-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

What Are Overnight Funds? Exploring the Objectives of Overnight Funds

May 03, 2024

5 min

4 Rating

In an alternate universe of mutual funds, “overnight success” might differ in meaning from the one in this world; here, overnight mutual funds can offer different types of successes, such as short-term returns, low-risk exposure, etc.

For example, imagine you want to secure your surplus cash for a short time. It is here that overnight funds take up the role of unsung heroes and offer you one way to conveniently invest your surplus cash in low-risk debt instruments that mature overnight. Hence, the name “overnight funds."

SEBI defines overnight funds as open-ended debt funds that primarily invest in overnight securities like reverse repo rates, with a one-day maturity period. Stressing again, overnight funds can be one of the safest investment options due to their low-risk and short-term investment characteristics, which can potentially help investors mitigate market volatility.

Objectives of overnight funds

Overnight mutual funds function with a simple understanding, i.e., to help investors manage their surplus cash in a better financial way. The fund’s aim of becoming a safe harbor for investors cannot be overstated, as they principally work on these three objectives:

Objective 1: Overnight funds invest in reputable entities with short-term maturities like Treasury bills, commercial papers, etc., which enables a convenient trading process for investors.

Objective 2: These short-term maturities possess potential immunity against fluctuating interest rates and credit risks, making them a less risky investment option for investors.

Objective 3: The fund's one-day maturity facilitates high liquidity benefits to the investors. During the trading day, investors can buy or sell with ease, making the transaction simpler.

How do overnight funds work?

The working framework of overnight funds is simple. For an investor, it is paramount to know where these funds are invested and the return payment.

Step 1: Investment

These funds primarily invest in collateralized borrowing and lending organizations (CBLOs), overnight reverse repos, and the concerning debt-related instruments of maturity up to one day. [CBLOs are money-market instruments that represent an obligation between buyers and sellers through loans.

Overnight funds follow two things:These funds are obliged to invest in only those securities with overnight maturities.

These funds are debarred from investing in risky debt instruments to promote low-risk exposure for investors.

Step 2: Source of income

The short-term maturity period of these funds does not really position as the best option for long-term capital wealth accumulation. However, these funds can be a great investment option for short-term income generation. Investors receive income through interest payments earned on debt securities.

Benefits of investing in an overnight fund

Overnight mutual funds cater to the investor’s financial needs. Investing in overnight mutual funds can be a possible way of earning profits in short-term period. Although these benefits could be attractive, investors must remember not to ignore any potential risks that may be associated with these funds.

1. Can protect against market volatility

Investing in debt funds for a long-term period may attract potential risks on the returns like interest rate fluctuations, uncertain liquidity risks, or credit risks. However, overnight funds’ short-term maturity period may be able to protect your investments from these risks. The portfolio changes every day, which can shield it from these potential risks.

2. Easy withdrawal

The high liquidity attribute of these funds allows investors to buy or sell units anytime during the trading day. This attribute facilitates an easy withdrawal process.

3. Short-term investment horizon

A short-term investment can be as important as a long-term investment. For short-term plans like vacation planning, upcoming birthday, or anniversary celebrations, one-day maturity period overnight funds can be the solution.

4. Low-risk nature

This benefit makes overnight mutual funds desirable in the eyes of investors. The low-risk nature of these funds is a result of investing in overnight securities only. The short-term maturity period can secure your investments from credit risks and fluctuating interest rates.

Who can benefit from investing in overnight mutual funds?

A short-term investor can choose to invest in overnight funds. These funds are specifically designed with the aim of providing returns in this specific time period. Also, investing in these funds can be a solution to managing your idle cash.

Taxation on overnight funds

Capital gains are the profitable earnings from a mutual fund scheme, and they are subject to tax rates. Taxation is calculated based on the tenure of the investment period in the specific mutual fund scheme. Overnight funds are subject to taxation similarly to debt funds.

If investors redeem less than 36 months, capital gains will fall under short-term capital gains (STCG). These gains are taxed according to the investor’s income tax slab once they are added to his account.

When investors redeem the units after holding them for more than 36 months, the procured gains come under long-term capital gains (LTCG). They are taxed at 20% with the benefits of indexation.

Dividend payments are taxed according to investors’ income tax brackets.

Disclaimer: In view of individual nature of tax consequences, each investor is advised to consult his / her own professional tax advisor before taking any investment decision.

Conclusion

Investing is a journey to a secure financial future. By making wise investment decisions, you not only gain wealth but also turn your financial aspirations into reality. Short-term goals can be fulfilled with the help of overnight funds. Therefore, investors should embrace the possible opportunities that overnight funds can provide.

Aditya Birla Sun Life AMC Limited/Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

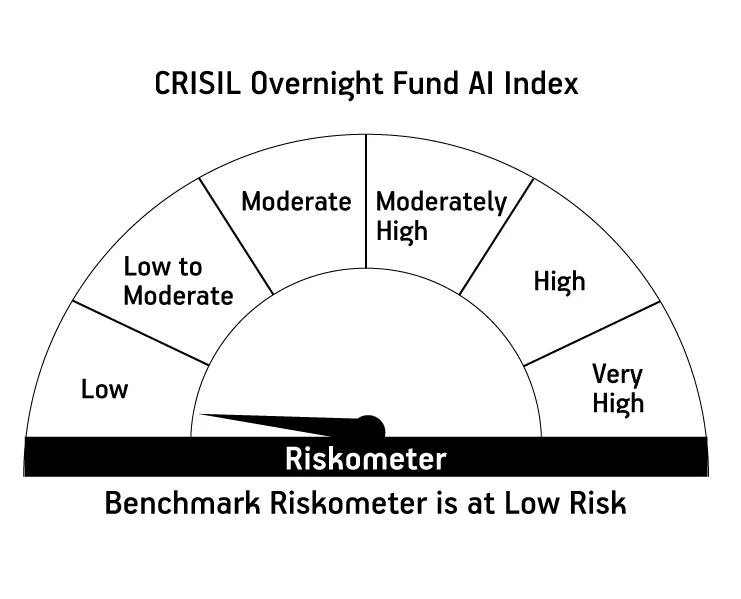

| Aditya Birla Sun Life Overnight Fund | ||

| (An open ended debt scheme investing in overnight securities. A relatively low interest rate risk and relatively low credit risk) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000