-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Equity Fortnightly December'17

Jan 24, 2018

5 mins

3 Rating

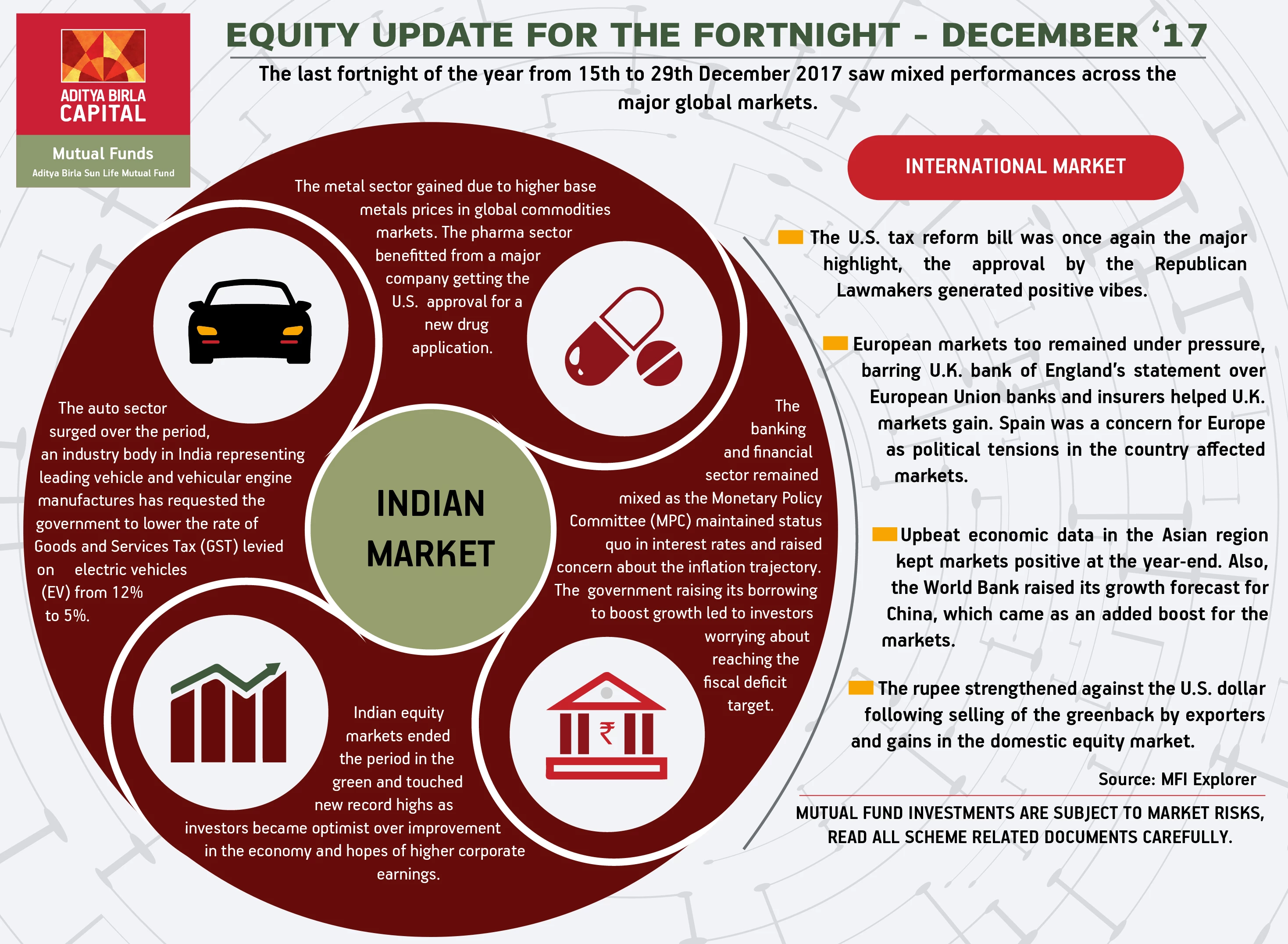

The last fortnight of the year from 15th to 29th December 2017 saw mixed performances across the major global markets.

International Market

The U.S. tax reform bill was once again the major highlight, the approval by the Republican Lawmakers generated positive vibes.

European markets too remained under pressure, barring U.K. bank of England’s statement over European Union banks and insurers helped U.K. markets gain. Spain was a pain point for Europe as political tensions in the country affected markets.

Upbeat economic data in the Asian region kept markets positive at the year-end. Also, the World Bank raised its growth forecast for China, which came as an added boost for the markets.

Indian Market

Indian equity markets ended the period in the green and touched new record highs as investors became optimist over improvement in the economy and hopes of higher corporate earnings.

The banking and financial sector remained mixed as the Monetary Policy Committee (MPC) maintained status quo in interest rates and raised concern about the inflation trajectory.

The government raising its borrowing to boost growth led to investors worrying about reaching the fiscal deficit target.

The auto sector surged over the period, the Society of Indian Automobile Manufacturers (SIAM), requested the government to lower the rate of Goods and Services Tax (GST) levied on electric vehicles (EV) from 12% to 5%.

The metal sector gained due to higher base metals prices in global commodities markets. The pharma sector benefitted from a major company getting the U.S. approval for a new drug application.

The rupee strengthened against the U.S. dollar following selling of the greenback by exporters and gains in the domestic equity market.

Source: MFI Explorer

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000