-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Know All About Nifty Smallcap 50 Index Fund

May 07, 2024

5 min

4 Rating

Many retail investors seek long-term wealth creation by embracing momentary disruptions in relatively unknown areas. Recently, stock pickers have found success in smallcap equities during intermittent risk-on bursts. Rather than chasing individual ideas, investing in the Nifty Smallcap 50 Index fund is a wise choice.

This index offers exposure to next-gen leaders undergoing early breakouts while retaining sufficient diversification guardrails to mitigate concentrated slippages.

What is the Nifty Small Cap 50 Index Fund?

As a standard indicator curated by India Index Services & Products (IISL), the Nifty Smallcap 50 index represents the performance of 50 growth-oriented smallcap companies filtering from 1000+ listed universe on the National Stock Exchange across main economy sectors. Constituent selection occurs based on free-float market capitalisation subject to filters.

The index incorporates a well-balanced mix of risk factors that allows investors to access emerging disruptive leaders while maintaining adequate protection against isolated failures. Hence, it is achieved by requiring traceability, which lists the history and positive cash flows, and implementing financial health filters based on earnings quality, leverage ratios, and valuation standards.

Features of Nifty Small Cap 50 Index Fund

-

Tracks Nifty Smallcap 50 index comprising 50 growth-oriented smallcap companies listed on National Stock Exchange

-

Constituent selection based on traceability, financial health and valuation filters make it an optimal blend of risk and return

-

As smallcap companies are in the developing stage, they carry high growth potential owing to disruptive business models

-

Smaller firms carry higher volatility from economic sensitivity and liquidity risks

-

Higher tolerance for risk is warranted to harness segment potential over the long term

-

Passive fund management tracks the underlying index by replicating constituent weightings

-

An expense ratio under 1% makes it a cost-effective avenue compared to active stock-picking

Advantages of Nifty Small Cap 50 Index Fund

Access High Growth Potential

By targeting next-gen leaders compared to mature large-cap names, smallcap index funds offer a launch pad for partaking in disruptive business models across sectors like chemicals, healthcare, food processing, e-commerce, etc., poised for extended earnings acceleration phases.

Portfolio Diversification

The wide-spanning 50 smallcap players insulate against concentration risks, hedging from single stock failures. Allocating a portion into a smallcap index serves tactical diversification for investors severely underweight in the segment relative to large-cap coherence.

Lower Costs than Selective Stock Picking

Smallcap index funds offer diversified exposure while minimising costs and risks associated with stock picking. Their research efforts to identify emerging winners before institutional flows provide price uplift make them a valuable investment option.

Passive Investing Fostering Cost Effectiveness

Passive index tracking and money manager absence translate into expense ratios below 1% - ensuring investors retain maximum portfolio gains over the long term without leakage to fees. A minimum investment of ₹500 is also accessible.

Also Read – What is Passive Fund?Wealth Creation from Small Caps Over Long Term

Investors should pay attention to an equally long list of precautions, given the asset class remains disproportionately vulnerable to economic upheavals, spelling risk of capital loss.

However, investors shouldn’t overlook an equally long list of precautions, given the asset class remains disproportionately vulnerable to economic upheavals, spelling risk of capital loss.

How to Invest in a Nifty Small Cap 50 Index Fund?

Investing in the Nifty Smallcap 50 Index Fund is similar to investing in any other mutual fund or index ETF. Depending on their preference, investors can choose to allocate their funds through a regular mutual fund house, a discount brokerage, or an online investment portal.

The process begins by registering and logging into a digital platform that offers the targeted index fund/ETF. The Aditya Birla Sun Life nifty smallcap 50 index fund direct growth provides targeted exposure to high-growth potential, but higher-risk smallcap companies. After selecting it from the list filtering for "Index - Equity - Smallcap", input the desired investment amount in multiples of 5100 rupees to purchase fund units or quantities of shares for ETFs.

Schedules for systematic investments through monthly SIPs or withdrawals are available via simple instructions. Confirmation messages reflecting the processing of index fund unit allotments or ETF share purchases appear with the ability to track real-time valuation of fund/ETF based on live NAV. Understanding process intricacies for investing, monitoring and redeeming Nifty Smallcap index exposure unlocks a valuable avenue for harnessing segment alpha.

Conclusion

For patient investors equipped to handle risks inherent to rapidly growing companies across market cycles, Nifty Smallcap 50 index funds offer a balanced tactical tool for harnessing domestic disruption stories using the convenience of a mutual fund wrapper without assuming the pains of individual stock consolidation or monitoring needs. Though volatility runs ingrained, maintaining moderated allocation size, having a long-term mindset, and avoiding panic redemptions help smoothly capture attractive risk premia over full cycles.

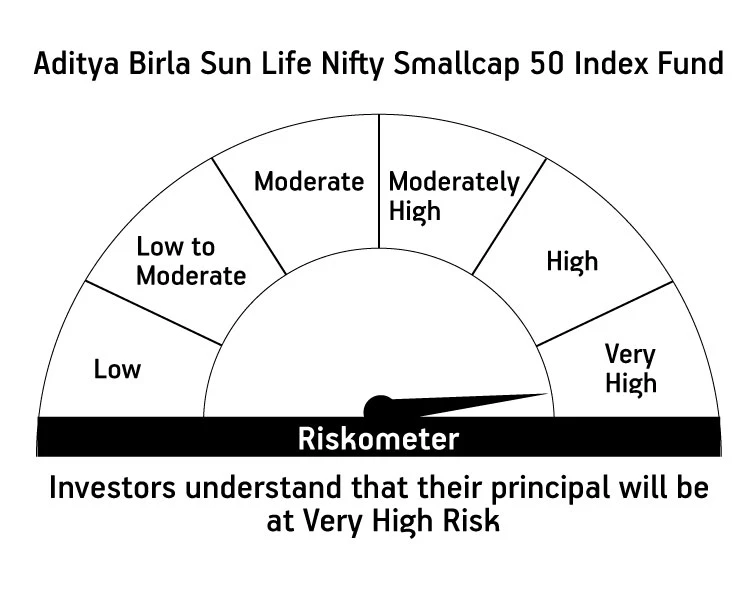

| Aditya Birla Sun Life Nifty Smallcap 50 Index Fund | ||

| (An open ended scheme tracking Nifty Smallcap 50 TR Index) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000