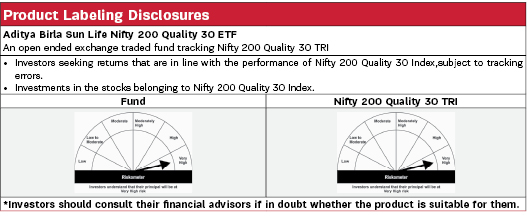

Aditya Birla Sun Life Nifty 200 Quality 30 ETF |

|

| An open ended exchange traded fund tracking Nifty 200 Quality 30 TRI BSE Scrip Code: 543574 | Symbol: NIFTYQLITY |

| Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate returns that are in line with the performance of Nifty 200 Quality 30 Index, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There is no assurance that the objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Ms. Priya Sridhar |

| Managing Fund Since | |

|---|---|

| December 31, 2024 |

| Experience in Managing the Fund | |

|---|---|

| 1.3 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.29% |

| Including additional expenses and goods and service tax on management fees. | |

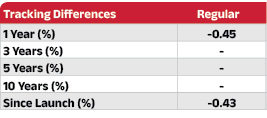

| Tracking Error | |

|---|---|

| Regular | 0.06% |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 25.62 Crores |

| AUM as on last day | 25.35 Crores |

| Date of Allotment | |

|---|---|

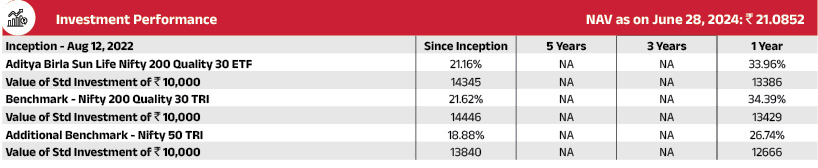

| August 12, 2022 |

| Benchmark | |

|---|---|

| Nifty 200 Quality 30 TRI |

| Other Parameters | |

|---|---|

| Standard Deviation | 13.59% |

| Sharpe Ratio | 0.74 |

| Beta | 1.00 |

| Tracking Error (3 year) | 0.11% |

| Treynor Ratio | 0.10 |

| Minimum Application Amount: | |

|---|---|

| For Transactions Directly with the Fund: | |

| For Market Makers: | The Creation Unit size shall be 1,00,000 units and in multiples thereof. |

| For Large Investors: | Min. application amount shall be Rs. 25 Crores and in multiples of Creation Unit Size |

| For Transactions on Stock Exchanges: | |

|---|---|

| Units of ETF scheme can be traded (in lots of 1 Unit) during the trading hours on all trading days on NSE and BSE on which the Units are listed. |

|

|

|---|

| 21.8452 |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| IT - Software | 25.55% |

| HCL Technologies Limited | 5.09% |

| Infosys Limited | 5.06% |

| Tata Consultancy Services Limited | 4.86% |

| Persistent Systems Limited | 2.91% |

| LTIMindtree Limited | 2.59% |

| Oracle Financial Services Software Limited | 1.78% |

| Tata Elxsi Limited | 1.75% |

| KPIT Technologies Limited | 1.50% |

| Food Products | 9.87% |

| Nestle India Limited | 5.35% |

| Britannia Industries Limited | 4.43% |

| Kwality Wall's India Ltd | 0.09% |

| Diversified FMCG | 9.28% |

| Hindustan Unilever Limited | 5.21% |

| ITC Limited | 4.07% |

| Aerospace & Defense | 9.15% |

| Bharat Electronics Limited | 5.58% |

| Hindustan Aeronautics Limited | 3.58% |

| Consumer Durables | 8.27% |

| Asian Paints Limited | 3.35% |

| Dixon Technologies (India) Limited | 3.06% |

| Havells India Limited | 1.86% |

| Automobiles | 7.10% |

| Bajaj Auto Limited | 3.86% |

| Issuer | % to Net Assets |

| Hero MotoCorp Limited | 3.23% |

| Industrial Products | 5.01% |

| Cummins India Limited | 2.83% |

| POLYCAB INDIA Limited | 2.19% |

| Consumable Fuels | 4.31% |

| Coal India Limited | 4.31% |

| Personal Products | 4.04% |

| Colgate Palmolive (India) Limited | 4.04% |

| Capital Markets | 3.04% |

| HDFC Asset Management Company Limited | 3.04% |

| Non - Ferrous Metals | 2.97% |

| Hindustan Zinc Limited | 2.97% |

| Agricultural Food & other Products | 2.90% |

| Marico Limited | 2.90% |

| Chemicals & Petrochemicals | 2.45% |

| Pidilite Industries Limited | 2.45% |

| Textiles & Apparels | 2.28% |

| Page Industries Limited | 2.28% |

| Leisure Services | 1.88% |

| Indian Railway Catering & Tourism Corporation Limited | 1.88% |

| Industrial Manufacturing | 1.86% |

| Mazagon Dock Shipbuilders Limited | 1.86% |

| Cash & Current Assets | 0.03% |

| Total Net Assets | 100.00% |

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes managed by Ms. Priya Sridhar is 20. Click here to know more on performance of schemes managed by Fund Managers.

Standard deviation of daily tracking difference computed for a 1 year horizon. If the fund is non-existent for 1 year then since inception returns are considered.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

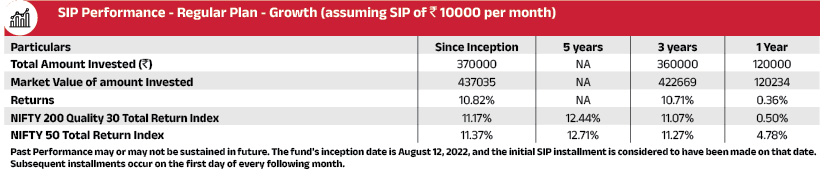

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.