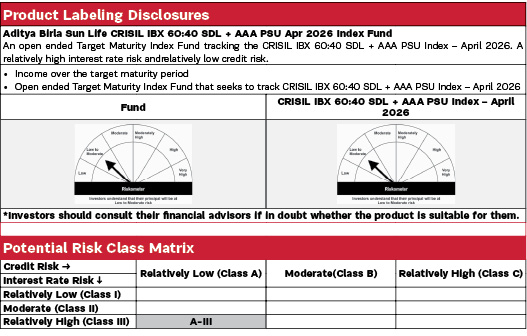

Aditya Birla Sun Life CRISIL IBX 60:40 SDL + AAA PSU Apr 2026 Index Fund |

|

| An open ended Target Maturity Index Fund tracking the CRISIL IBX 60:40 SDL + AAA PSU Index – April 2026. A relatively high interest rate risk and relatively low credit risk. |

| Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate returns corresponding to the total returns of the securities as represented by the CRISIL IBX 60:40 SDL + AAA PSU Index – April 2026 before expenses, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There is no assurance that the objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Mr. Bhupesh Bameta & Mr. Sanjay Godambe |

| Managing Fund Since | |

|---|---|

| December 02, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 3.3 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.45% |

| Direct | 0.20% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 43.96 Crores |

| AUM as on last day | 44.06 Crores |

| Date of Allotment | |

|---|---|

| December 02, 2022 |

| Benchmark | |

|---|---|

| CRISIL IBX 60:40 SDL + AAA PSU Index – April 2026 |

| Other Parameters | |

|---|---|

| Modified Duration | 0.06 years |

| Average Maturity | 0.07 years |

| Yield to Maturity | 5.51% |

| Macaulay Duration | 0.06 years |

| Standard deviation of daily tracking difference computed for a 1 year horizon. If the fund is non-existent for 1 year then since inception returns are considered. | |

|

|

||

|---|---|---|

Regular Plan |

Direct Plan |

|

| Growth | 12.3449 |

12.4389 |

| IDCW$: | 12.3460 |

12.4381 |

| $Income Distribution cum capital withdrawal | ||

| Application Amount for fresh subscription | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 500/- and in multiples of ₹ 1/- thereafter |

| Tracking Error | |

|---|---|

| Regular | 0.12% |

| Direct | 0.12% |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| State Government bond | 31.16% | |

| 8.67% KARNATAKA 24FEB26 SDL | 22.74% | SOV |

| 8.67% MAHARASHTRA 24FEB2026 SDL | 3.64% | SOV |

| 8.51% HARYANA 10FEB2026 SDL | 2.50% | SOV |

| 8.08% CHHATTISGARH 23MAR2026 SDL | 2.28% | SOV |

| Government Bond | 16.18% | |

| 5.63% GOI 12APR2026 | 13.40% | SOV |

| Issuer | % to Net Assets |

Rating |

| 6.99% GOVERNMENT OF INDIA 17APR26 | 2.78% | SOV |

| Fixed rates bonds - Corporate | 6.81% | |

| Export Import Bank of India | 2.27% | ICRA AAA |

| REC Limited | 2.27% | CRISIL AAA |

| Indian Railway Finance Corporation Limited | 2.27% | ICRA AAA |

| Cash & Current Assets | 45.85% | |

| Total Net Assets | 100.00% |

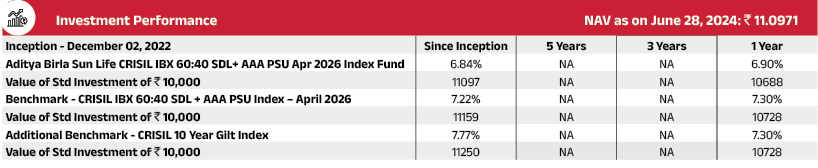

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 6. Total Schemes managed by Mr. Bhupesh Bameta is 15. Total Schemes managed by Mr. Sanjay Godambe is 8. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.