-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Equity Outlook Fortnightly - December 2017

Jan 24, 2018

5 mins

3 Rating

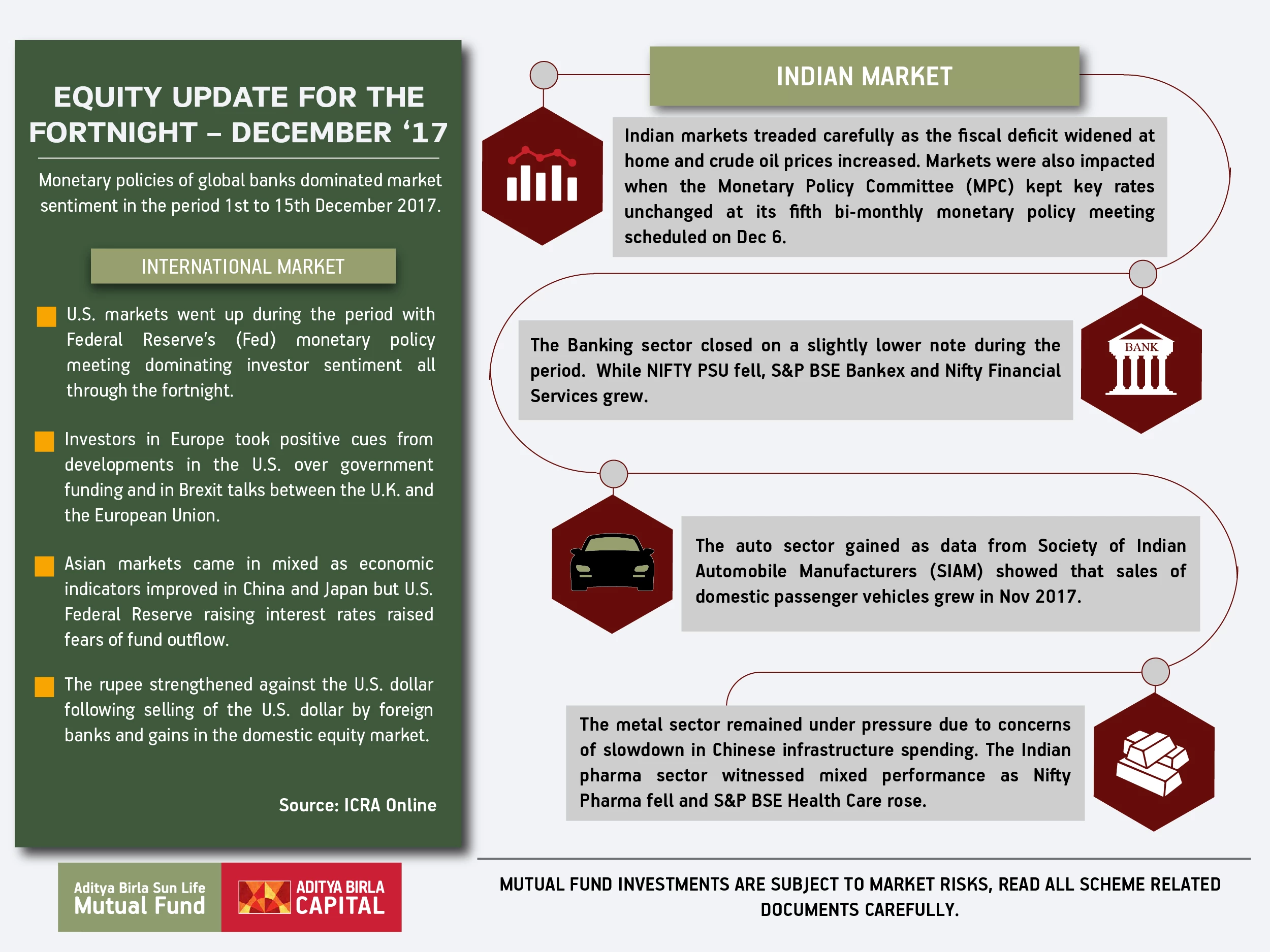

Monetary policies of global banks dominated market sentiment in the period 1 to 15th December 2017.

International Market

U.S. markets went up during the period with Federal Reserve’s (Fed) monetary policy meeting dominating investor sentiment all through the fortnight.

Investors in Europe took positive cues from developments in the U.S. over government funding and in Brexit talks between the U.K. and the European Union.

Asian markets came in mixed as economic indicators improved in China and Japan but U.S. Federal Reserve raising interest rates raised fears of fund outflow.

Indian Market

Indian markets treaded carefully as the fiscal deficit widened at home and crude oil prices increased.

Markets were also impacted when the Monetary Policy Committee (MPC) kept key rates unchanged at its fifth bi-monthly monetary policy meeting scheduled on Dec 6.

The Banking sector closed on a slightly lower note during the period. While NIFTY PSU fell, S&P BSE Bankex and Nifty Financial Services grew.

The auto sector gained as data from Society of Indian Automobile Manufacturers (SIAM) showed that sales of domestic passenger vehicles grew in Nov 2017.

The metal sector remained under pressure due to concerns of slowdown in Chinese infrastructure spending. The Indian pharma sector witnessed mixed performance as Nifty Pharma fell and S&P BSE Health Care rose.

The rupee strengthened against the U.S. dollar following selling of the U.S. dollar by foreign banks and gains in the domestic equity market

Source: ICRA Online

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000