-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Equity Update for the Fortnight – April 2018 - II

May 22, 2018

4 mins

4 Rating

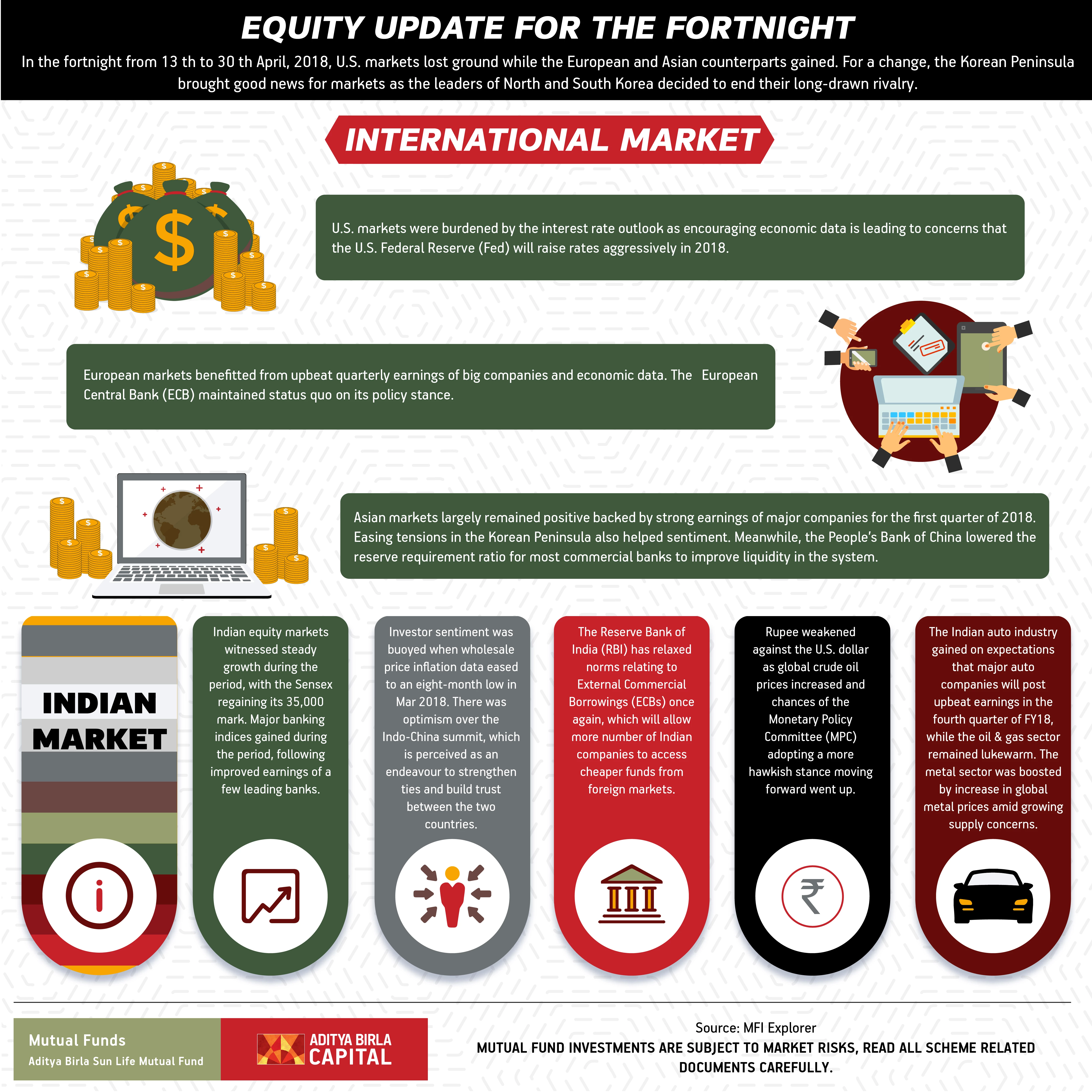

In the fortnight from 13th to 30th April, 2018, U.S. markets lost ground while the European and Asian counterparts gained. For a change, the Korean Peninsula brought good news for markets as the leaders of North and South Korea decided to end their long-drawn rivalry.

International Market

U.S. markets were burdened by the interest rate outlook as encouraging economic data is leading to concerns that the U.S. Federal Reserve (Fed) will raise rates aggressively in 2018.

European markets benefitted from upbeat quarterly earnings of big companies and economic data. The European Central Bank (ECB) maintained status quo on its policy stance.

Asian markets largely remained positive backed by strong earnings of majorcompanies for the first quarter of 2018.Easing tensions in the Korean Peninsula also helped sentiment.

Meanwhile, the People's Bank of China lowered the reserve requirement ratio for most commercial banks to improve liquidity in the system.

Indian Market

Indian equity markets witnessed steady growth during the period, with the Sensex regaining its 35,000 mark.

Investor sentiment was buoyed when wholesale price inflation data eased to an eight-month low in Mar 2018.There was optimism over the Indo-China summit, which is perceived as an endeavour to strengthen ties and build trust between the two countries.

Major banking indices gained during the period, following improved earnings of a few leading banks.

The Reserve Bank of India (RBI) has relaxed norms relating to External Commercial Borrowings (ECBs) once again, which will allow more number of Indian companies to access cheaper funds from foreign markets.

The Indian auto industry gained on expectations that major auto companies will post upbeat earnings in the fourth quarter of FY18, while the oil & gas sector remained lukewarm. The metal sector was boosted by increase in global metal prices amid growing supply concerns.

Rupee weakened against the U.S. dollar as global crude oil prices increased and chances of the Monetary Policy Committee (MPC) adopting a more hawkish stance moving forward went up.

Source: MFI Explorer

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000