-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

From Tanks to Drones: How the defence Industry is Evolving and Why It Matters

Aug 20, 2024

5 min

4 Rating

The Indian defence sector’s transformation in recent years is phenomenal. The country has climbed the cadre of being a burgeoning economic powerhouse, with significant emphasis on its defence industry. The country recognizes the importance of bolstering its defence capabilities and expansion. This evolution is significant due to recent political instabilities, turning almost the entire world into a war-like zone. Also, it ensures national security and can present a myriad of opportunities for technological advancement and economic growth.

Understand how the country’s defence sector is evolving and why it could be a good opportunity for you to invest in mutual funds investing in the defence sector.

Modernization and indigenization

The Indian government incremented the defence budget, reflecting a commitment to maintain a modern military force. The budget focuses on the enhanced military weapons and vehicles, upgraded cyber defence services, and the inclusion of advanced technologies. All these transformations indicate strengthening of the defence framework.

The “Make in India” initiative recognizes the country’s self-reliance in the defence production. India aims to reduce foreign dependency for military supplies and equipment and stimulate the production and manufacturing capabilities of local industries. This may put India on the global map for the defence exports.

Increased participation from the private sector

The collaborative approach with the private sector can help proliferate the defence sector. Private companies and the government-backed PSUs can lead to the efficient development and production of the defence-related products. Significant companies are already contributing to the defence industry. The country is also witnessing the rise of new start-ups bringing in refreshed innovations, especially in the defence sector. These start-ups with the right prerequisites can lead to support and develop ground-breaking defence products and services.

Impact on the economy and employment

The Indian economy has multiplied throughout the years, attributing some percentages due to the substantial growth in the defence sector. The development of defence production units and manufacturing hubs has stimulated significant economic activity, also causing the local businesses to boom along with the nation. This ripple effect even extended to employment, leading to job creation. This increased economic activity also benefited various other industries that are indirectly related to the defence sector.

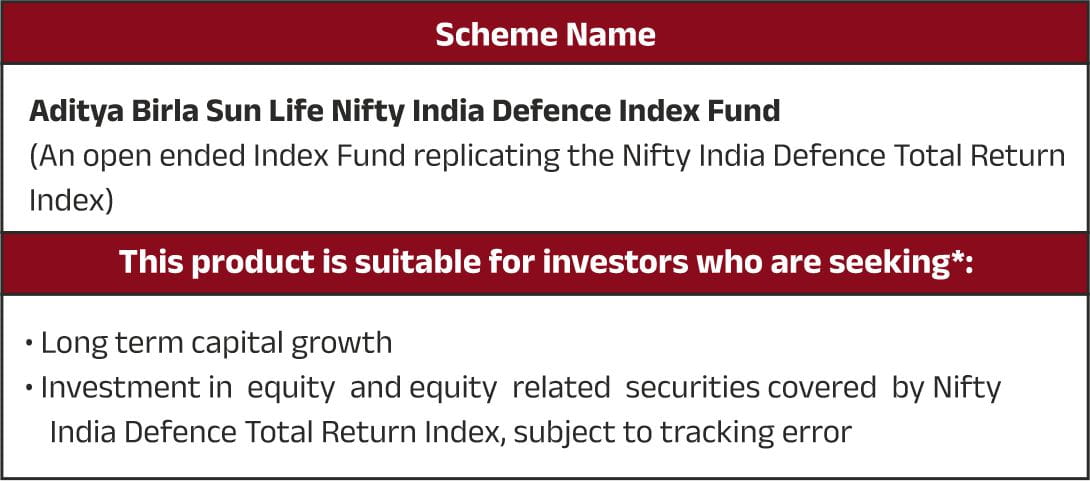

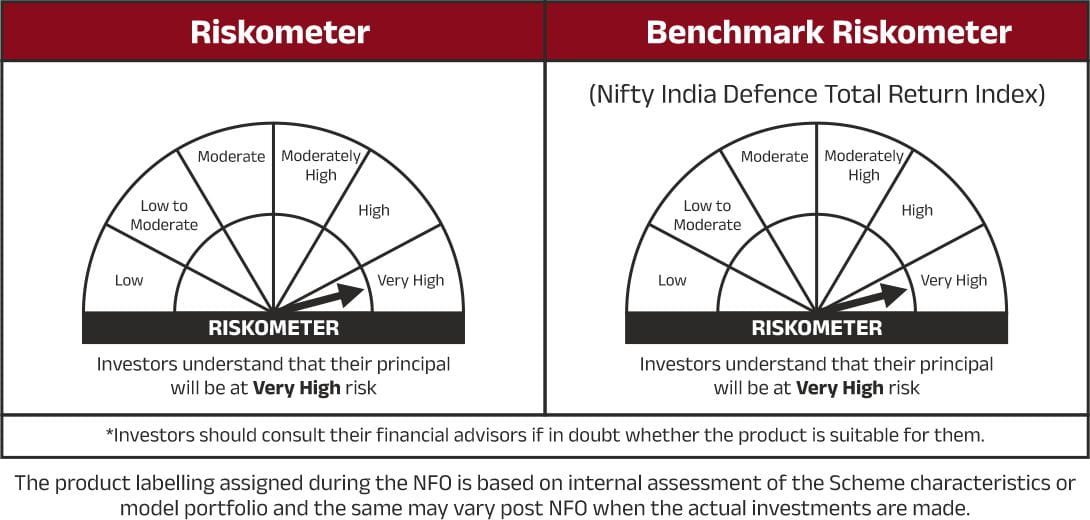

Aditya Birla Sun Life Nifty India Defence Index Fund: a NFO offering

Aditya Birla Sun Life Nifty India Defence Index Fund is an open-ended defence index-based sector fund that invests in a diversified portfolio of companies belonging to the defence industry. This thematic equity fund aims to track the performance of Nifty India Defence Total Return Index to generate potential returns on the investments. The sector has shown growth potential as the country is investing in technology-associated military products. Sharing the same perspective, Aditya Birla Sun Life Mutual Fund is launching its NFO to give investors an investment exposure to the defence sector.

Conclusion

The evolution of the Indian defence sector is a stimulus to India’s strategic growth in terms of military strength, national security, and economic expansion. India is presently reframing the narrative into being the country on the path of progress. This growth may have far-reaching implications at the regional as well as global stage, contributing to collaborative ventures with foreign countries and the upliftment of local industries.

The sector(s)/stock(s) mentioned herein do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stocks(s).

Aditya Birla Sun Life AMC Limited/Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000