-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

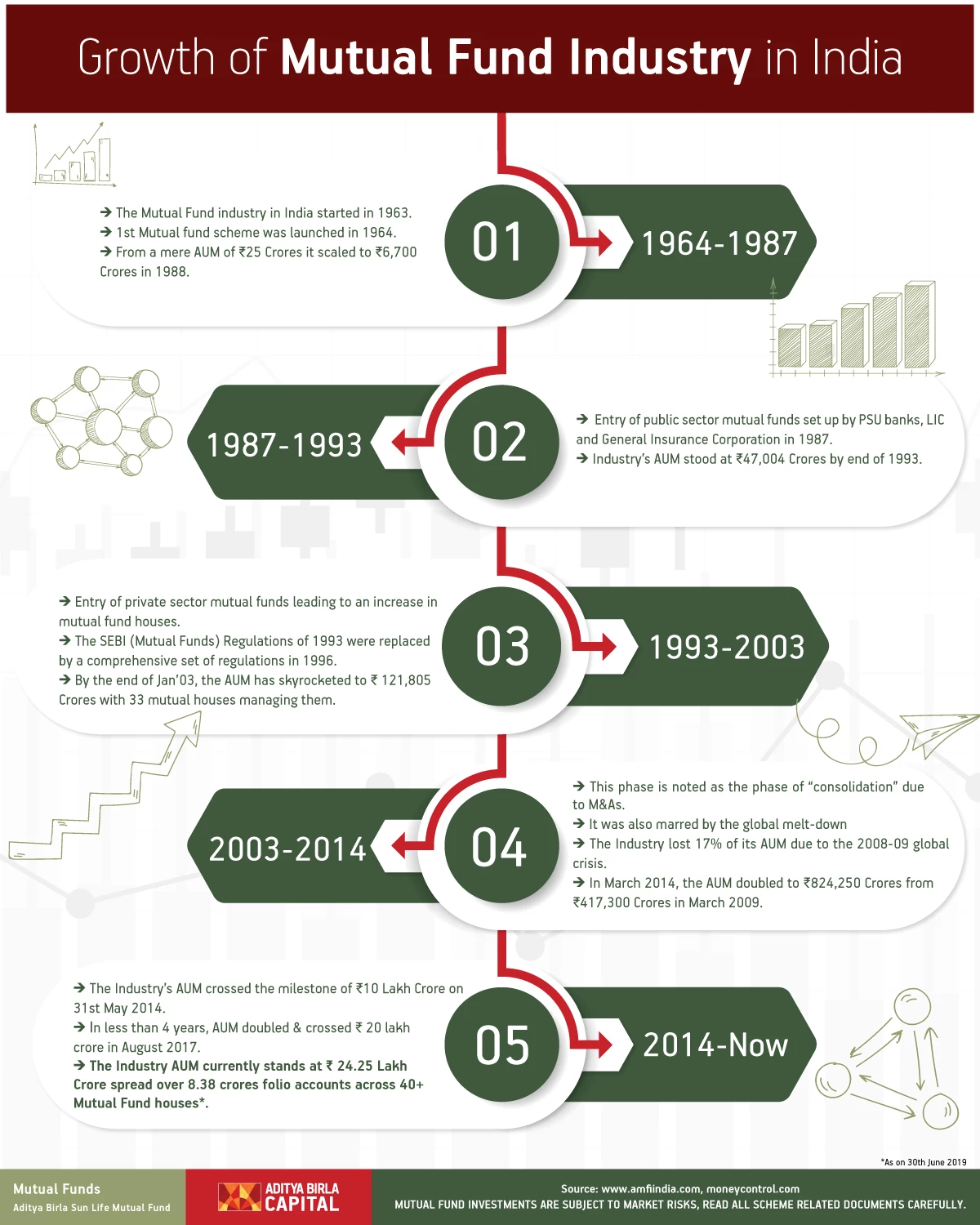

Growth of Mutual Fund Industry in India

Aug 01, 2019

4 mins

4 Rating

First Phase 1964-1987

The Mutual Fund industry in India started in 1963.

1st Mutual fund scheme was launched in 1964.

-

From a mere AUM of ₹ 25 Crores it scaled to ₹ 6,700 Crores in 1988.

Second Phase 1987-1993

Entry of public sector mutual funds set up by PSU banks, LIC and General Insurance Corporation in 1987

-

Industry’s AUM stood at ₹ 47,004 Crores by end of 1993

Third Phase 1993-2003

Entry of private sector mutual funds leading to an increase in mutual fund houses

The SEBI (Mutual Funds) Regulations of 1993 were replaced by a comprehensive set of regulations in 1996

By the end of Jan’03, the AUM has skyrocketed to ₹ 121,805 Crores with 33 mutual houses managing them

Fourth Phase 2003-2014

This phase is noted as the phase of “consolidation” due to M&As.

It was also marred by the global melt-down

The Industry lost 17% of its AUM due to the 2008-09 global crisis.

-

In March 2014, the AUM doubled to ₹ 824,250 Crores from ₹ 417,300 Crores in March 2009.

Fifth Phase 2014-Present

-

The Industry’s AUM crossed the milestone of ₹ 10 Lakh Crore on 31st May 2014

In less than 4 years, AUM doubled & crossed ₹ 20 lakh crore in August 2017.

The Industry AUM currently stands at ₹ 24.25 Lakh Crore spread over 8.38crores folio accounts across 40+ Mutual Fund houses*

*As on 30th June 2019

Source: www.amfiindia.com;

https://www.moneycontrol.com/news/business/mutual-funds/mutual-funds-add-5-3-lakh-folios-in-june-4198861.html

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000