Summary

ROI is a simple yet crucial profitability metric derived using total income and actual investments. This post discusses ROI and its benefits in detail.

Content

Almost every individual with financial awareness understands the benefits of investing. Especially long-term investments can potentially grow your wealth through the power of compounding. However, it is also equally important to diversify your portfolio by including different asset classes to minimise the volatility risk.

Now, when you’re investing for a long term in different investment instruments or businesses, it becomes important to track their performances through various financial parameters. ROI is one such parameter that investors extensively use for the assessment of their investments.

The ROI full form is Return on Investment. Let’s now delve deeper to know what is ROI, its uses, and its importance.

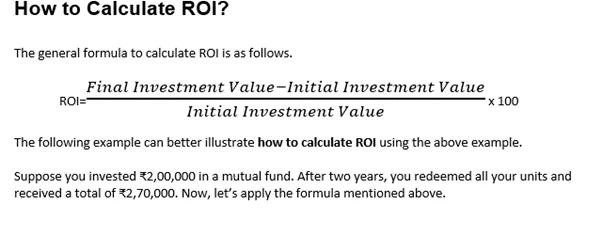

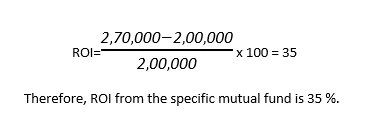

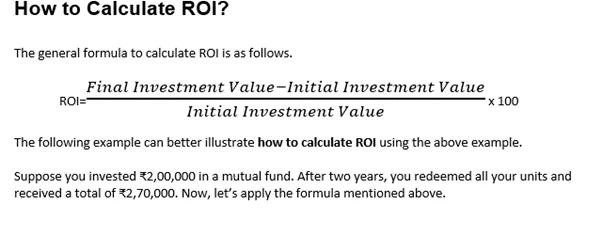

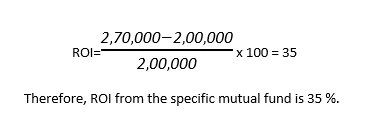

What Is Return on Investment (ROI)?

The return on investment (ROI) is a vital profitability metric used to evaluate returns from a particular investment. ROI is expressed in the percentage and can be used to assess the efficiency of different investment options like equities,

mutual funds, fixed deposits, etc.

Advantages of ROI

Limitations of ROI

Ignores Investment Tenure

ROI ignores the investment tenure, which is a big factor to consider while gauging the efficiency of an investment option.

For example, if you earned ₹1,50,000 by investing ₹1,00,000 in an investment option, the ROI will show 50%. But, it will not consider the investment tenure it took to achieve the stated return.

Ignores Inflation

ROI can’t show the impact of inflation on your investments. So, you need to separately arrive at the true value of your investments after adjusting the inflation rates.

Doesn’t Consider Tax Implications

The returns from an investment can be taxable depending on the type of investment. But, the ROI formula only considers the final investment value while calculating returns. Therefore, your actual returns might be low depending on the taxes it attracts.

Doesn’t Reflect True Business Potential

Sometimes, an investment’s actual value can remain locked for a long time. In such a situation, the ROI may suggest a poor rate of returns, whereas the business may be silently consolidating its position.

For example, consider a company that decides to expand its manufacturing capacity, potentially increasing its future profits. But, the ROI might show a poor return as the firm doesn’t have significant profit margins at present.

Unable to Calculate Non-Financial Benefits

While some investments don't have any financial benefits, they are crucial for the growth of the business. For example, infrastructure upgradation, workers' training, technology integration, and other such investments can benefit a firm's growth in the future. However, ROI can't account for these non-tangible benefits.

How Can You Use ROI?

Evaluate Investment Decisions

It is crucial to periodically revise your investment decision to decide whether to continue the investment or not. ROI is one of the fundamental performance metrics investors use to evaluate their investment decisions.

Improve Financial Portfolio

You can use ROI to compare your own personal investments and make changes accordingly. For instance, you can improve your holdings in asset classes with high ROIs if all the other financial metrics, like CAGR, sales growth, etc., also meet your investment parameters.

Importance of ROI

ROI helps understand the impact of an investment on the growth of a business or a financial portfolio. It can also help refine your future investment strategies. In recent times, there have been efforts to increase the scope of ROI beyond financial terms.

Consequently, ROI is increasingly used to assess non-financial returns like socio-environmental factors and careers. Therefore, we can expect to see an even greater role of ROI in finance and other areas in the future.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000