-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

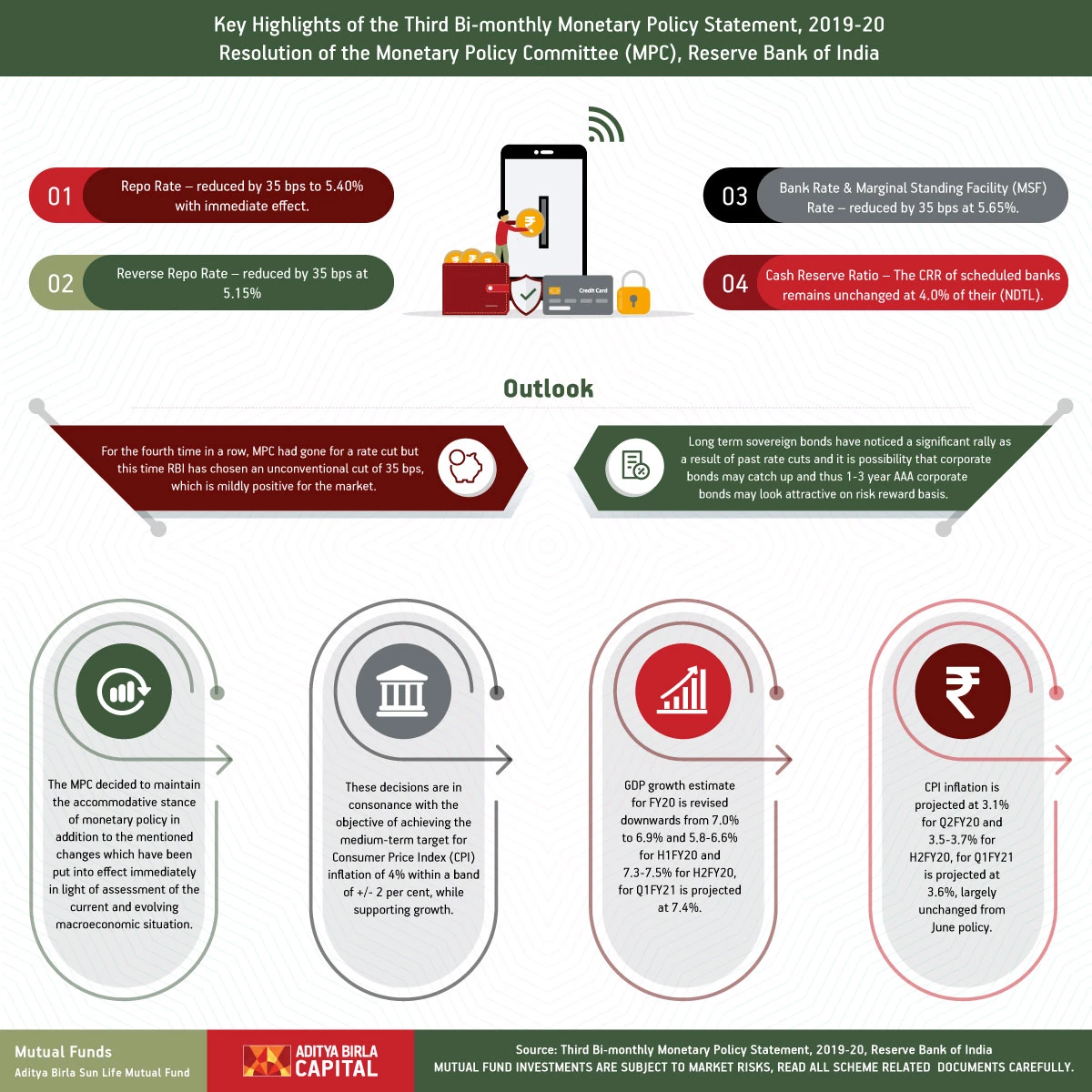

Key Highlights of the Third Bi-monthly Monetary Policy Statement, 2019-20

Aug 12, 2019

5 mins

4 Rating

Repo Rate – reduced by 35 bps to 5.40% with immediate effect

Reverse Repo Rate – reduced by 35 bps at 5.15%

Bank Rate & Marginal Standing Facility (MSF) Rate – reduced by 35 bps at 5.65%

Cash Reserve Ratio – The CRR of scheduled banks remains unchanged at 4.0% of their net demand and time liabilities (NDTL).

The MPC decided to maintain the accommodative stance of monetary policy in addition to the mentioned changes which have been put into effect immediately in light of assessment of the current and evolving macroeconomic situation.

These decisions are in consonance with the objective of achieving the medium-term target for Consumer Price Index (CPI) inflation of 4% within a band of +/- 2 per cent, while supporting growth.

GDP growth estimate for FY20 is revised downwards from 7.0% to 6.9% and 5.8-6.6% for H1FY20 and 7.3-7.5% for H2FY20, for Q1FY21 is projected at 7.4%.

CPI inflation is projected at 3.1% for Q2FY20 and 3.5-3.7% for H2FY20, for Q1FY21 is projected at 3.6%, largely unchanged from June policy.

Outlook

For the fourth time in a row, MPC had gone for a rate cut but this time RBI has chosen an unconventional cut of 35 bps, which is mildly positive for the market.

Long term sovereign bonds have noticed a significant rally as a result of past rate cuts and it is possibility that corporate bonds may catch up and thus 1-3 year AAA corporate bonds may look attractive on risk reward basis.

Source: Third Bi-monthly Monetary Policy Statement, 2019-20, Reserve Bank of India

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000