-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Mutual Fund Investing for NRIs

Jul 19, 2019

6 mins

5 Rating

Take an example of Mr. Ajay Singh who had shifted to Dubai 3 years ago. A great work opportunity along with a zero personal income tax scenario and an important financial center - it didn’t take him long then to say yes.

He is quite settled now and makes a decent pay package. Life is good. However, at some point he would like to come back to India. To ensure that it works out money wise, he wants to create an investment portfolio in India. Not to mention, India also happens to be a in long term growth cycle hence presenting a good investing opportunity.

The thought that he is struggling with is how should he go about building this portfolio. He has invested money into real estate in India since he wishes to have a place to stay when he comes back.

Now he wants to look at different investments. Direct Stocks is one option, but they demand attention, study and analysis. Given his work and family commitments, that could become messy.

However, he has been reading a bit on mutual funds and wants to know how he too can use them in his portfolio?

It is your question on your mind as well. Right?

Today, we are answering some of the most important queries regarding how NRIs can invest in mutual funds in India.

Mutual funds aim to present a convenient, low cost, tax effective solution for most investors including NRIs.

In fact, for future requirements of money in India, you can plan to build a dedicated portfolio of mutual funds to meet such needs. It could be retiring in India, funding education for your children in India or buying an asset in the future or starting a business.

There is a solution for every need. In fact, you can have access to almost all the funds that are available to Resident Indians. Low cost index funds / ETFs, large cap funds, multicap, mid or small cap, hybrid, thematic or sectoral, you can have it all.

The choice is vast.

Too many choices either freeze us or push us into decisions we can regret later. You must be careful as to what funds you add to your portfolio.

Choosing your mutual funds

It is easy to get confused in a wide range of scheme names and investing strategies.

Here are a few key pointers you can use to select funds:

Know your investment time horizon (for how many years you wish to invest) and your risk profile (how much short-term volatility can you take).

Look at the past track record in terms of risk and return (above average return, average risk)

Don’t try to chase returns or invest based on past performance alone. Typically, a higher risk is involved in chasing higher returns.

Patience is key. Sticking around with any strategy for a few years is important to let it play out.

Count the experience of the fund manager and the fund (at least 5 years). Read about the fund manager as also his/her interviews and articles. Clarity in views about investing can be a good signal about the fund / manager.

If you still find this difficult, then take the simplest approach. You may invest in index funds/ETFs as a good starting point to build the core of your portfolio. Later, you can seek help of an investment adviser to better align your portfolio to your needs.

How easy or difficult is to invest / sell? Does it include paperwork?

An NRE or NRO account with an Indian Bank is a prerequisite for investing in India. You also must ensure that your PAN Card and KYC are in place before you start investing. FATCA and CRS declarations should also be made.

You can then simply invest in mutual fund schemes online. Most online platforms including the website of the mutual fund allows you to open an online account and start investing right away.

You can even sell online and receive the money directly into your bank account.

Except in case of US/Canada NRIs, as per current laws, you may need to be present in India to open your investment account.

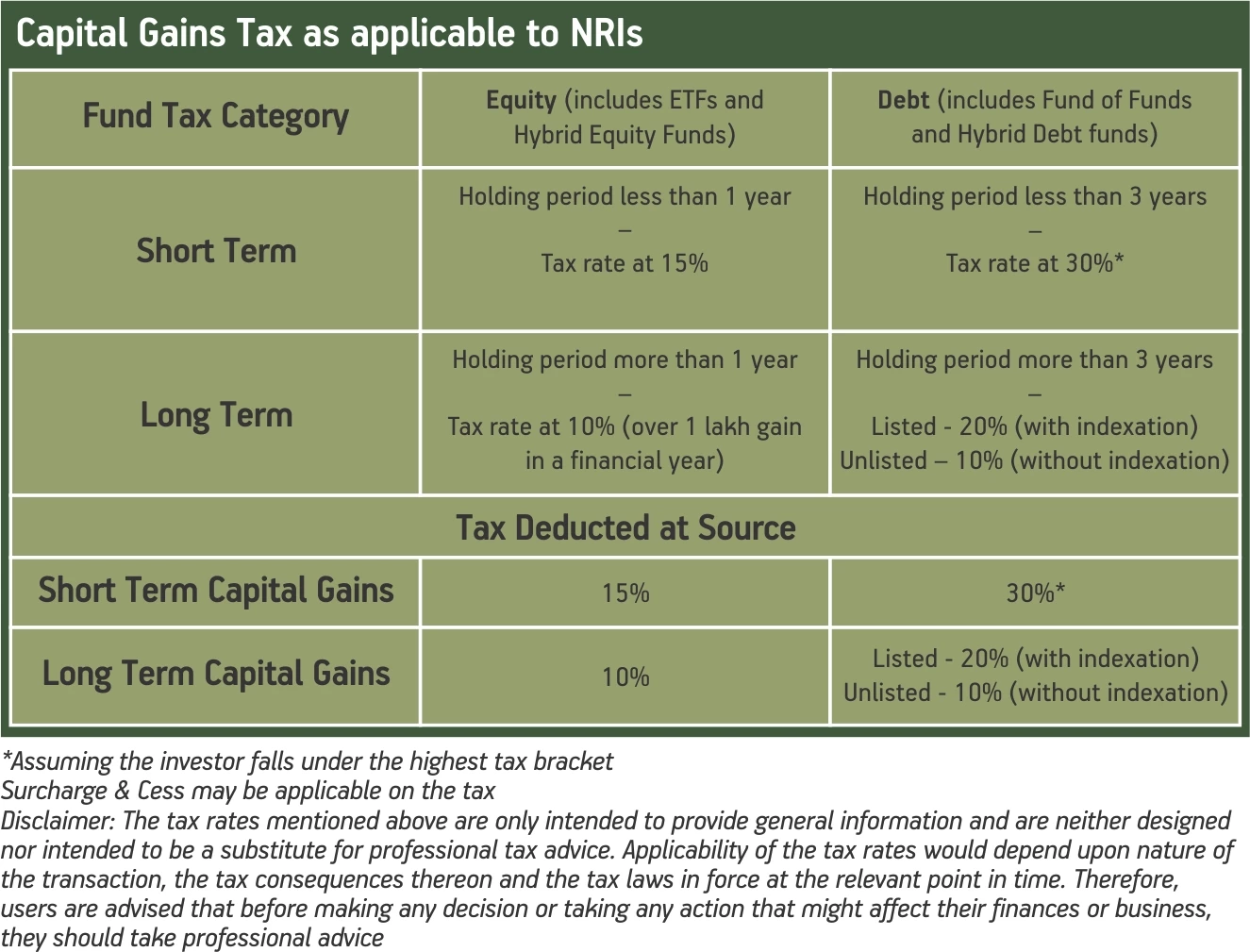

How are mutual fund returns taxed?

In case of mutual funds, capital gains tax is applicable, but only when you sell.

For equity funds sold after 1 year, any gains over 1 lakh in a financial year, are taxed at 10%.

For debt funds, if sold before 3 years, any gains on selling will be taxable as per your income tax bracket in India. For funds sold after 3 years, cost indexation benefit is applicable. Post indexation, the capital gains tax rate is flat 20%.

TDS is applicable for NRIs on redemption of equity and debt mutual funds. It is charged at the highest applicable rate. However, you can file tax returns and get refunds, as applicable to you.

What if I want to take my money back for any reason?

No problem. You can remit the money back in your base country. If you use an NRO account, upto 1 million USD per financial year can be repatriated every year. In case of NRE account, there is no limit.

In conclusion, once the requisite paperwork is in place, Mutual Fund investments can be fairly automated, which is a big help given the distance, and quite a convenience for non-residents.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000