-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Investing in India’s growth story – A deep dive into Aditya Birla Sun Life PSU Equity Fund

Jan 16, 2024

5 min

4 Rating

The Government of India in its ‘Vision-2030’ has set the target for India to be a 10 trillion-dollar economy by 20301 – potentially uplifting it to the rank of the 3rd largest economy in the world from its current rank of no.5.

Abundance of growth envisioned and achieved.

Robust and consistent year-on-year GDP growth is a must to fulfil these visions for the Indian economy.

The Indian economy witnessed a year-on-year GDP growth of 7.6% and 7.8% in the last two quarters of 2023 – actually surpassing the RBI estimate of 6.5%3.

India seems to be well on its way to be amongst the top 3 economies in the world4.

Can you benefit from the India growth story with just a single investment?

Most certainly yes, by investing in the big contributors and the big beneficiaries of the Indian growth story!

PSUs have the potential to be a big contributor!

How so?

Simply put Public Sector Undertakings (PSUs) are those companies in which the government has substantial stake. They include companies where the Central/State Government(s) has majority shareholding or management control or has powers to appoint majority of directors.

As the name suggests PSUs are engaged in sectors that provides services that benefit and are essential to the public at large.

So, as India grows PSUs have the potential to grow too!

And here is why:

- PSUs contribute significantly to building the economy.

They are typically involved in sectors that are the building blocks of the economy. Ones without which sustained economic growth is not possible. Gas & Power, Fuels, Banking & Finance, Agriculture, Transport, Infrastructure….to name a few.

- Infrastructure leaders

There is a lot that needs to take place in an economy to support robust and fast paced growth. Building social and physical infrastructure is one such area. PSUs are heavily engaged in building this right from railways, highways to healthcare and education.

- Government spending on the rise

The government is committed to its growth vision for India and is heavily investing in building capacities to reach there. Be it on Research and Development R&D in PSUs or incentives or PSU reforms, PSUs stand to benefit significantly from these measures.

An added spark - a new lease of life for many PSUs

With privatisation/disinvestment on the cards for many PSUs, they stand to gain additional push to their growth. Privatisation can bring on a higher level of efficiency and higher profitability to the companies which can ultimately benefit investors in PSUs.

An efficient way to participate in PSUs

With 56 listed5 PSUs in operation today, selecting the right PSUs which can grow in the years to come can be a mammoth task.

At Aditya Birla Sun Life Mutual Fund, we have a dedicated mutual fund that researches and selects a handful of promising PSUs to invest in.

Introducing the Aditya Birla Sun Life PSU Equity Fund

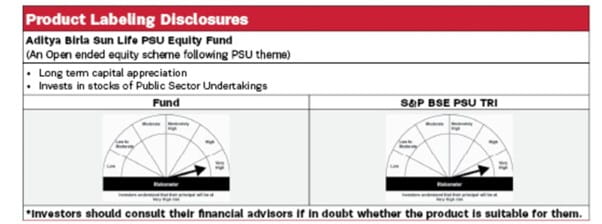

An open ended equity scheme following PSU theme – this fund actively analyses and seeks out a selection of PSU stocks that have strong fundamentals and prospects of future growth along with relative stability.

The fund thus seeks to earn long term capital appreciation for its investors through an equity-based investment.

Why invest in Aditya Birla Sun Life PSU Equity Fund?

- Growth potential

PSUs are on the cusp of growth and expansion today with an added boost of PSU reforms and privatisation. Investing in this fund can capitalise on all of this for long term growth potential.

- Diversified

Being a thematic fund, it invests across sectors and across market caps for the best mix of PSUs. Giving a wide exposure not only provides healthy opportunities for growth but also diversifies your risk.

- Fund manager expertise

Being headed by experienced and knowledgeable fund managers, the fund aims to ensure calculated and thorough portfolio selection.

- Low minimums

You can invest in this fund with as little as Rs.500/-, which means you do not need to have a high investing threshold to start your PSU investing journey.

- Ease of investing

The fund is open ended with no entry or exit load (after 30 days holding) making it convenient for investors. The fund also offers various options and plans to suit your specific investing needs – from growth to IDCW options and SIP/STP/SWP/Lumpsum modes.

So, wait no further and jump onto the India growth journey through an apt investing vehicle – the Aditya Birla Sun Life PSU Equity Fund.

Risk-o-meter as on date 31st December 2023.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1. Press Information Bureau from Government of India, Ministry of Finance dated 01st February 2019

2. Roadmap to Viksit Bharat announced by Finance Minister in Vibrant Gujarat Summit dated 10th January 2024

3. https://tradingeconomics.com/india/gdp-growth-annual

4. https://www.reuters.com/world/india/india-be-worlds-third-largest-economy-by-2030-sp-global-ratings-2023-12-05/ – dated 5th December 2023.

Reiterated by Finance Minister at Vibrant Gujarat Summit dated 10th January 2024

5. S&P BSE PSU Stocks as on 15th January 2024

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

FAQ's

1800-270-7000

1800-270-7000