-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Equity Outlook Fortnightly - November 2017

Dec 11, 2017

5 mins

3 Rating

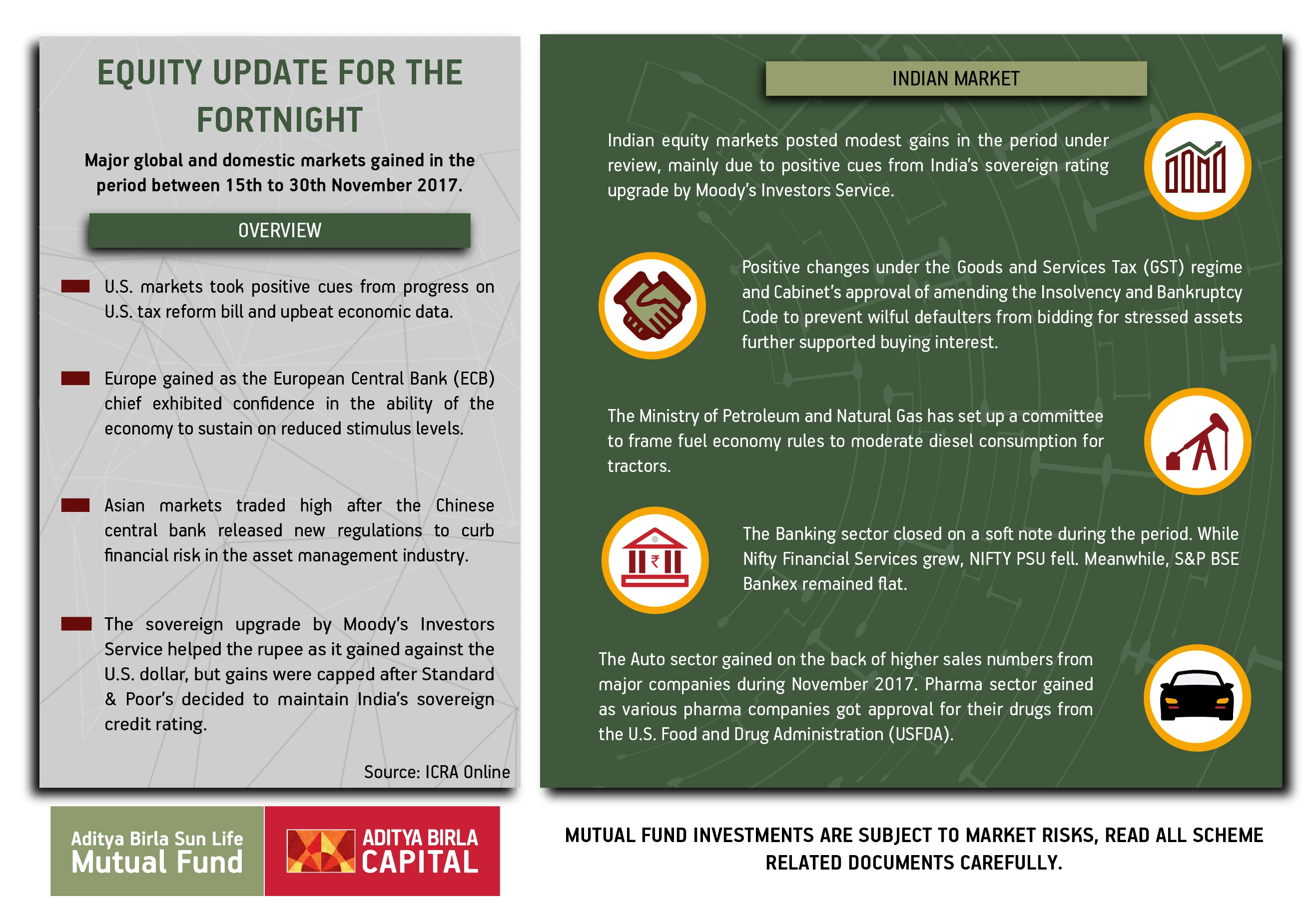

Major global and domestic markets gained in the period between 15 to 30 November 2017.

International Market

U.S. markets took positive cues from progress on U.S. tax reform bill and upbeat economic data. Street.

Europe gained as the European Central Bank (ECB) chief exhibited confidence in the ability of the economy to sustain on reduced stimulus levels.

Asian markets traded high after the Chinese central bank released new regulations to curb financial risk in the asset management industry.

Indian Market

Indian equity markets posted modest gains in the period under review, mainly due to positive cues from India’s sovereign rating upgrade by Moody’s Investors Service.

Positive changes under the Goods and Services Tax (GST) regime and Cabinet’s approval of amending the Insolvency and Bankruptcy Code to prevent wilful defaulters from bidding for stressed assets further supported buying interest.

The Ministry of Petroleum and Natural Gas has set up a committee to frame fuel economy rules for moderation of diesel consumption.

The Banking sector closed on a soft note during the period. While Nifty Financial Services grew, NIFTY PSU fell. Meanwhile, S&P BSE Bankex remained flat.

The Auto sector gained on the back of higher sales numbers from major companies during November 2017.

Pharma sector gained as various pharma companies got approval for their drugs from the U.S. Food and Drug Administration (USFDA).

The sovereign upgrade by Moody’s Investors Service helped the rupee as it gained against the U.S. dollar, but gains were capped after Standard & Poor’s decided to maintain India’s sovereign credit rating.

Source: ICRA Online

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000