Aditya Birla Sun Life Liquid Fund |

|

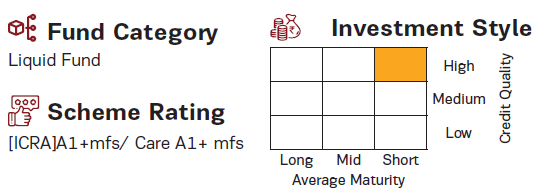

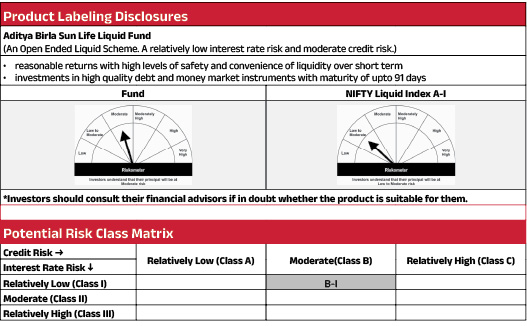

| An Open Ended Liquid Scheme. A relatively low interest rate risk and moderate credit risk. |

| Data as on 30th January 2026 |

Aditya Birla Sun Life Liquid Fund |

|

| An Open Ended Liquid Scheme. A relatively low interest rate risk and moderate credit risk. |

| Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| The objective of the scheme is to provide reasonable returns at a high level of safety and liquidity through Investment Objective judicious investments in high quality debt and money market instruments. The Scheme does not guarantee/indicate any returns. There is no assurance that the objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Mr. Kaustubh Gupta, Ms. Sunaina Da Cunha & Mr. Sanjay Pawar |

| Managing Fund Since | |

|---|---|

| July 15, 2011, July 15, 2011, July 01, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 14.7 years, 14.7 years, 3.8 Year |

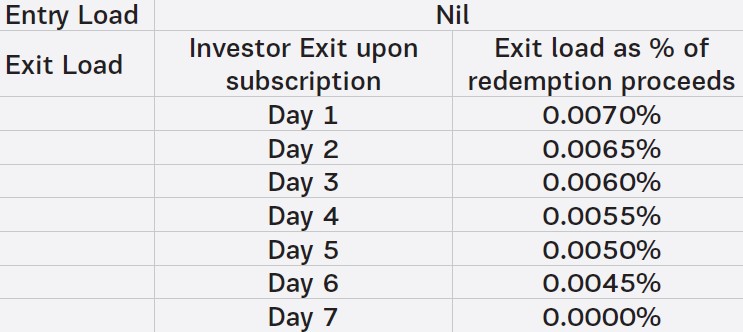

| Load Structure (as % of NAV) (Incl. for SIP) |

|---|

|

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.35% |

| Direct | 0.21% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 57047.54 Crores |

| AUM as on last day^ | 54212.15 Crores |

| ^Net assets excludes aggregate investments by other schemes of Aditya Birla Sun Life Mutual Fund amounting to ₹402.62 Crs as on January 30, 2026. | |

| Date of Allotment | |

|---|---|

| June 16, 1997 |

| Benchmark | |

|---|---|

| NIFTY Liquid Index A-I |

| Other Parameters | |

|---|---|

| Modified Duration | 0.08 years |

| Average Maturity | 0.08 years |

| Yield to Maturity | 6.58% |

| Macaulay Duration | 0.08 years |

| Portfolio Turnover | 2.23 |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Daily/Weekly/Monthly: Minimum ₹ 100/-and in multiples of ₹ 1/- thereafter |

|

|

||||

|---|---|---|---|---|

| Regular Plan | Retail Plan@ | Institutional Plan | Direct Plan | |

| Growth | 434.9510 | 705.8350 | 724.3331 | 440.5345 |

| IDCW$: | 114.1020 | - | - | 149.8954 |

| Weekly IDCW$: | 100.2420 | - | 108.2017 | 100.2424 |

| Daily IDCW$: | 100.2120 | 163.7234 | 108.0429 | 100.2124 |

| $Income Distribution cum capital withdrawal ^The Face Value per unit of all the plans/ options under Aditya Birla Sun Life Liquid Fund is ₹ 100/- @Retail Plan and Institutional Plan has been discontinued and does not accept fresh subscriptions/Switch in. |

||||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Money Market Instruments | 78.34% | |

| RBL Bank Limited | 4.54% | ICRA A1+ |

| Union Bank of India | 2.27% | ICRA A1+ |

| Yes Bank Limited | 1.82% | CRISIL A1+ |

| Karur Vysya Bank Limited | 1.82% | ICRA A1+ |

| The Jammu & Kashmir Bank Limited | 1.81% | CRISIL A1+ |

| HDFC Bank Limited | 1.73% | ICRA A1+ |

| Punjab National Bank | 1.64% | ICRA A1+ |

| HDFC Bank Limited | 1.51% | ICRA A1+ |

| Reliance Retail Ventures Limited | 1.46% | CRISIL A1+ |

| Axis Bank Limited | 1.37% | ICRA A1+ |

| Small Industries Development Bank of India | 1.37% | CRISIL A1+ |

| Bank of India | 1.37% | CRISIL A1+ |

| IndusInd Bank Limited | 1.28% | CRISIL A1+ |

| Small Industries Development Bank of India | 1.27% | CRISIL A1+ |

| Small Industries Development Bank of India | 1.09% | CRISIL A1+ |

| Union Bank of India | 1.09% | ICRA A1+ |

| Small Industries Development Bank of India | 1.05% | CRISIL A1+ |

| IndusInd Bank Limited | 1.00% | CRISIL A1+ |

| IIFL Finance Limited | 0.95% | ICRA A1+ |

| Union Bank of India | 0.92% | ICRA A1+ |

| IDBI Bank Limited | 0.92% | ICRA A1+ |

| IndusInd Bank Limited | 0.92% | CRISIL A1+ |

| Small Industries Development Bank of India | 0.92% | CRISIL A1+ |

| IndusInd Bank Limited | 0.91% | CRISIL A1+ |

| IndusInd Bank Limited | 0.91% | CRISIL A1+ |

| Karur Vysya Bank Ltd/The | 0.91% | ICRA A1+ |

| Tata Power Company Limited | 0.91% | CRISIL A1+ |

| PNB Housing Finance Limited | 0.91% | CRISIL A1+ |

| Cholamandalam Investment and Finance Company Limited | 0.91% | ICRA A1+ |

| Bank of Baroda | 0.91% | CARE A1+ |

| Union Bank of India | 0.91% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 0.91% | ICRA A1+ |

| IndusInd Bank Limited | 0.91% | CRISIL A1+ |

| Punjab & Sind Bank | 0.91% | ICRA A1+ |

| Small Industries Development Bank of India | 0.91% | CRISIL A1+ |

| State Bank of India | 0.91% | CRISIL A1+ |

| IDBI Bank Limited | 0.90% | ICRA A1+ |

| Punjab & Sind Bank | 0.82% | ICRA A1+ |

| Canara Bank | 0.77% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 0.77% | ICRA A1+ |

| DCB Bank Limited | 0.73% | CRISIL A1+ |

| ICICI Securities Limited | 0.73% | ICRA A1+ |

| Sharekhan Ltd | 0.73% | ICRA A1+ |

| Bajaj Financial Securities Limited | 0.73% | CRISIL A1+ |

| Canara Bank | 0.55% | CRISIL A1+ |

| Axis Bank Limited | 0.55% | ICRA A1+ |

| CESC Limited | 0.55% | ICRA A1+ |

| Bajaj Finance Limited | 0.55% | ICRA A1+ |

| Sharekhan Ltd | 0.55% | ICRA A1+ |

| Axis Securities Limited | 0.55% | ICRA A1+ |

| Manappuram Finance Limited | 0.54% | CRISIL A1+ |

| Bajaj Financial Securities Limited | 0.54% | CRISIL A1+ |

| Small Industries Development Bank of India | 0.54% | CRISIL A1+ |

| ICICI Home Finance Company Limited | 0.50% | ICRA A1+ |

| Nuvama Clearing Services Ltd | 0.50% | ICRA A1+ |

| Canara Bank | 0.46% | CRISIL A1+ |

| Bank of India | 0.46% | CRISIL A1+ |

| ICICI Securities Limited | 0.46% | ICRA A1+ |

| ICICI Securities Limited | 0.45% | ICRA A1+ |

| Bank of Baroda | 0.45% | CARE A1+ |

| Punjab National Bank | 0.45% | ICRA A1+ |

| Cholamandalam Investment and Finance Company Limited | 0.45% | ICRA A1+ |

| IIFL Finance Limited | 0.45% | ICRA A1+ |

| Julius Baer Capital India Private Limited | 0.45% | ICRA A1+ |

| Bank of India | 0.37% | CRISIL A1+ |

| IndusInd Bank Limited | 0.37% | CRISIL A1+ |

| DSP Investment Managers Pvt Ltd | 0.37% | ICRA A1+ |

| Manappuram Finance Limited | 0.37% | CRISIL A1+ |

| IDFC First Bank Limited | 0.36% | CRISIL A1+ |

| Sharekhan Ltd | 0.36% | CRISIL A1+ |

| Axis Bank Limited | 0.36% | ICRA A1+ |

| Bank of India | 0.36% | CRISIL A1+ |

| Axis Securities Limited | 0.36% | ICRA A1+ |

| Poonawalla Fincorp Limited | 0.36% | CRISIL A1+ |

| SBICAP Securities Limited | 0.36% | ICRA A1+ |

| Tata Housing Development Company Limited | 0.36% | CARE A1+ |

| DSP Investment Managers Pvt Ltd | 0.36% | ICRA A1+ |

| Tata Housing Development Company Limited | 0.36% | CARE A1+ |

| National Bank For Agriculture and Rural Development | 0.32% | ICRA A1+ |

| City Union Bank Limited | 0.32% | CRISIL A1+ |

| Piramal Finance Limited | 0.27% | CRISIL A1+ |

| Godrej Consumer Products Limited | 0.27% | ICRA A1+ |

| Deutsche Investments India Private Limited | 0.27% | ICRA A1+ |

| IndusInd Bank Limited | 0.27% | CRISIL A1+ |

| Issuer | % to Net Assets |

Rating |

| Nuvama Wealth & Investment Ltd | 0.27% | ICRA A1+ |

| Manappuram Finance Limited | 0.27% | CRISIL A1+ |

| Reliance Retail Ventures Limited | 0.27% | CRISIL A1+ |

| IndusInd Bank Limited | 0.27% | CRISIL A1+ |

| Julius Baer Capital India Private Limited | 0.27% | ICRA A1+ |

| Birla Group Holdings Private Limited | 0.27% | ICRA A1+ |

| DSP Investment Managers Pvt Ltd | 0.27% | ICRA A1+ |

| DSP Investment Managers Pvt Ltd | 0.27% | ICRA A1+ |

| Axis Bank Limited | 0.23% | ICRA A1+ |

| Export Import Bank of India | 0.23% | ICRA A1+ |

| DSP Investment Managers Pvt Ltd | 0.23% | ICRA A1+ |

| DSP Investment Managers Pvt Ltd | 0.23% | ICRA A1+ |

| Axis Bank Limited | 0.18% | ICRA A1+ |

| Piramal Finance Limited | 0.18% | ICRA A1+ |

| Bank of Baroda | 0.18% | IND A1+ |

| Godrej Properties Limited | 0.18% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 0.18% | ICRA A1+ |

| ALEMBIC PHARMACEUTICALS LIMITED | 0.18% | CRISIL A1+ |

| ALEMBIC PHARMACEUTICALS LIMITED | 0.18% | CRISIL A1+ |

| Kotak Securities Limited | 0.18% | ICRA A1+ |

| Fedbank Financial Services Ltd | 0.18% | ICRA A1+ |

| Mirae Asset Capital Markets India Pvt Ltd | 0.18% | ICRA A1+ |

| Godrej Properties Limited | 0.18% | ICRA A1+ |

| SBICAP Securities Limited | 0.18% | ICRA A1+ |

| Godrej Properties Limited | 0.18% | ICRA A1+ |

| Infina Finance Private Limited | 0.18% | ICRA A1+ |

| SBICAP Securities Limited | 0.18% | ICRA A1+ |

| SBICAP Securities Limited | 0.18% | ICRA A1+ |

| Bajaj Financial Securities Limited | 0.18% | CRISIL A1+ |

| SBICAP Securities Limited | 0.18% | ICRA A1+ |

| Julius Baer Capital India Private Limited | 0.18% | ICRA A1+ |

| Tata Housing Development Company Limited | 0.15% | CARE A1+ |

| Birla Group Holdings Private Limited | 0.14% | ICRA A1+ |

| HDFC Bank Limited | 0.14% | ICRA A1+ |

| Godrej Industries Limited | 0.14% | ICRA A1+ |

| Godrej Industries Limited | 0.14% | ICRA A1+ |

| Godrej Industries Limited | 0.14% | ICRA A1+ |

| Godrej Properties Limited | 0.14% | ICRA A1+ |

| Godrej Industries Limited | 0.14% | ICRA A1+ |

| DCB Bank Limited | 0.14% | CRISIL A1+ |

| Godrej Industries Limited | 0.14% | CRISIL A1+ |

| Godrej Industries Limited | 0.14% | CRISIL A1+ |

| Godrej Properties Limited | 0.14% | ICRA A1+ |

| HDFC Bank Limited | 0.14% | ICRA A1+ |

| HDFC Bank Limited | 0.09% | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 0.09% | ICRA A1+ |

| Bank of Baroda | 0.09% | IND A1+ |

| Small Industries Development Bank of India | 0.09% | CRISIL A1+ |

| IDBI Capital Markets & Securities Ltd | 0.09% | CARE A1+ |

| Godrej Properties Limited | 0.09% | ICRA A1+ |

| HDFC Bank Limited | 0.09% | ICRA A1+ |

| HSBC InvestDirect Financial Services India Ltd | 0.09% | CRISIL A1+ |

| Tata Teleservices Limited | 0.05% | CRISIL A1+ |

| National Bank For Agriculture and Rural Development | 0.05% | CRISIL A1+ |

| Muthoot Finance Limited | 0.05% | CRISIL A1+ |

| Muthoot Finance Limited | 0.05% | CRISIL A1+ |

| Punjab National Bank | 0.05% | ICRA A1+ |

| Bank of Baroda | 0.05% | CARE A1+ |

| IDBI Capital Markets & Securities Ltd | 0.05% | CARE A1+ |

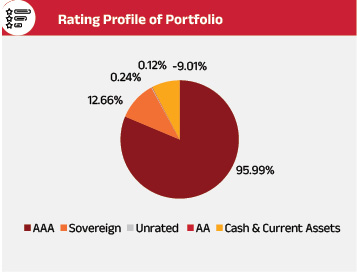

| TREASURY BILLS | 11.17% | |

| Government of India | 2.93% | SOV |

| Government of India | 1.83% | SOV |

| Government of India | 1.83% | SOV |

| Government of India | 1.15% | SOV |

| Government of India | 0.91% | SOV |

| Government of India | 0.55% | SOV |

| Government of India | 0.46% | SOV |

| Government of India | 0.46% | SOV |

| Government of India | 0.35% | SOV |

| Government of India | 0.32% | SOV |

| Government of India | 0.22% | SOV |

| Government of India | 0.12% | SOV |

| Government of India | 0.05% | SOV |

| Fixed rates bonds - Corporate | 2.44% | |

| Small Industries Development Bank of India | 0.74% | ICRA AAA |

| Small Industries Development Bank of India | 0.69% | CRISIL AAA |

| Small Industries Development Bank of India | 0.55% | ICRA AAA |

| HDB Financial Services Limited | 0.32% | CRISIL AAA |

| LIC Housing Finance Limited | 0.14% | CARE AAA |

| Alternative Investment Funds (AIF) | 0.26% | |

| Corporate Debt Market Development Fund | 0.26% | |

| State Government bond | 0.19% | |

| 8.28% KARNATAKA 06MAR2026 SDL | 0.18% | SOV |

| 8.69% KERALA 24FEB2026 SDL | 0.01% | SOV |

| Cash & Current Assets | 7.60% | |

| Total Net Assets | 100.00% |

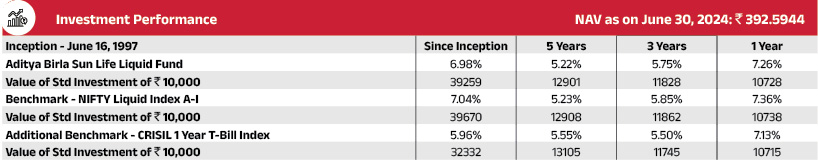

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 1. Total Schemes managed by Mr. Kaustubh Gupta is 11. Total Schemes managed by Ms. Sunaina Da Cunha is 5. Total Schemes managed by Mr. Sanjay Pawar is 4. Other funds managed by Mr. Sanjay Pawar - Aditya Birla Sun Life CRISIL Liquid Overnight ETF Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

This page is a part of the February 2026 Factsheet of Aditya Birla Sun Life Mutual Fund. Click on https://mutualfund.adityabirlacapital.com/empower/ for the digital factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.