, the state has effectively tackled criminal elements. As per a report by Elara Capital, it ranks #2 in the country in the ease of doing business. The state has seen a total FDI inflow of INR 18,584 Million in FY24 (YTD).

The state is leveraging technology to enhance efficiency and transparency in governance. Initiatives include the CM Dashboard, an integrated complaints redressal system, a construction monitoring system, and an electronic Human Resource Management System (eHRMS) for state employees. The Integrated Service Portal consolidates numerous citizen services, improving accessibility and convenience.

UP is focusing on industrial and infrastructure development, including Special Investment Regions, industrial parks, roads, highways, logistics, passenger transport, civil aviation, and defence. Lucknow’s road infrastructure has notably improved, and the state is developing metro systems in nine districts, two of which are already operational. Additionally, a defence corridor is being established to boost manufacturing capabilities.

The share of food in household expenditure (%) reduces with an increase in per capita income. One can see a similar trend in UP.

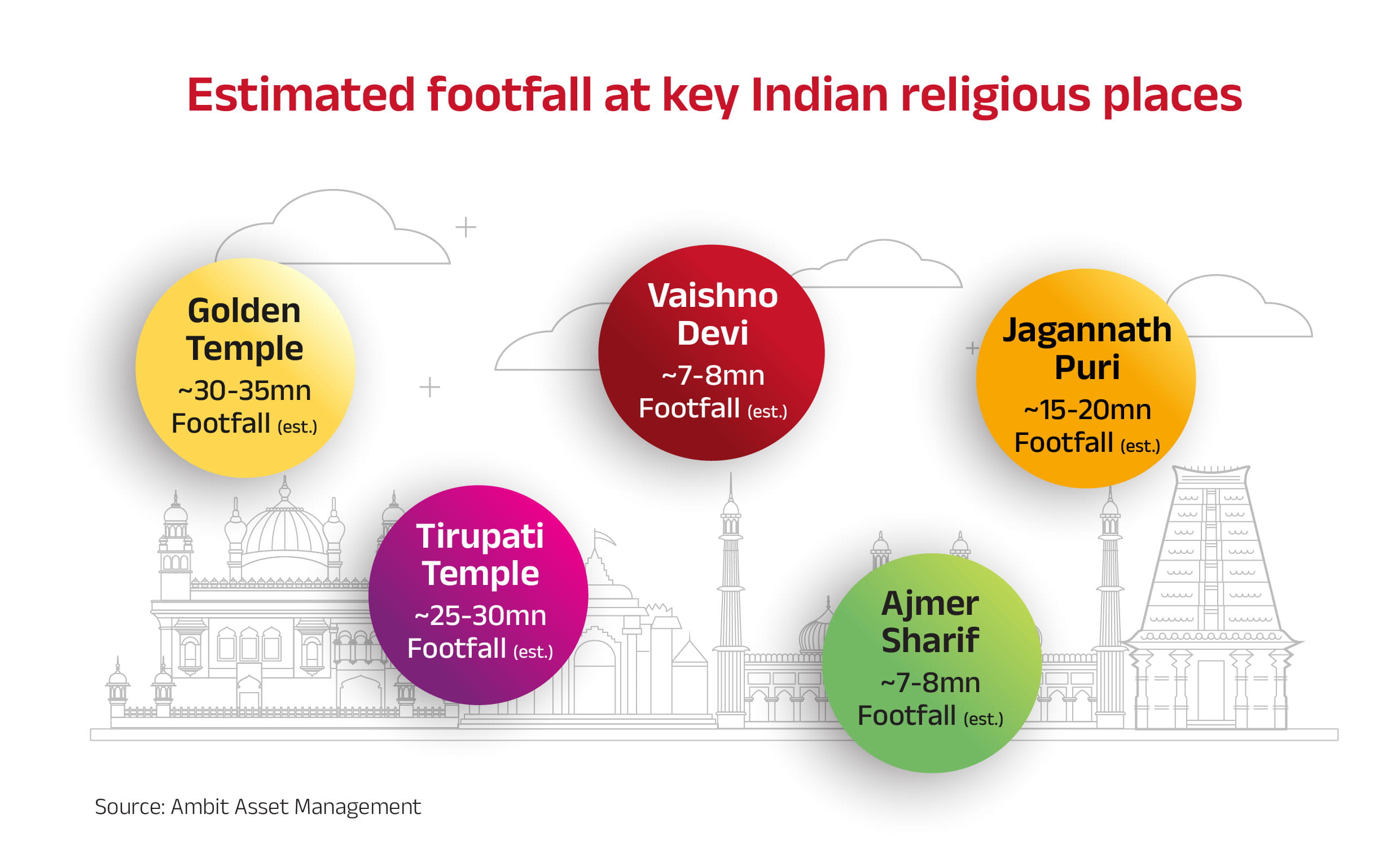

Source: Household consumption Expenditure Survey, Ambit Asset Management There is strong demand for discretionary consumption items, with a preference for branded apparel and footwear, while staples see a shift towards local brands. Two-wheeler sales are robust, especially among small business owners. Dealers report increased monthly sales and anticipate further growth. The penetration of electric rickshaws highlights the emerging EV wave in the state. The housing market in UP is experiencing strong demand, particularly in mid-income and premium segments. However, rising land and construction costs pose challenges. Despite these costs, developers have been able to pass on the increases to consumers, though prices may now stabilise. Affordable housing has become less viable due to these rising costs. Religious tourism in India is on the rise, with significant infrastructure enhancements at key sites. Varanasi, for instance, has attracted 129 million visitors since its recent makeover. Ayodhya also expects increased tourism, with 22 million visitors in 2022 and total tourist expenditures exceeding INR 2 trillion. This surge in tourism is driving up real estate demand and prices in these areas. NBFCs are experiencing growth, but there is a risk of household overleveraging. Easy access to credit is driving purchases of two-wheelers, four-wheelers, and appliances, potentially leading to a credit bubble. One challenge is a labour shortage, as many prefer to stay home, benefiting from social programs and MNREGA payments. Younger individuals are increasingly trading stocks, while older generations and government employees favour mutual funds. This shift has implications for the availability of manual labour even in UP which is supposed to have excess labour. As a consequence of the labour shortage, there is increased mechanization. Tractor sales are booming, with dealers reporting annual sales of 200-250 units per month. Increased cultivation of cash crops and infrastructure projects are driving this demand. Tractors are not only used for farming but also for hauling materials, compensating for the labour shortage. Farmers are increasingly adopting mechanisation, with some owning multiple tractors.

Source: ABSLAMC Research, Elara Capital The views and opinions expressed are those of Vinod Bhat, Portfolio Manager & Head – Knowledge Management and do not necessarily reflect the views of Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”). This is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/ communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). ABSLAMC has used information that is publicly available including information developed in house. Information gathered and material used in this document is believed to be from reliable sources. Further the opinions expressed and facts referred to in this document are subject to change without notice and ABSLAMC is under no obligation to update the same. Further, recipients of this report shall not copy/ reproduce/quote contents of this document, in part or in whole, or in any other manner whatsoever without prior and explicit written approval of ABSLAMC. Past performance may or may not be sustained in the future. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Driving States and Ambitious Targets

The nature of my work necessitates travelling to different markets and this gives me a pulse of the country and gauge the actual state of affairs. I intend to capture my observations and learnings from these visits that showcases the shifting economic picture of India.

Our itinerary included meetings with senior UP state officials and field visits around Lucknow and Ayodhya-Faizabad, engaging with various stakeholders such as traders, farmers, auto and farm equipment dealers, real estate developers, and industry representatives.

It is to be noted though that the state economy has been growing at an average of 5.3% per annum over the past five years, outpacing the national average by 1%. Since 2021, UP's growth rate has accelerated to 9.2%. The state's investment as a percentage of output, at 6.6%, is the highest in India and its share in India’s GDP stands at 8.12%.

Improved Law and Order:

Technological Advancements:

Industrial and Infrastructure Development:

Changing Consumption Patterns:

E-commerce is facilitating access to branded goods, though it is also leading to job losses in traditional retail setups. FMCG volume growth may no longer accurately reflect rural sentiment, as spending patterns shift towards more aspirational goods and services.

Rising Two-Wheeler Demand:

Housing Market Dynamics:

Religious Tourism Boom:

Increased footfalls at religious destinations to increase the contribution of tourism sector to India's GDP (%)

Of course, there are some challenges too. Two key concerns are:

Household Indebtedness:

Labour Shortages:

Mechanisation and Tractor Sales:

UP state government has also shortlisted a few other focus sectors such as Agri and Allied space (Precision Agri, horticulture, dairy, fisheries); Urban Development, Real Estate & Housing (100+ new townships planned with walk-to-work model), integrated water and waste infra; Energy and Utilities (Transmission infra, solar, compressed biogas); Health Infrastructure (Medical colleges, hospitals, and trauma centres ), and Commodities (Wheat, milk, rice, sugarcane output have been seeing significant growth).

To achieve its $1 trillion economy target, UP will need $5 trillion in investments. In the past year alone, projects worth $120 billion have commenced, and Memorandums of Understanding (MOUs) worth $500 billion were signed at the Global Business Summit in February 2024.

Seeing the pace of execution on the ground, my road trip gave me increased confidence that the past is history. The tour bolstered my view that India's economic growth will sustain. Especially, the State of UP is undergoing a massive transformation with cleanup of law and order, infrastructure upgrade, increased commodity production, and digitization of services. With 24 crore people (~1/5th of India’s population), the state which used to be a drag on the country’s growth seems to be in a strong position now to pull India’s growth up. Per capita income of the state has doubled in the past seven years. There is a general sense of optimism and high confidence amongst the population, especially amongst small business owners with almost everyone we met looking to expand distribution outlets to capitalize on demand.

To sum it up, the state of UP is on a secular growth trajectory and is likely to make a significant contribution to meeting the ambition of Viksit Bharat by 2047.

You May Also Like

Loading...

1800-270-7000

1800-270-7000