-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

Why large cap funds belong in your core mutual fund portfolio?

Mar 05, 2024

5 min

4 Rating

What do most of us look for while building our investing portfolio? While individual and specific investing goals might differ – there is one common motto – ‘balancing risk and return.’ This means earning reasonable returns along with good risk management is the core goal of investors!

Because at the end of the day we are all looking to make our money grow and certainly wish to keep our invested money safe as well.

Large caps - an investment that personifies this core goal!

Large cap stocks popularly called as blue-chip stocks tend to be an investors favourite for this very reason – reasonable growth and returns with an element of potential stability!

What makes them so?

Let us first understand which stocks qualify as these ‘large caps?

As the name suggests, these are the ‘largest’ listed companies by market capitalisation on the stock exchange. To be precise, large caps are the top 100 listed companies by market capitalisation.

In short, they are the ‘TOP OF THE ORDER’!

Their USP:

Industry or sector giants

Large cap companies are well established in their field. Having amassed years of experience, they typically operate at a scale that has today given them a good market share within their sectoral space.

The fundamentals to back them up

Large cap companies tend to have strong balance sheets coupled with high productivity, efficiency, and robust corporate governance. All in all, they have a solid base in place to maintain a consistent growth trajectory.

Brand appeal

Large cap companies are mostly well-known companies who through their years of product/service offerings have created a significant goodwill in the market. They tend to be the ‘go to’ companies for their sectoral demand.

Why investors could choose large caps for their core portfolio:

Large¬ caps combine the best of both worlds -

Good growth trajectory

With a considerable market share and established foot print, large caps tend to have a stable growth curve. Their strong fundamentals can help investors achieve consistent and sustainable capital growth over long run.

ALONG WITHA well-managed risk profile

Their strong fundamentals allow large caps to better withstand volatility. This keeps downside minimal in bearish market cycles.

This balance of risk and reward of large caps makes them well suited to be the balancing factor for your portfolio, making them worthy of prime position in your core investment portfolio.

Each of these 100 stocks though come with their own specific risk profile and will have different growth drivers working in their favour at different points of time.

So how will you choose from this reasonably large and complex universe of large caps?

In fact, choosing the right stocks at the right time is essential for them to live up to their core characteristic of relative stability with growth.

Large cap mutual funds can find their way to your portfolio here.

These are equity oriented mutual funds, that invest a minimum of 80% of its net assets into large cap stocks.

Therefore, along with the investing benefits of large caps, a large cap equity fund offers a host of benefits that make them a good investing choice:

Give you access to expert fund manager skills

Fund managers research, analyse and select the right large cap stocks at the right time to give your portfolio an extra edge. Their consistency in this also keeps your portfolio updated with changing market conditions, without the need of any effort by the investor.

Diversified portfolio

A large cap fund gives you participation in a group of healthy large cap stocks through a single investment tool. This gives your investment sufficient variety and access to varied growth opportunities.

Investing convenience

A click of a button helps build a diverse portfolio, which is highly liquid and which you can enter and exit at your will without the need to bear extra costs. Their need for low minimums also makes them amenable to any investor – small or big, every investor gets the same benefits!

So, while planning your investments, keep large cap funds at the core to give your portfolio solidity while continue to explore other funds for your specific goal needs.

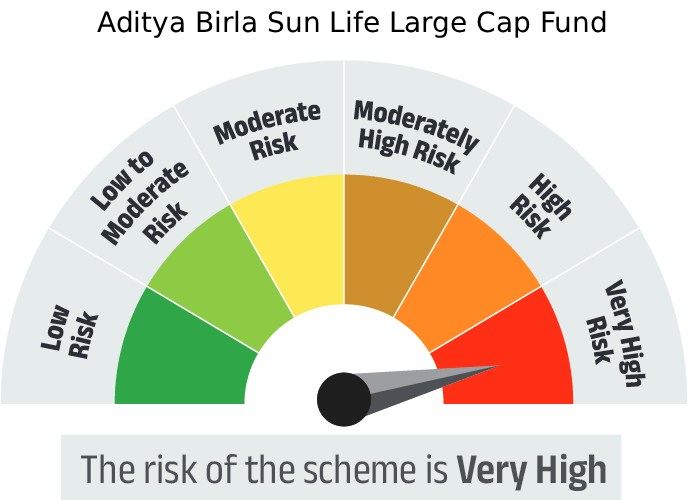

And when considering large-cap funds, one notable option is the Aditya Birla Sun Life Large Cap Fund. With a track record of investing in well-established companies and maintaining a diversified portfolio, this fund can be a suitable choice for those seeking the benefits of large-cap exposure.

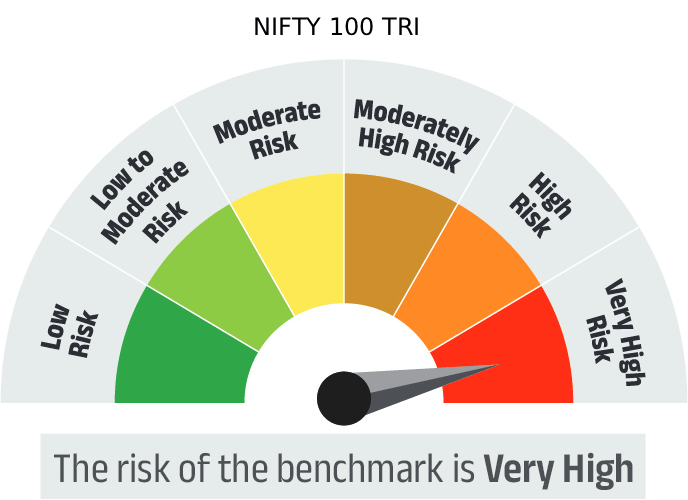

| Scheme Name | This product is suitable for investors who are seeking* | Risk-o-Meter | Benchmark Risk-o-Meter |

|---|---|---|---|

Aditya Birla Sun Life Large Cap Fund |

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000