-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

From Tax Relief to Financial Freedom: The multi-faceted benefits of ELSS

Mar 21, 2024

5 min

4 Rating

As we close in on this financial year, one of the keys ‘tick the box’ in financial planning is making your tax saving investments. But is tax planning just a routine ticks the box activity?

Well, if you have been investing in traditional tax saving investments, it may seem just like any other ‘routine tick the box’ activity. However, ELSS instruments tick the boxes on various levels beyond mere tax saving.

In a world of smartphones and smart appliances, your investments should also be smart – carrying the ability to multi-task and achieve a lot. Let us see how ELSS achieves this.

The basics of ELSS Tax Saver Fund

ELSS short for Equity-Linked Savings Scheme is a specific category of equity mutual fund schemes categorised by the SEBI which is eligible for deduction under section 80C of the Income Tax Act. (up to Rs.1,50,000 each year)

It invests at least 80% of its assets in equity and equity related instruments and comes with a lock-in period of 3 years.

What makes ELSS different?

ELSS Tax Saver Fund have some unique noteworthy features that make them offer multi-faceted benefits to investors:

Lowest lock-in amongst tax saving options

ELSS has a lock-in period of 3 years from the date of investment. This is considerably lower than all other available tax saving options where lock-in period ranges anywhere from 5 years to 15 years.

Diversified and flexible equity-based investment portfolio

ELSS invests predominantly into equity instruments. They have the flexibility to invest across market caps and across sectors as per the fund managers discretion. This means ELSS has a plethora of investable opportunities to explore.

Managed by expert fund managers

ELSS like any other actively managed portfolio is managed by expert fund managers. These fund managers determine the investment portfolio after conducting in-depth research and analysis of investing conditions. They also periodically monitor and modify the portfolio to keep it updated and in line with market conditions.

Convenient investing options

ELSS allows investors to invest via lumpsum or SIP route, as per their convenience and affordability. Online investing mode ensures both hassle-free investing and redemption just at the click of a button.

These features ensure investors not only get to achieve their goal of tax saving but also stand to potentially gain significant additional financial benefits.

Its benefits, basic and beyond:

The benefits of ELSS are multi-faceted and include:

Tax saving

The foremost benefit is in the form of tax relief. By investing in ELSS one can get a deduction of up to Rs.1,50,000 each year from the taxable income.

Better liquidity

Lower lock-in means you have better liquidity of your investment while retaining the same tax benefit. This helps better plan your financial goals without money being locked away for 5,10 and 15 years.

Long-term capital growth potential of equity

Equity as a class of investments, being market-linked offers a good return potential to long-term investors. ELSS has the highest equity exposure from amongst other tax saving investments with the added benefit of fund manager expertise and flexibility to build a lucrative equity portfolio. This gives you the potential to earn potential capital gains in the long term.

Accumulate wealth through compounding

ELSS keeps you invested for a minimum of 3 years which begins compounding and the longer you continue to stay invested the longer you are likely to reap benefits of compounding. You can even earmark these investments to specific long-term goals that are likely to be presented beyond the 3+ year mark.

Stress-free financial planning

Convenient SIP investing means that you can slowly but surely complete your tax-saving investment without the burden of a lumpsum payment. It also gives all the other benefits that come with SIP investing be it start-stop convenience, compounding benefit, rupee cost averaging benefit etc.

All in all, with ELSS you can gain a compounded financial benefit:

Tax saving + considerable potential financial gain + ease of investing

Perhaps it is time to think outside the conventional box and pick a ELSS Tax Saver Fund for your section 80C investment for this year and every year going forward.

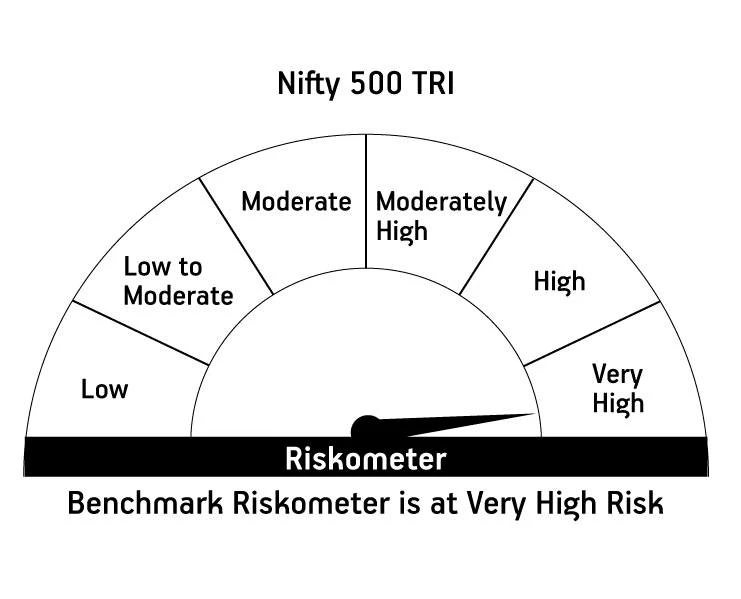

Aditya Birla Sun Life ELSS Tax Saver Fund(An open ended Equity Linked Saving Scheme with a statutory lock in of 3 years and tax benefit) |

||

This product is suitable for investors who are seeking |

||

|

|

|

*Investors should consult their financial advisers if in doubt whether the product is suitable for them |

||

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000