-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Jingle All the Way to Financial Play in 2024

Dec 22, 2023

5 min

4 Rating

Christmas is finally here, spreading festive cheer! Apart from enjoying the holidays, having good food and exchanging gifts, the arrival of Christmas also signals another event: the countdown to the New Year!

Yes, the new year is days away and it’s time to start planning for all your new year resolutions. And while you must have your own dreams and desires such as a new house, a car, new job or even that dream vacation with your loved ones, here’s one that ought to be on your list right away. We’re talking about financial planning, as it is this resolution that will help you fulfil your other dreams.

No matter how big or small your wishes and resolutions, proper financial planning and execution is necessary to help you achieve them all. But you might wonder, how does one go about all this planning? Don’t worry, we’re here to help!

Step 1: Assess Your Financial Situation

The first step to proper financial planning for a smooth financial new year is to assess your current financial situation. For this, it’s important to take stock of what your sources of income are and also your spending pattern. Are there people who depend on you financially? How much do you save? Make an honest assessment of all these points.

Even if you have your spendings and earnings list handy, it is always better to review it at the start of the year. Make sure to adjust it for life events like marriage, child, career switch, and any other changes brought by inflation or upgrade in standard of living.

This done, make a list of your financial and life goals. Only when your finances are aligned with your goals will you be able to take the correct investment decisions that can pull you along the right path to goal fulfilment.

Step 2: Start Small with SIP

The formula to financial freedom is as much about smart spending as it is about saving and investing. To spend smart, you need to prioritise your expenses, just like you prioritise your goals. You could start with simple hacks: buying indigenous, local products instead of imported, branded ones. Or cutting down on spends at the café by making yourself a coffee at home. These little savings can eventually snowball into a sizeable corpus which can then be invested wisely with the aim to multiply them.

Even when it comes to investing, you can start with baby steps in the form of Systematic Investment Plans (SIP). You could start with a monthly SIP of as little as Rs. 500 and inculcate the habit of regular investing. This SIP amount can also be increased as and when you deem fit to give your financial journey a boost.

But the question arises, which investment instruments do you begin with? Equity gives you the opportunity to earn greater returns however comes greater risks too, while debt acts as a hedge against volatility. Small caps have a higher chance of growing your money faster at the same time have higher volatility, but large caps give your portfolio some much-needed stability if the market takes a downturn.

Where should you invest to get advantages of all these asset classes without burdening your pocket?

PRO investing is an option you could consider.

Also Read – What is SIP?

Step 3: Strengthen your core portfolio with PRO:

The secret to successful investment lies in diversification. PRO investing brings together the advantages of all these diverse asset classes, market caps and sectors in one investment basket.

PRO investing is a strategy to invest in Aditya Birla Sun Life’s three legacy mutual fund schemes – Aditya Birla Sun Life Flexi Cap Fund, Aditya Birla Sun Life Large Cap Fund, and Aditya Birla Sun Life Balanced Advantage Fund, simultaneously. Each of these three funds has its own unique characteristics:

Aditya Birla Sun Life Flexi Cap Fund invests across large cap, mid cap, small cap stocks, giving you exposure to overall growth in the stock market.

Aditya Birla Sun Life Large Cap Fund predominantly invests in large cap stocks, giving you the advantage of size.

Aditya Birla Sun Life Balanced Advantage Fund navigates market volatility by dynamically balancing equity and fixed income investments.

Together, the three funds aim to ride the bull market and manage risks in a bear market, while also giving you taxation benefits. Thus, you gain access to a diverse basket of opportunities in a single investment!

With PRO investing at the core of your investment portfolio, you can give your money the chance to generate wealth in the long run.

Christmas is the season of giving, so why not give your financial plans the push they need to achieve the end goal? And why stop here? With regular, disciplined, and long-term investing, you can not only fulfil your current goals but aim for bigger, better things!

So, keep those festive and financial bells jingling not just on Christmas day, but all the way into the new year with Aditya Birla Sun Life PRO investing.

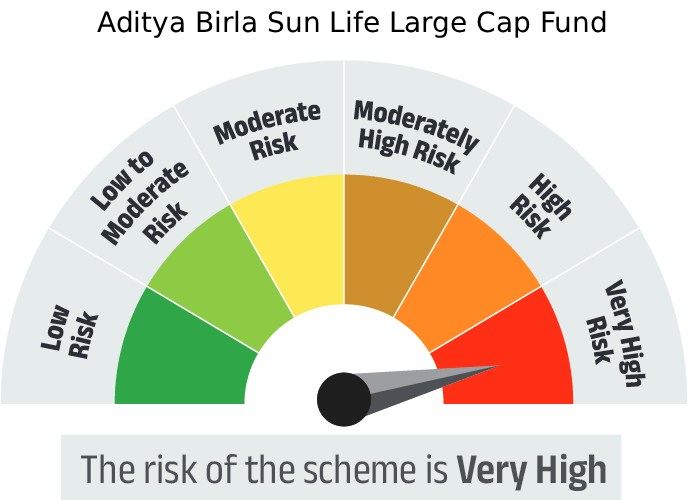

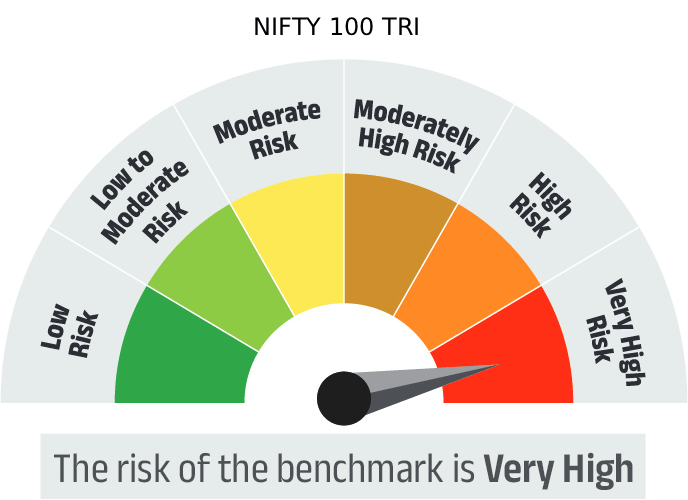

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Large Cap Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

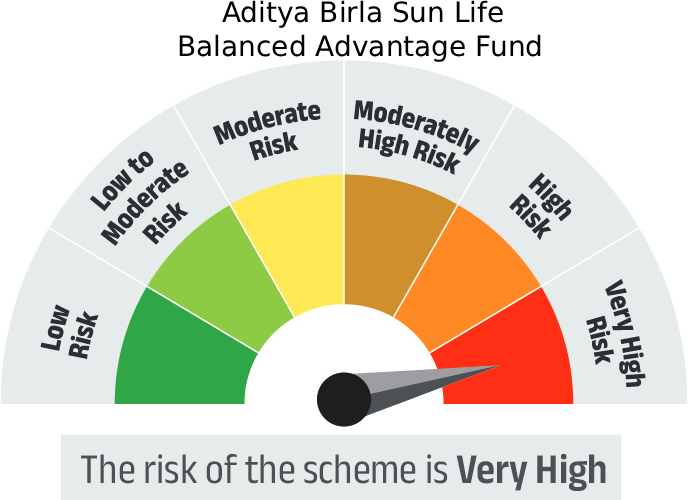

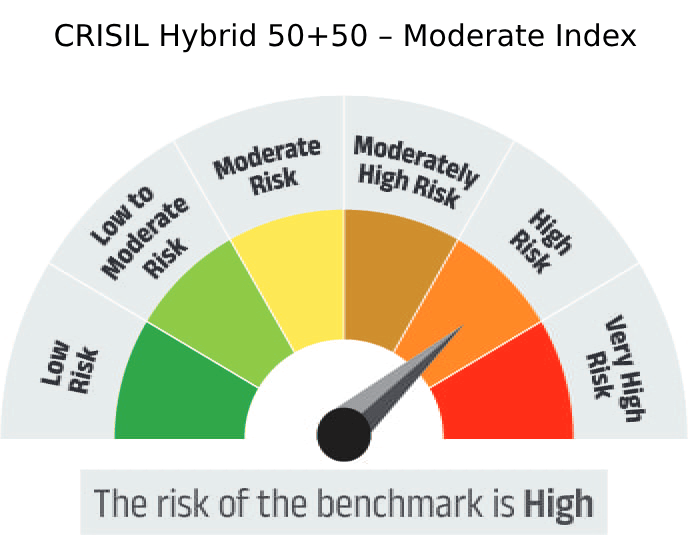

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Balanced Advantage Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

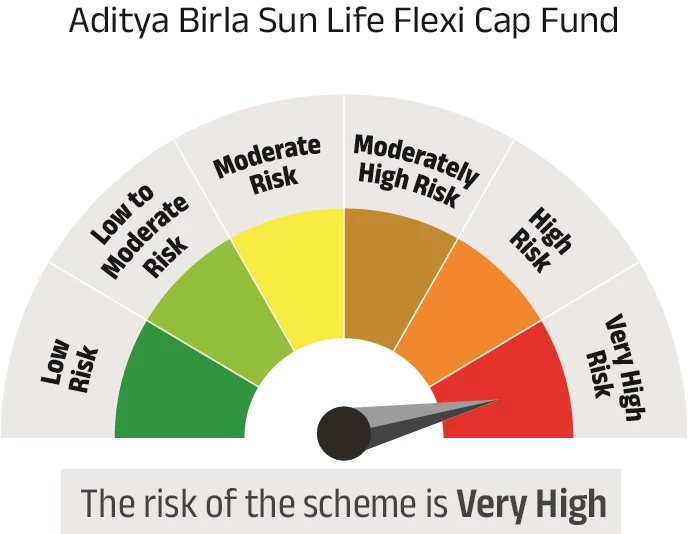

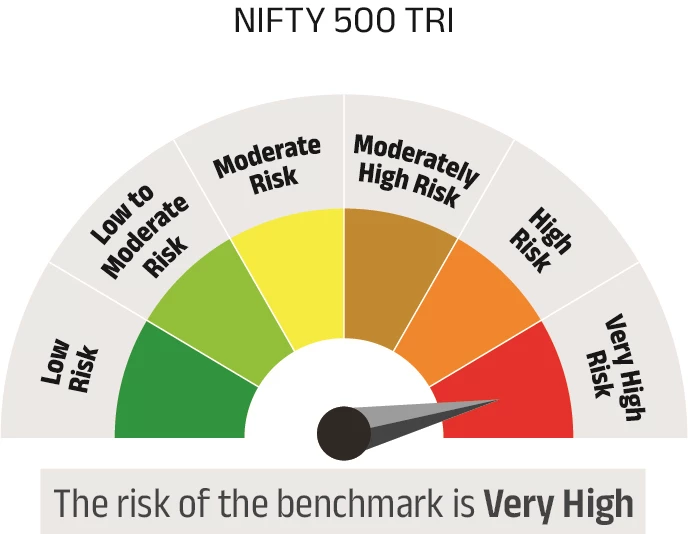

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Flexi Cap Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

For more information on these schemes, please refer to the SID/KIM of the respective scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

FAQ's

1800-270-7000

1800-270-7000