-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Budget Decode 2

Jan 30, 2018

3 mins

3 Rating

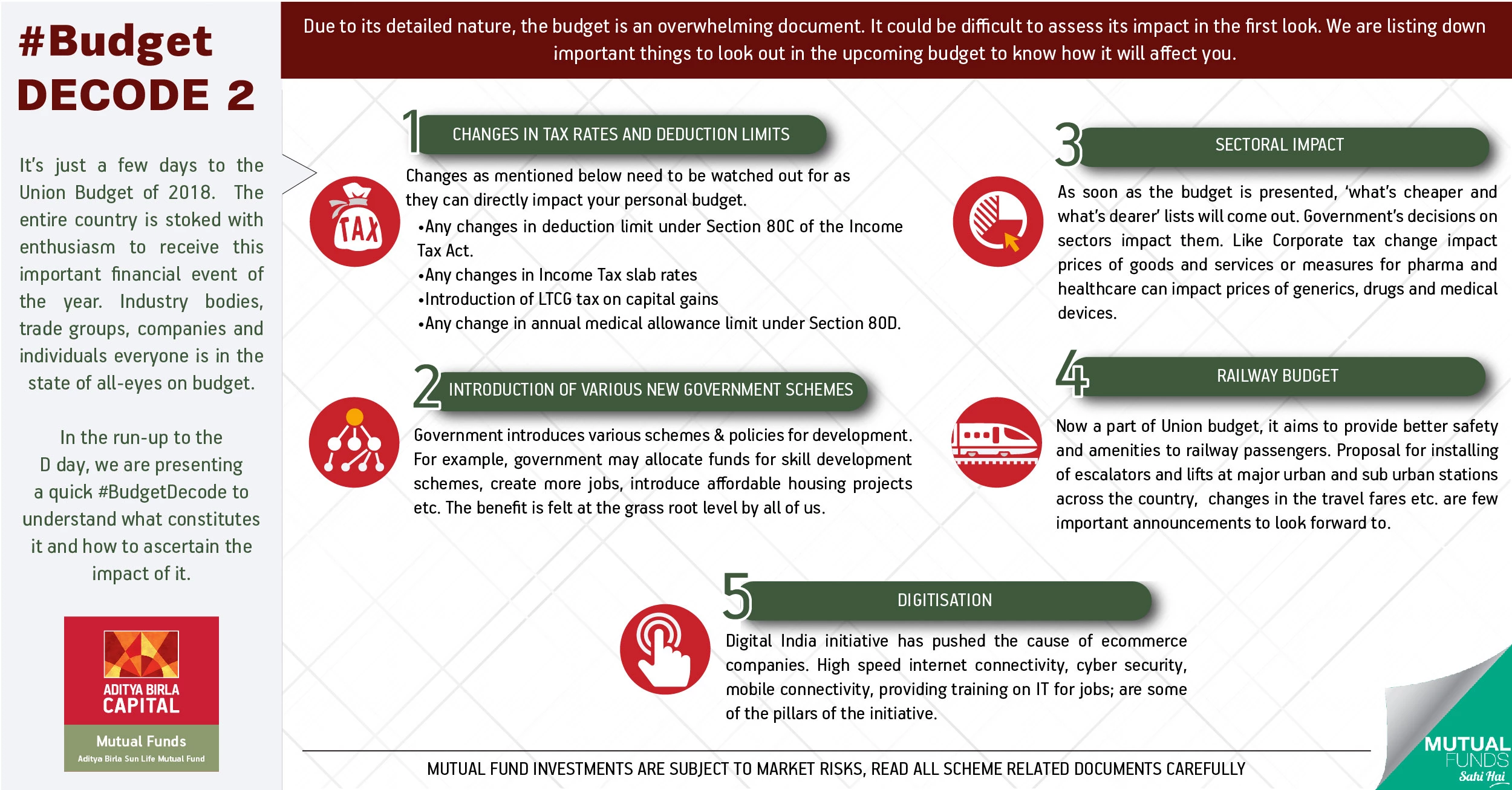

Due to its detailed nature, the budget is an overwhelming document. It could be difficult to assess its impact in the first look. We are listing down important things to look out in the upcoming budget to know how it will affect you.

- Changes in Tax Rates and Deduction limits:

Changes as mentioned below need to be watched out for as they can directly impact your personal budget.

- Any changes in deduction limit under Section 80C of the Income Tax Act.

- Any changes in Income Tax slab rates

- Introduction of LTCG tax on capital gains

- Any change in annual medical allowance limit under Section 80D.

- Introduction of various new government schemes:

Government introduces various schemes & policies for development. For example, government may allocate funds for skill development schemes, create more jobs, introduce affordable housing projects etc. The benefit is felt at the grass root level by all of us. - Sectoral Impact

As soon as the budget is presented, ‘what’s cheaper and what’s dearer’ lists will come out. Government’s decisions on sectors impact them. Like Corporate tax change impact prices of goods and services or measures for pharma and healthcare can impact prices of generics, drugs and medical devices. - Railway Budget

Now a part of Union budget, it aims to provide better safety and amenities to railway passengers. Proposal for installing of escalators and lifts at major urban and sub urban stations across the country, changes in the travel fares etc. are few important announcements to look forward to. - Digitisation

Digital India initiative has pushed the cause of ecommerce companies. High speed internet connectivity, cyber security, mobile connectivity, providing training on IT for jobs; are some of the pillars of the initiative.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000