-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Beyond Big and Small: How to make the most of Mid-cap opportunities?

Jan 30, 2024

5 min

4 Rating

Life is beyond just black and white. It is in fact a million shades of grey!

In stock investing too, we tend to basket investors into the risk averse or the risk takers. It is said if you want to go safe then go big with the large caps or blue chips else go all out with risk with the small caps. Essentially focus often lies on the extremes of large caps and small caps.

Though, the magic often lies in the middle!

The Mid-cap opportunity - think of it as getting a little bit of both worlds large and small caps.

Mid-cap stocks are listed companies with moderate capitalisation. They rank between the large cap stocks and the small cap stocks i.e.: amongst the top 100-250 companies listed on the stock exchange.

The mid-cap opportunity

Successful companies tend to go through several phases in their growth cycle - from start up to maturity. A good start up leads to some success and then can take off to high growth and eventually stabilise to a level of business maturity.

Midcaps are typically those companies that are at the take off stage i.e.: at the cusp of expansion and growth.

They tend to offer the best of both worlds!

Less risky than small caps

Having been in the industry and made their footprint, these companies typically have moved beyond the startup phase with a proven business model. Making them a less risky option compared to fledgling small caps.

With potentially a greater growth potential than large caps

On the other hand, being in a growth phase means there's still room and potential for long-term growth before they reach a stability stage as those of large caps that have lower albeit stable consistent growth.

The midcap opportunity in India

The mid-cap market space in India is home to several well-known companies and brands.

It represents stocks from across the sectors ranging from a host of finance companies to pharma, consumer sectors, IT, infra and logistics, food and beverage and the likes.

How can you capitalise on these mid-cap opportunities?

With an investable universe of 150 companies, it would require considerable expertise to study, analyse and choose the right stocks to include in your portfolio.

Can you outsource this task? Most certainly yes!

By opting for the mutual fund route.

For mid-cap investments, there are two types of mutual funds you can opt for:

Active Midcap Funds

Mid cap mutual funds are equity mutual funds that invest at least 65% of their portfolio into mid-cap stocks. These funds are managed by professional fund managers who actively make decisions on buying and selling securities based on their research and analysis. The goal is to generate returns by leveraging the manager's expertise and market insights.

Features:Fund manager expertise:

They use their expertise to undertake market study to choose a portfolio of high growth midcap stocks. Aiming to give your portfolio the advantage of stock selection.Keeps your portfolio up to date:

Fund managers periodically reassess their selection and make changes to keep the portfolio relevant to changing market situations and to grab new investing opportunities as and when they arise.Diversification

These mutual funds ensure you get access to several sectors and industries – giving your portfolio a robust variety of midcap stocks.Minimum Investment Amount

Some mid cap funds permit investments with amounts as low as Rs.500, allowing investors to begin small and as per their affordability yet retaining the diversification benefit.

Passive Midcap Funds

These are index funds that track midcap indices such as the NIFTY MIDCAP 150, NIFTY MIDCAP 100. Their objective is to replicate the performance of these indices for investors by building a portfolio of the same stocks in the index and in the same weights as the tracked index subject to tracking errors.

While mid cap index funds continue to offer long term growth potential and diversification benefits, they also offer some additional passive investing features:

- Lower investing costs

Index funds follow passive investing strategy, so they charge a lower expense ratio, translating into better returns for your investments.

Also Read – What is Investment?

As India’s growth continues to look promising, so do the potential of growing mid-caps! And mutual funds are certainly an ideal way to capitalise on these mid cap investing opportunities.

At Aditya Birla Sun Life Mutual Fund, we offer both active and passive mid-cap funds. To explore these funds and make the right choice for you, please visit the following links:

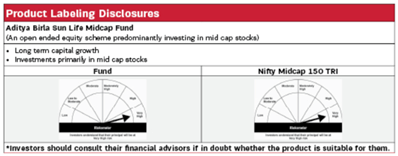

Aditya Birla Sun Life Midcap Fund

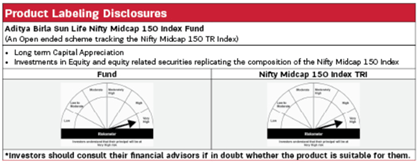

Aditya Birla Sun Life Nifty Midcap 150 Index Fund

The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the Fund may or may not have any position in these sector(s)/stock(s)/issuer(s).

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

FAQ's

1800-270-7000

1800-270-7000