-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Equity Update for the Fortnight March-2018

Apr 30, 2018

4 mins

4 Rating

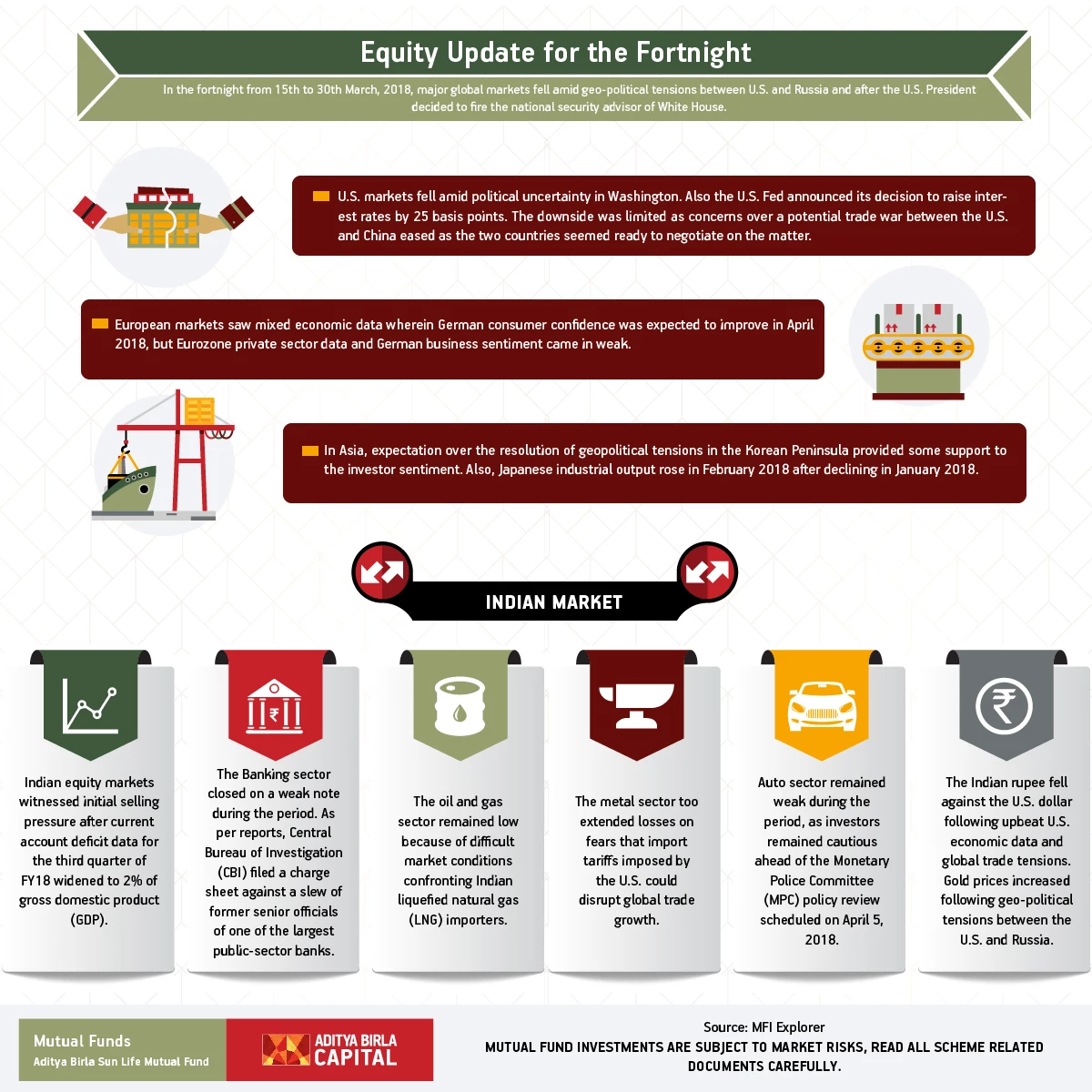

In the fortnight from 15th to 30th March, 2018, major global markets fell amid geo-political tensions between U.S. and Russia and after the U.S. President decided to fire the national security advisor of White House.

International Market

U.S. markets fell amid political uncertainty in Washington. Also the U.S. Fed announced its decision to raise interest rates by 25 basis points.

The downside was limited as concerns over a potential trade war between the U.S. and China eased as the two countries seemed ready to negotiate on the matter.

European markets saw mixed economic data wherein German consumer confidence was expected to improve in April 2018, but Eurozone private sector data and German business sentiment came in weak.

In Asia, expectation over the resolution of geopolitical tensions in the Korean Peninsula provided some support to the investor sentiment. Also, Japanese industrial output rose in February 2018 after declining in January 2018.

Indian Market

Indian equity markets witnessed initial selling pressure after current account deficit data for the third quarter of FY18 widened to 2% of gross domestic product (GDP).

The Banking sector closed on a weak note during the period. As per reports, Central Bureau of Investigation (CBI) filed a charge sheet against a slew of former senior officials of one of the largest public-sector banks.

The oil and gas sector remained low because of difficult market conditions confronting Indian liquefied natural gas (LNG) importers. The metal sector too extended losses on fears that import tariffs imposed by the U.S. could disrupt global trade growth.

Auto sector remained weak during the period, as investors remained cautious ahead of the Monetary Police Committee (MPC) policy review scheduled on April 5, 2018.

The Indian rupee fell against the U.S. dollar following upbeat U.S. economic data and global trade tensions. Gold prices increased following geo-political tensions between the U.S. and Russia.

Source: MFI Explorer

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000