-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABSL BSE India Infrastructure Index Fund is Live Now

Equity

ETFs - Others

An open ended exchange traded fund tracking physical price of Silver

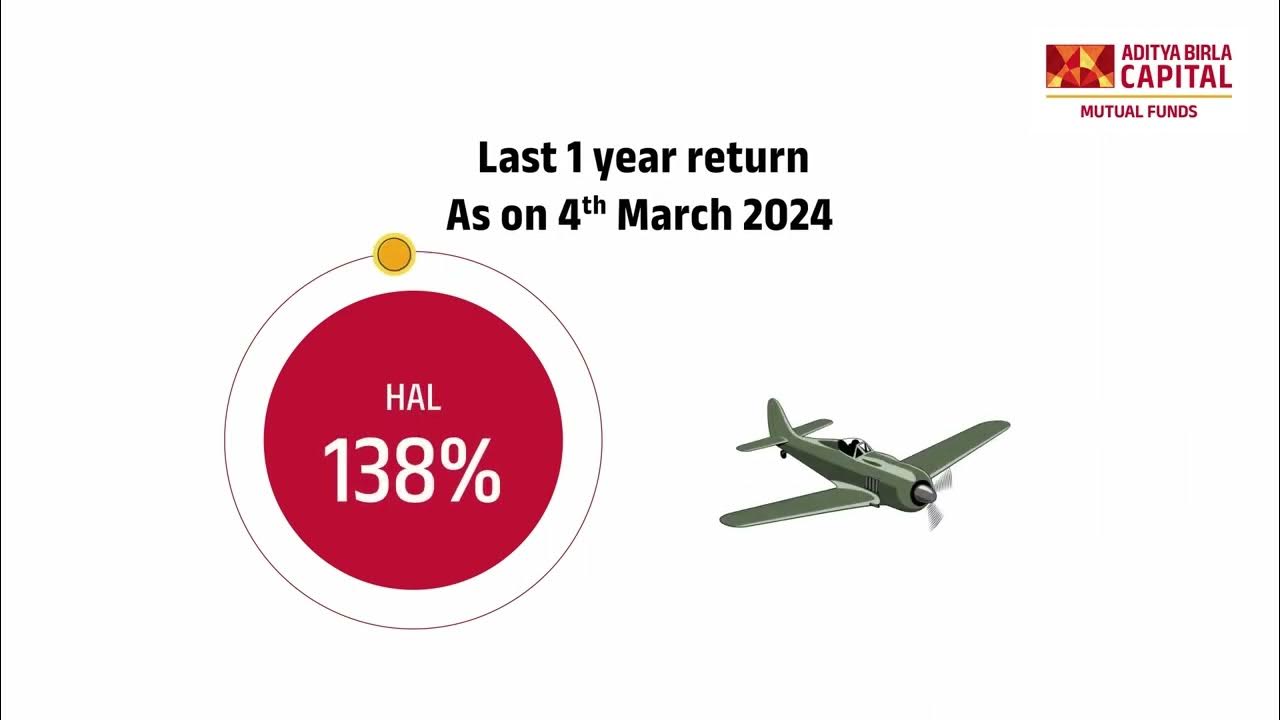

Annualized Returns %

Annualized

Returns %

Fund Overview

Aditya Birla Sun Life Silver ETF is an open-ended exchange traded fund tracking physical price of Silver.

Investment Objective

The investment objective of the Scheme is to generate returns that are in line with the performance of physical silver in domestic prices, subject to tracking error. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved.

Why one can invest:

-

If you are looking to invest in silver as a commodity, that has proven to provide stable performance across market cycles

-

If you are looking to invest in silver but without the costs and hassles of buying physical silver

-

If you are looking for an alternative mode to invest in silver which ensures ease of liquidity, purity and low investing & holding costs.

-

To get these benefits even with low investments – Each Unit of Aditya Birla Sun Life Silver ETF will be approximately equal to 1 (one) gram of Silver

-

If you are looking for an ETF mode of investing that combines the benefit of mutual fund investing with trading ease and convenience of stocks

Fund Details

CAGR

Latest NAV

AUM

Inception Date

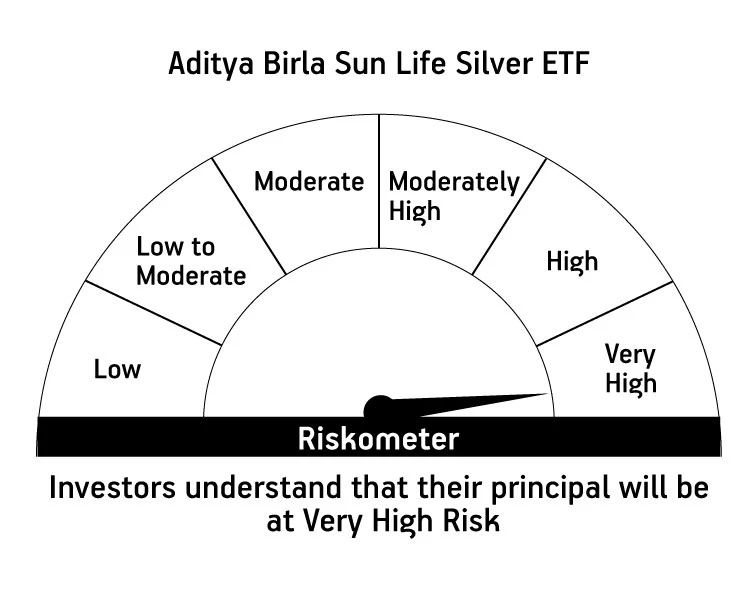

Risk

Investment Horizon

5+ Years

Annualized Benchmark Returns

Min Investment: Rs.

Entry load

NIL

Exit load

NIL

Total Expense Ratio (TER)

Sharpe Ratio

NA

Beta Ratio

NA

Other Parameters

NA

Standard Deviation

NA

Modified Duration

NA

Yield to Maturity

NA

Portfolio Turnover:

NA

Average Maturity

NA

Macaulay Duration

NA

Net Equity Exposure

NA

Fund Managers

Mr. Sachin Wankhede

Riskometer

(An open ended exchange traded fund tracking physical price of Silve)

This product is suitable for investors who are seeking

-

Investors seeking returns that are in line with the performance of silver over the long term, subject to tracking errors

-

Investments in physical silver of 99.9% purity (fineness)

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Portfolio & Sector Holdings

Retail

% of Net Assets

Sector Holdings

Fund Summary

- Silver is a multi-faceted commodity which finds use across industries. Across uses, silver demand is expected to see double digit growth in the years to come; boosting its prices.

- It has also proven its worth historically, by providing consistent returns through all market cycles – an inflation hedge in bearish times and responsive to bullish times

- Silver is traditionally held in physical form. Investment in silver in this form though has some drawbacks – purity concerns, oxidation concerns in physical holding, high costs from making costs to holding costs and liquidity costs

- Aditya Birla Sun Life Silver ETF aims to give investors the benefits of silver investing, without the drawbacks of holding it in physical form

- An exchange traded fund is an investment tool that combines the benefit of mutual funds and trading benefit of stocks.

- Being an ETF, units of the fund are held in demat form and listed and traded on the stock exchanges; giving investors ease of liquidation and low-cost silver investing

Click here to view the Aditya Birla Sun Life Silver ETF Unit Creation

Fund discipline

- The Scheme aims to allocate a minimum of 95% of its net assets to silver and silver related instruments.

- The scheme will invest in physical silver of the prescribed quality and standard. (Physical silver of 99.9% purity confirming to “as per the regulatory norms" Good Delivery Standards.

- It can also invest up to 10% of net assets in Exchange Traded Commodity Derivatives (ETCDs) having silver as underlying. This 10% upper limit is not applicable where the intention is to take actual delivery of physical silver.

- The balance (0-95%) can be allocated to Debt & Money market instruments (including Cash and Cash Equivalent), as permitted by SEBI/RBI; to meet liquidity requirements of the scheme.

- The scheme follows a passive investment strategy, aiming to track the spot price of silver, by investing in it

- Units of the ETF are listed and can be thus bought and sold through the BSE & NSE at real-time prices

Tax Applicability

Investment held for less than 36 months

Short Term Capital Gain Tax would be applicable. Any gains/profits would be added to income of the investor taxed at applicable slab rates (plus applicable surcharge and cess).

Investment held for more than 36 months

Long Term Capital Gain Tax would be applicable. Gains/profits would be taxed at 20% (plus applicable surcharge and cess) after indexation benefit.

Forms & Downloads

Investors also viewed

Don’t know where to start? Start here!

Frequently Asked Questions

Silver has several favourable physical properties that has made it in demand for industrial use, for renewable energy, as jewellery and as investments.

Investing in silver can be beneficial owing to the following – high demand to exceed supply and push prices up, likely hedge against inflation and stable returns through market phases.

An exchange traded fund is a mutual fund scheme that tracks an index, a commodity, bonds or a basket of assets. The units of ETF are mandatorily listed and traded on exchange platform.

An ETF combines certain benefits of both mutual funds and stocks. Investing features of mutual funds such as diversification, even at low minimums – can be as low as few hundreds to few thousands depending on the scheme ; as well as trading convenience benefit of stocks.

A silver ETF is a commodity ETF that invests in and tracks the price of physical silver. It does so by investing in silver and silver related instruments as specified by SEBI (physical silver of 99.9% purity and/or ETCDs with silver as underlying)

Investing in Silver ETF is more beneficial that holding physical silver due to the following – liquidity and trading ease, purity and safety assurance, low costs, low minimums and no wealth tax applicability.

In order to invest in Aditya Birla Sun Life Silver ETF, you must have an active demat and trading account. The units of the scheme in demat form can be bought and sold through the demat account from the stock exchange.

The exit load is Nil.

The units of the Scheme shall be compulsorily traded in dematerialized form and hence, there shall be no exit load for the units purchased or sold through stock exchanges. However, the investor shall have to bear costs in form of bid/ask spread and brokerage or such other cost as charged by his broker for transacting in units of the schemes through secondary market.

Yes, having a demat account is necessary for investing in this fund.

- Returns Calculator

Popular Searches

Mutual Funds Investment

Equity Funds

Debt Funds

Hybrid Funds

Index Funds

ETF

Fund of Funds (FoF)

Target Maturity Funds

What is a Mutual Fund?

What is Equity Fund?

What is Index Fund?

Types of Mutual Funds

Systematic Transfer Plan (STP)

SWP in Mutual Funds

Balanced Advantage Funds

Open-Ended Schemes

What is ETF?

Mutual Fund Tax Benefits

Expense Ratio

IDCW

What is AUM?

What is AMC?

Indexation in Mutual Funds

One Time Mandate

Exit Load

What is Bank Nifty?

What is Finnifty?

What is Nifty?

What is Tax?

What is Debt?

What is ITR?

What is Chapter VI (A)

What is Investment?

Compound Annual Growth Rate (CAGR)

1800-270-7000

1800-270-7000