-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

ADITYA BIRLA SUN LIFE NIFTY SMALLCAP 50 INDEX FUND: Everything That You Should Know?

Apr 15, 2024

8 min

4 Rating

ADITYA BIRLA SUN LIFE NIFTY SMALLCAP 50 INDEX FUND Aditya Birla Sun Life Nifty Smallcap 50 Index Fund grants smallcap equity participation without active bet concentrations by closely replicating the underlying index.

Instead of fund managers aggressively speculating on penny stocks, this fund mirrors demonstrated index behaviours using structured diversification management methodologies. Thus, there is decent upside potential without the risk of individual stock selection pitfalls.

Summary of Key Performance Metrics So Far

Particulars |

CAGR % Returns |

|||

1 Year |

3 Years |

5 Years |

Since Inception |

|

Aditya Birla Sun Life Nifty Smallcap 50 Index Fund |

68.49% |

NA |

NA |

18.96% |

B: Nifty Smallcap 50 TRI |

73.24% |

NA |

NA |

20.49% |

AB: Nifty 50 TRI |

30.27% |

16.35% |

15.27% |

15.90% |

Current Value of Standard Investment of ₹10,000 invested (in ₹) |

||||

Aditya Birla Sun Life Nifty Smallcap 50 Index Fund |

16,873 |

NA |

NA |

16,835 |

B: Nifty Smallcap 50 TRI |

17,272 |

NA |

NA |

17,465 |

AB: Nifty 50 TRI |

13,008 |

15,736 |

20,356 |

15,549 |

Inception date: April 01, 2021 |

||||

NAV as on March 31, 2024: 16.83. Fund Managers: Mr. Haresh Mehta (since March 31, 2023) & Mr. Pranav Gupta (since June 08, 2022). Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co- Managed by Fund Managers is 15. Total Schemes managed by Mr. Haresh Mehta is 15. Total Schemes managed by Mr. Pranav Gupta is 17.

For disclosure of quarterly AUM/ AAUM and AUM by Geography, please visit our website: https://mutualfund.adityabirlacapital.com/.

A reasonably growing corpus signifies investor acceptance and participation.

Assessing Various Fees and Investment Horizon

-

Exit Load - For redemption/switch out of units on or before 15 days from the date of allotment: 0.25% of applicable NAV

-

Expense Ratio – 1.05%

-

Recommended Investment Tenure: Minimum 3 years ideal for smoothing interim fluctuations observed

Source - https://groww.in/mutual-funds/aditya-birla-sun-life-nifty-smallcap-50-index-fund-regular-growth

Why Passive Route Makes Sense

-

Broad Diversification - 50 stocks dilute risks efficiently

-

Market Returns - Participates in indexes general upward progression

-

Low Costs - Saves on research teams skills, freeing savings

-

Optimal Allocations - Indexes assign weights spreading risks reasonably reasonably

-

Simplicity - Easy selection and tracking suits newcomers unaccustomed to intricacies in the mutual funds universe conveniently

Understanding How It Works

The fund replicates the index religiously by periodically holding all 50 constituents at comparable weights. Thus, performance aligns reasonably with the overall smallcap index over corresponding periods, subject to tracking error.

However, with highly volatile behaviours intrinsically temporarily, sizable fluctuations remain unavoidable, requiring holding abilities for favourable long-term outcome generation. Rebalancing activities realign weights whenever churn occurs within the underlying index periodically.

Small Caps Interpretations Myths vs Realities

-

Myths: Risky penny stocks destroy wealth rapidly

-

Reality: Potential future industry leaders offering high growth at reasonable valuations

-

Myths: Excessive churn through entry/exits trying to opportunistically time adversity

-

Reality: Consistency generating moderate inflation-beating returns over multiple years

-

Myths: Hopeless picking black swan gems in a haystack singlehandedly through research

-

Reality: Index diversification distributes risks optimally, taming volatility swings harshness

Thus, the low-cost index fund structure simplifies engaging the smallcap segment, minus the pitfalls and complexities that the active variant presents.

Choosing a Passive Route

Index Fund Pros:

Diversifies risks through caps prudent capping

Low costs due to portfolio mirroring

Aspects Needing Active Management Still:

Due Diligence: Research credibility is still required

Rebalancing Needs: Rebalancing activities to realign weights whenever churn occurs within the underlying index periodically.

Index Constituents Weights Distribution

Name |

% of Net Assets |

Suzlon Energy Ltd. |

9.65% |

KPIT Technologies Ltd. |

5.71% |

APL Apollo Tubes Ltd. |

4.76% |

Apollo Tyres Ltd. |

4.64% |

BSE Ltd. |

4.32% |

Kajaria Ceramics Ltd. |

4.29% |

Kei Industries Ltd. |

3.71% |

Crompton Greaves Consumer Electricals Ltd. |

3.29% |

Multi Commodity Exchange Of India Ltd. |

3.26% |

Cyient Ltd. |

3.21% |

The data was taken on 12th Apr’24

Ref - https://mutualfund.adityabirlacapital.com/products/wealth-creation-solutions/aditya-birla-sun-life-nifty-smallcap-50-index-fund

Thus, representative sector participation ensures that the optimal balance is maintained periodically and that the portfolio is excessively oriented towards a few pockets. Thereby, interim deviations normalise appreciably over long periods, indicating steadiness for patient investors focused on adopting the long view prudently.

Issuer(s) / Stock(s) and Sector(s) mentioned in the document are for the purpose of disclosure of the portfolio of the Scheme(s) and should not be construed as recommendation. The fund manager(s) may or may not choose to hold the stock mentioned, from time to time.

NSE disclaimer: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Draft Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the 'Disclaimer Clause of NSE’.

Steps to Invest In:

Goals Matching

Clarity on tenure and risk tolerance aspects keeps expectations aligned prudently.

Review Overall Fit

Assess portfolio balance needs, given that volatility is traditionally higher for calibrations.

Online Investments

Investment platforms ease lumpsum buying or systematic monthly SIPs, enhancing affordability.

Monitor and Track

Log in periodically to view portfolio returns and constituent allocations for seamless, prudent tracking.

Thus, low-cost index funds effectively simplify smallcap segment participation through benchmark mirroring while overcoming limitations faced during high-risk active selection pitfalls. Staying informed aids in optimising overall mutual fund allocations and maximising advantages sustainably.

Conclusion

Nifty Smallcap 50 Index Fund delivers an optimal route, participating in demonstrated smallcap index returns conveniently through a low-cost passive structure proficiently. Periodic review and rebalancing still warrant merit for ensuring disciplined investing experiences and durably optimising risk-adjusted profiles. Thereby evaluating tactical index fund blending for maximising overall portfolio construction efficiencies.

Note: Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

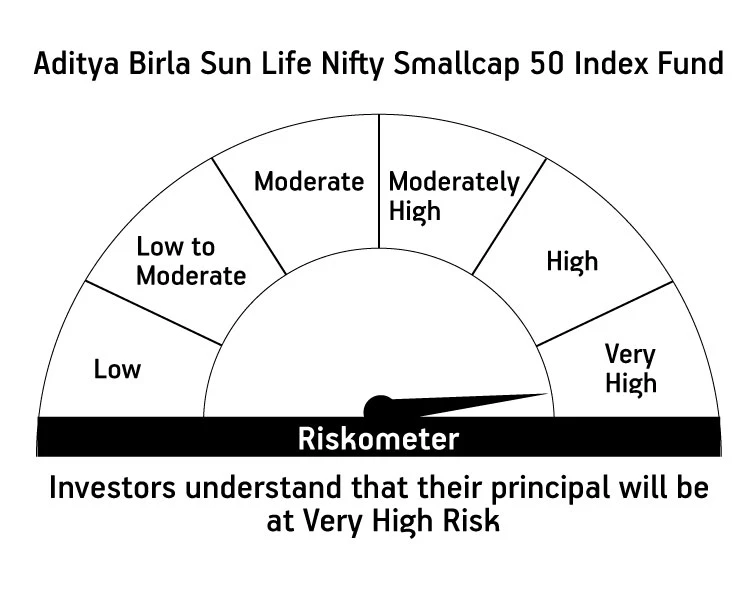

| Aditya Birla Sun Life Nifty Smallcap 50 Index Fund | ||

| (An open ended scheme tracking Nifty Smallcap 50 TR Index) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000