Before investing, every investor would want to know at least the approximate returns their mutual fund investment could generate. Here’s a detailed guide to help you navigate this intricate returns landscape and make informed decisions.

Embarking on the journey of mutual fund investments requires a nuanced understanding of the financial landscape. One of the most crucial aspects that demand our attention is the profits or returns our investments can deliver.

If not precise, at least an approximate understanding of what our investment could generate is essential to make informed decisions. In this post, we’ll explore mutual fund returns, their types, and more, to help you invest confidently and proactively shape your financial future-

Types of Mutual Fund Returns

One of the most common issues people face when trying to analyze the performance of a mutual fund scheme is understanding the various return metrics. Here’s what they mean-

-

Absolute Returns

The absolute or point-to-point returns represent the total percentage change in the value of the investment. The method is commonly used for calculating returns of mutual fund investments held for less than a year.

For instance, if you invested ₹1.5 lakhs 6 months ago and the current value of the investment is ₹1.75 lakh, the absolute returns of your investment will be-

Absolute Returns= [(Final Value -Initial Value)/Initial Value

= [(175,000-150,000)/150,000]

=16.66%

-

Annualized Returns

Annualized mutual fund returns measure the average annual performance of an investment over a specific period. It is used to know the CAGR (Compounded Annual Growth Rate) of the investment. Note that annualized returns take the compounding effect into consideration.

For instance, let’s assume your mutual fund investment of ₹1 lakh grows to ₹1.5 lakhs in two years. The absolute returns in this case will be 50% but the annualized returns will be calculated as follows-

Annualized Returns= [(Ending Value/Initial Investment)^ 1/Number of Years]-1

= (150,000/100,000) ^ ½ – 1]

=22.47%

-

Trailing Returns

The trailing returns showcase the fund’s performance over a specific trailing period, like 1, 3, or 5 years. The method is commonly used for analyzing the recent performance of the scheme.

For instance, let’s assume the NAV (Net Asset Value) of a mutual fund scheme is ₹70 today and it was ₹50 three years ago. So, the three-year trailing returns of the scheme will be calculated as follows-

Trailing Return= (Current NAV/Starting NAV)^(1/Number of Years) - 1

=(70/50)^(1/2) – 1

=9.57 %

Note –

Absolute return is the total return on an investment over a specified period and it represents total profit or loss generated during in that period of time.

Annualized return is the average rate of return on investment per year over a specific period. It shows the compounding effect of an investment's return.

-

Rolling Returns

Rolling returns are used for assessing the annualized average returns of a mutual fund scheme over a period of time. The period can be monthly, weekly, or daily and up to the last day of the selected duration. The returns are then compared to a similar duration of the scheme’s benchmark index or fund category and represented in a graphical format.

For instance, if the investment tenure is 5 years and the starting date for rolling returns calculation is 1st January 2015, it’ll calculate annualized mutual fund return rates of the scheme and the benchmark or fund category from 1st January 2015 to 1st January 2020, 2nd January 2015 to 2nd January 2020, so on and so forth until 27th November 2018 to 27th November 2023. In a nutshell, it is calculating trailing returns of a fund on a daily basis.

What is the Average Mutual Fund Return Rate?

There are many reasons why it is difficult to provide an average mutual fund return rate. All the different types of mutual fund categories significantly vary in their investment strategies, objectives, and returns generating potential. Moreover, the returns are also considerably impacted by the market conditions, government policies, and overall domestic and global economy.

It is also wrong to assume that all of your mutual fund investments will always deliver positive returns, especially in the short term. Mutual funds are subject to market risks and investors should assess their risk profile before choosing a scheme.

Comparing Your Returns with Benchmark or Category Average

Investors usually compare the returns of a scheme with its benchmark index or scheme category to analyze whether it is worth investing in. Here’s what this means-

-

Comparing Returns Against Benchmark

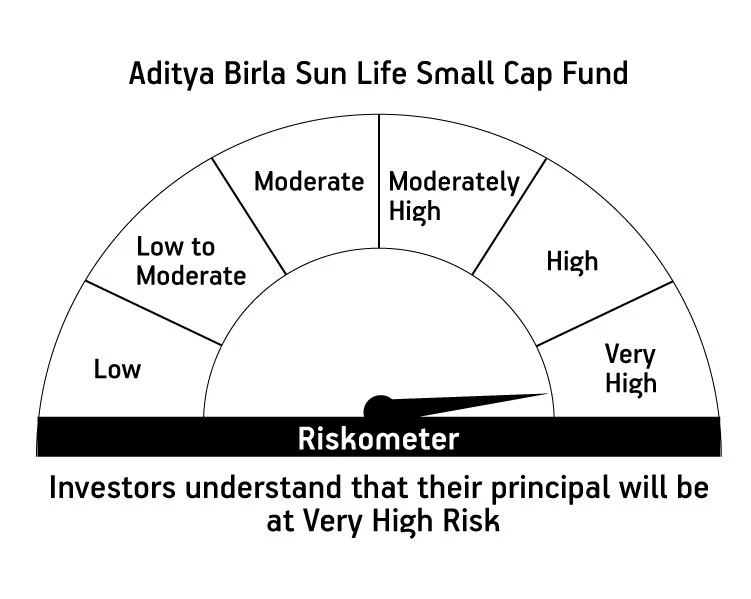

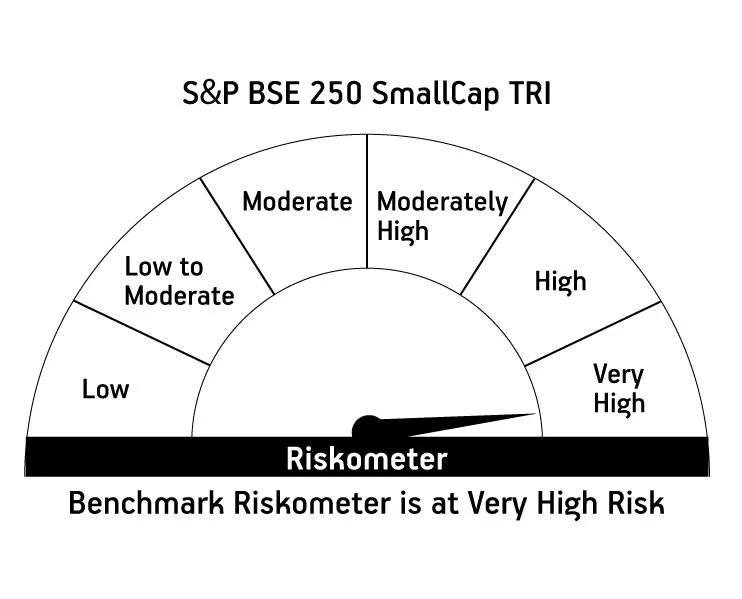

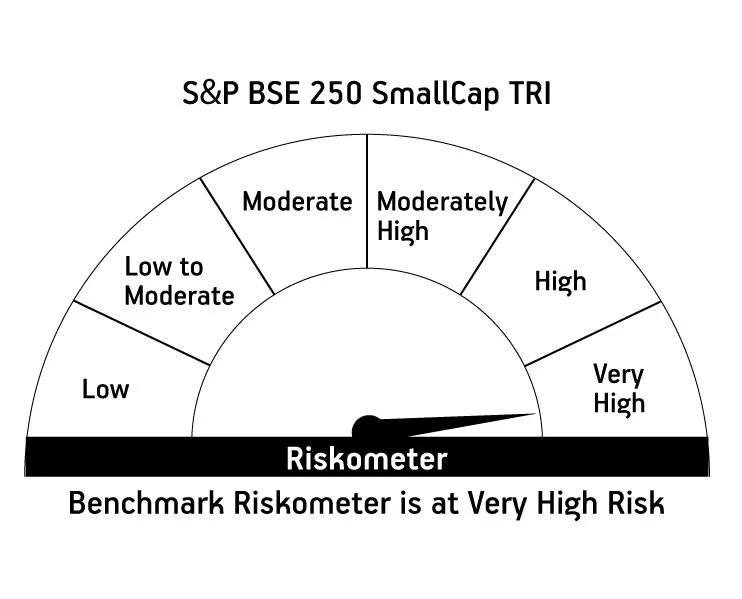

Every mutual fund scheme has an underlying benchmark index. For instance, if we take the Aditya Birla Sun Life Small Cap Fund , its underlying index is S&P BSE 250 Small Cap TRI.

So, if the scheme has been able to consistently deliver returns in line with or higher than the benchmark index over a period of 5-10 years, it is generally considered worth investing in. A similar comparison can also be done with major indices such as NIFTY50 or Sensex.

Note - This is only for illustration purpose and not actual performance.

-

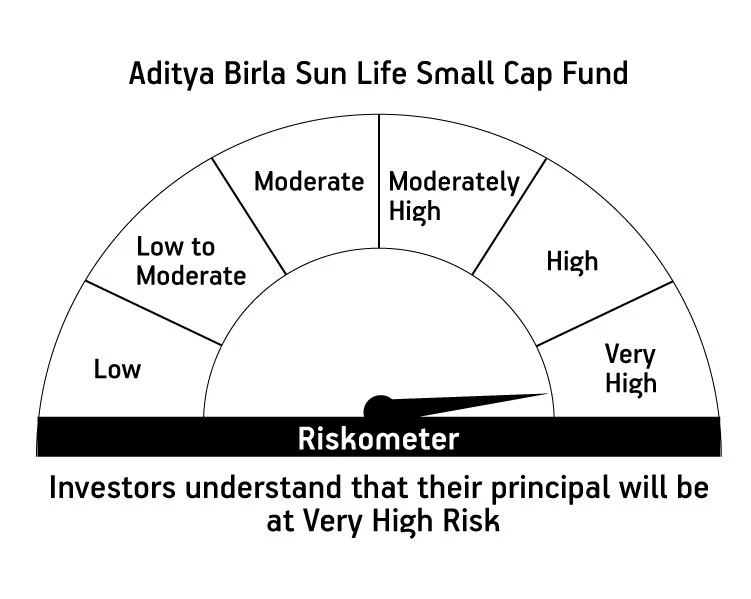

Comparing Returns Against Category Average

There are many different types of mutual fund categories, like equity, debt, hybrid, and more. Comparing the performance of a selected scheme with the category average is also an excellent way to assess its performance.

For instance, if we take the same Aditya Birla Sun Life Small Cap Fund , we can compare its performance against the average returns generated by the small-cap fund category in the same duration.

|

(Aditya Birla Sun Life Small Cap Fund is an open ended equity scheme predominantly investing in small cap stocks)

|

This product is suitable for investors who are seeking

|

- Investments primarily in Small cap companies

|

|

|

|

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

|

Generating Returns from Your Mutual Fund Investments

Understanding the basics of mutual fund returns is critical for your investment journey. It is only when you have a brief understanding of how to assess the performance of a scheme that you can ascertain whether it should be part of your portfolio.

But as always, focus on factors like your investment goals, tenure, and risk appetite before making a decision. The assistance of a financial advisor is recommended to build an investment portfolio as per your investor profile.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000