-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

Equity Market Update: Fortnightly Review – October 2018

Oct 29, 2018

5 mins

4 Rating

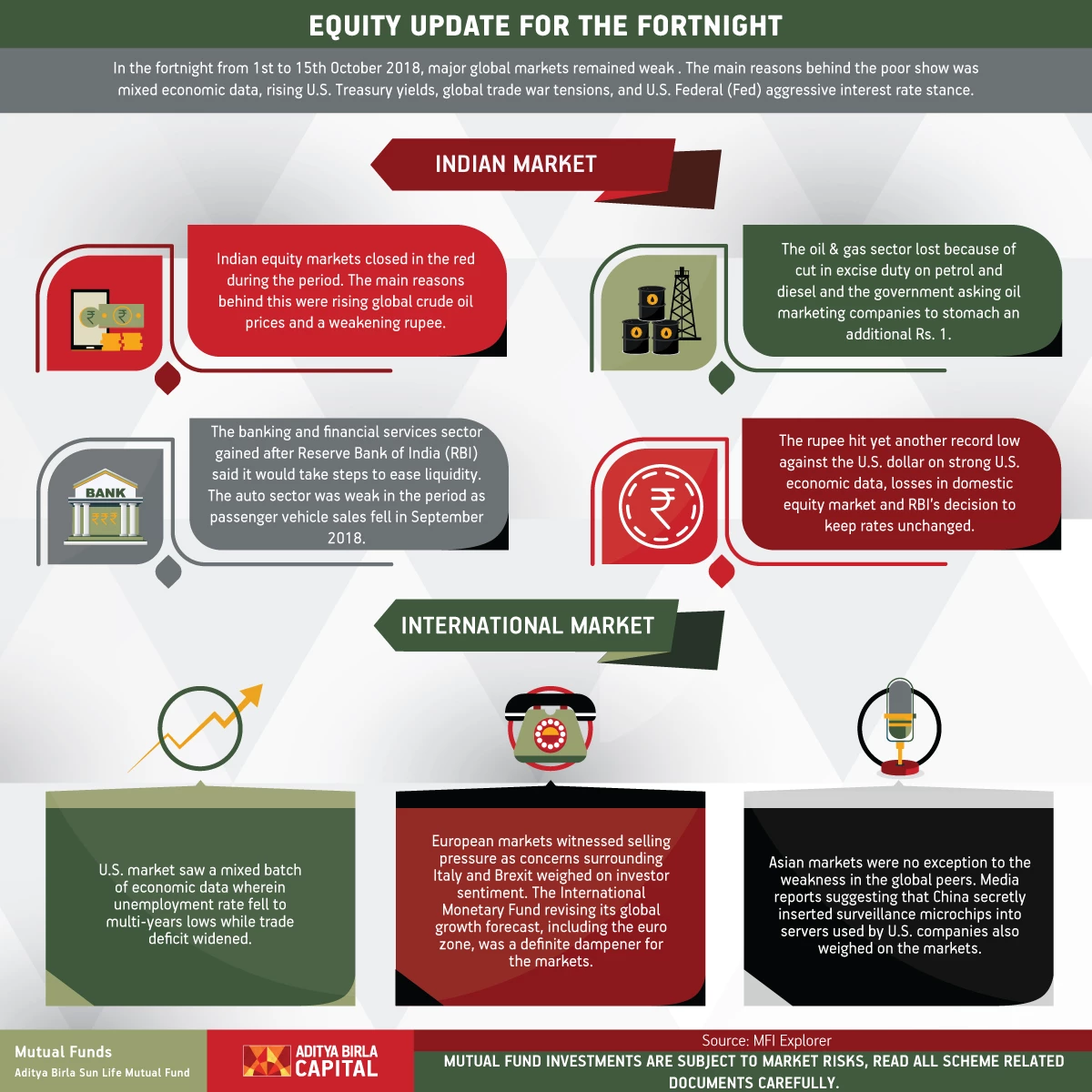

In the fortnight from 1st to 15th October 2018, major global markets remained weak . The main reasons behind the poor show was mixed economic data, rising U.S. Treasury yields, global trade war tensions, and U.S. Federal (Fed) aggressive interest rate stance.

International Market

U.S. market saw a mixed batch of economic data wherein unemployment rate fell to multi-years lows while trade deficit widened.

European markets witnessed selling pressure as concerns surrounding Italy and Brexit weighed on investor sentiment.The International Monetary Fund revising its global growth forecast, including the euro zone, was a definite dampener for the markets.

Asian markets were no exception to the weakness in the global peers.Media reports suggesting that China secretly inserted surveillance microchips into servers used by U.S. companies also weighed on the markets.

Indian Market

Indian equity markets closed in the red during the period. The main reasons behind this were rising global crude oil prices and a weakening rupee.

The banking and financial services sector gained after Reserve Bank of India(RBI) said it would take steps to ease liquidity.

The oil & gas sector lost because of cut in excise duty on petrol and diesel and the government asking oil marketing companies to stomach an additional Rs. 1.

The rupee hit yet another record low against the U.S. dollar on strong U.S. economic data, losses in domestic equity market and RBI’s decision to keep rates unchanged.

Source: MFI Explorer

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000