-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

5 Must Have Investments For Your Child's Future Plan Portfolio

Aug 01, 2019

5 mins

5 Rating

Saving for your child’s education is directly proportional to your regular contribution to your entire financial plan

Biggest Cash Outflow is saving for higher/professional degree education

2-year Post Graduate Programme in Management

2018 - MBA course – Rs 22 lakhs approx

2027 – MBA course – Rs 40 lakhs approx

2036 – MBA course – Rs 75 lakhs approx

(Assuming cost of education rising by 7% every year)

Source: https://www.iima.ac.in/web/pgp/apply/domestic/expenses

Lifestyle & Inflation

Standard of living & Inflation = Choice of where to send child for higher education, Child’s marriage in future etc

How to break through?

1. Be the Early-Bird

Don’t underestimate the Power of Compounding - Illustration

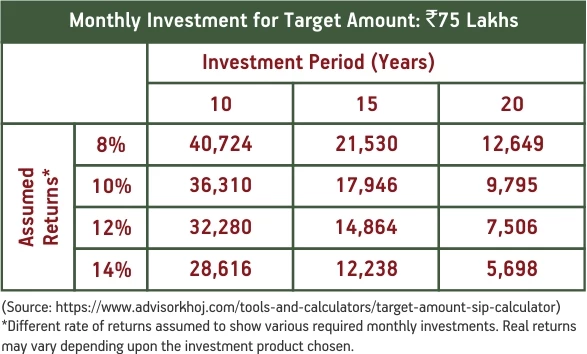

Current Child Age – 1 year Target corpus –Rs 75 lakhs Monthly Investment Target

2. Aim to invest in Right Options

a. Equity funds can be considered for long term

b. For short term needs such as school fees, uniform expenses, medical etc Debt or money market instruments can be considered

3. You can consider Children’s Funds

These invest in a combination of Debt and Equity instruments.

Comes with a lock in period to encourage long term investing for child

Provides an option to start Systematic Investment Plan (SIP)

4. You can invest in Gold for long term

Gold can be considered as an investment option

Invest through ETFs, Gold Fund or E-Gold

Gold can hedge during volatile times

You can allocate 10 – 15% of your overall portfolio towards gold

5. Investments and Insurance

Prudent to keep them separate

Insurance may cater to expenses after one’s demise

Aim to take appropriate cover as per your profile

Separate investment in Equities/Debt can help build corpus and wealth over long term

6. Skills and Values

Invest in child’s skill set – Art, Sports, Technology etc

Teach values – Honesty, Determination, Consideration etc

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000