-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Invest Wisely, Save Smartly: A Beginner's Guide to Tax-Saving Mutual Funds

Mar 07, 2024

5 min

4 Rating

What are the things you expect from your savings and investments? The money you invest today should grow over time, whether through dividends or capital appreciation. Right? But wise investors also consider the tax angle. They enhance their returns by investing smartly in a tax-saving mutual fund. This way, they not only give their money an opportunity to grow with the market but also have more money at their disposal from the tax saved.

Why opt for a tax-saving mutual fund?

The clock is ticking as March 31 is the last date to do any tax planning for the current financial year. If you are still following the old tax regime, Section 80C of the Indian Income Tax Act, 1961 allows you to deduct Rs. 1.5 lakh in tax-saving investments from your taxable income. This section can help high-income earners save up to Rs. 46,800 in tax bills (30% income tax and 4% cess).

To avail of Section 80C tax benefits, you can invest in different types of tax-saving investment instruments. Each instrument has a different lock-in period, during which you cannot withdraw funds. Then why opt for the tax-saving mutual fund?

Among investment instruments, equity has the potential to beat inflation and generate wealth in the long term. Equity grows with the economy and the business environment. However, equity investments need expertise and experience in the stock market, and mutual funds bring this expertise to individuals.

How does a tax-saving mutual fund help you save tax?

When you invest in a tax-saving mutual fund, your money is locked in for three years. You can deduct the investment amount from your taxable income under Section 80C. While you claim a tax deduction, the fund invests your money in equity and equity-related instruments, giving you the benefit of long-term capital appreciation. You can stay invested even after three years and let your money grow.

When you withdraw your money, you need not pay any tax on the profit portion of up to Rs. 1 lakh.

For instance, Amar invested Rs. 1.5 lakh in a tax-saving mutual fund in 2018. Suppose this amount grows to Rs. 3 lakhs, he makes a profit of Rs. 1.5 lakhs. If he withdraws this amount, he will pay tax only on Rs. 50,000 as capital appreciation up to Rs. 1 lakh is exempt from tax.

Once you know how a tax-saving mutual fund works, you can plan your investments and withdrawals according to your taxable income. Even if you haven’t made any tax-saving investments, you can consider investing a lump sum amount in the Aditya Birla Sun Life ELSS Tax Saver Fund and reduce your tax bill.

Also Read: What is ELSS?

Tax and investment planning with Aditya Birla Sun Life ELSS Tax Saver Fund

Aditya Birla Sun Life ELSS Tax Saver Fund is an Equity Linked Savings Scheme (ELSS) that helps taxpayers like you simultaneously plan their taxes and investments. Unlike traditional saving instruments that might offer fixed returns, the ELSS fund gives equity returns through capital appreciation.

The fund manager selects the stocks after carefully considering the economic trends, policy changes, a company’s profits and growth potential in a competitive environment. The fund diversifies your money across different sectors and company sizes, giving your money complete exposure to the market.

You could consider Aditya Birla Sun Life ELSS Tax Saver Fund for this tax season and avail of the Section 80 C benefit before March 31. You could also invest in this fund through a Systematic Investment Plan (SIP), automating your tax planning. In SIP, you set an auto debit of a particular amount. This amount is automatically deducted from your bank account and invested in the fund.

The SIP mode will take the burden of tax planning off from March alone, evenly spreading it throughout the year. Moreover, SIP will help you sail through the volatile market and remove the burden of timing the market.

Save smartly, invest wisely with the Aditya Birla Sun Life ELSS Tax Saver Fund and achieve two targets of capital appreciation and tax savings.

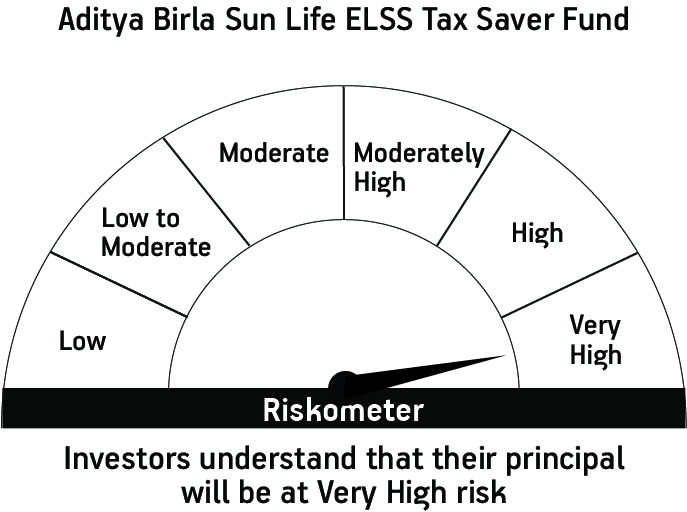

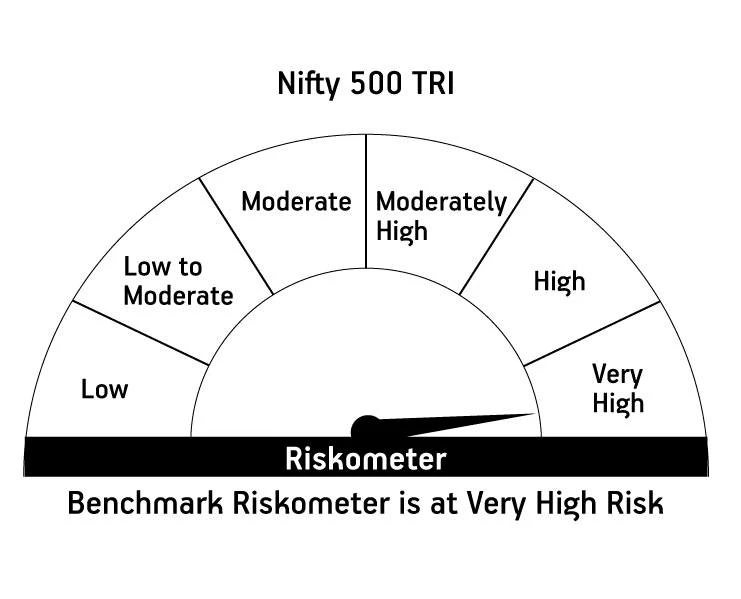

Product Labeling Disclosures |

|

Aditya Birla Sun Life ELSS Tax Saver Fund |

|

|

|

|

|

*Investors should consult their financial advisors if in doubt whether the product is suitable for them. |

|

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000