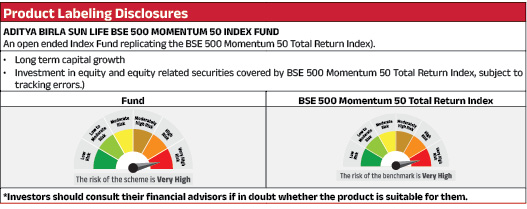

Aditya Birla Sun Life BSE 500 Momentum 50 Index Fund |

|

| An open ended Index Fund replicating the BSE 500 Momentum 50 Total Return Index |

| Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the scheme is to provide returns that, before expenses, closely correspond to the total returns of the securities as represented by the BSE 500 Momentum 50 Total Return Index, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There is no assurance or guarantee that the investment objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Ms. Priya Sridhar |

| Managing Fund Since | |

|---|---|

| August 08, 2025 |

| Experience in Managing the Fund | |

|---|---|

| 0.6 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switch out of units on or before 15 days from the date of allotment - 0.10% of applicable NAV |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.07% |

| Direct | 0.29% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 61.91 Crores |

| AUM as on last day | 62.52 Crores |

| Date of Allotment | |

|---|---|

| August 08, 2025 |

| Benchmark | |

|---|---|

| BSE 500 Momentum 50 Total Return Index |

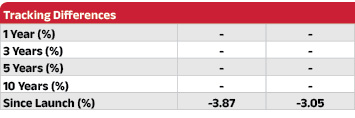

| Tracking Error | |

|---|---|

| Regular | 0.30% |

| Direct | 0.29% |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 100) |

| Min. Addl. Investment | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 100) |

| SIP | |

|---|---|

| Daily/Weekly/Monthly: Minimum ₹ 500/- and in multiples of ₹ 1/- thereafter |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 10.2034 | 10.2407 |

| IDCW$: | 10.2034 | 10.2417 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| Finance | 25.50% |

| Shriram Finance Ltd | 4.84% |

| Bajaj Finserv Limited | 3.76% |

| Bajaj Finance Limited | 3.66% |

| Muthoot Finance Limited | 3.14% |

| Cholamandalam Investment and Finance Company Limited | 3.02% |

| Aditya Birla Capital Limited | 1.91% |

| L&T Finance Limited | 1.79% |

| Mahindra & Mahindra Financial Services Limited | 1.21% |

| Manappuram Finance Limited | 1.15% |

| Authum Investment & Infrastructure Ltd | 0.67% |

| CHOICE INTERNATIONAL LTD | 0.35% |

| Automobiles | 15.70% |

| TVS Motor Company Limited | 4.06% |

| Eicher Motors Limited | 3.92% |

| Maruti Suzuki India Limited | 3.63% |

| Hero MotoCorp Limited | 3.39% |

| FORCE MOTORS LTD FORCE MOTORS LTD | 0.70% |

| Banks | 11.49% |

| AU Small Finance Bank Limited | 3.38% |

| Canara Bank | 2.86% |

| Indian Bank | 1.87% |

| RBL Bank Limited | 1.34% |

| City Union Bank Limited | 1.16% |

| Bank of India | 0.87% |

| Insurance | 6.64% |

| SBI Life Insurance Company Limited | 3.95% |

| Max Financial Services Limited | 2.70% |

| Capital Markets | 5.91% |

| Multi Commodity Exchange of India Limited | 3.38% |

| HDFC Asset Management Company Limited | 2.03% |

| Anand Rathi Wealth Limited | 0.50% |

| Aerospace & Defense | 4.95% |

| Bharat Electronics Limited | 4.61% |

| Garden Reach Shipbuilders & Engineers Limited | 0.34% |

| Transport Services | 3.80% |

| InterGlobe Aviation Limited | 3.80% |

| Issuer | % to Net Assets |

| Telecom - Services | 3.79% |

| Bharti Airtel Limited | 3.79% |

| Electrical Equipment | 3.24% |

| GE Vernova T&D India Ltd | 2.01% |

| Hitachi Energy India Limited | 1.23% |

| Healthcare Services | 3.08% |

| Fortis Healthcare Limited | 1.95% |

| Narayana Hrudayalaya Limited | 0.59% |

| Aster DM Healthcare Limited | 0.54% |

| Fertilizers & Agrochemicals | 3.00% |

| UPL Limited | 1.97% |

| Coromandel International Limited | 1.04% |

| Pharmaceuticals & Biotechnology | 2.57% |

| Laurus Labs Limited | 2.57% |

| Agricultural Commercial & Construction Vehicles | 2.55% |

| Ashok Leyland Limited | 2.55% |

| Financial Technology (Fintech) | 1.97% |

| One 97 Communications Limited | 1.97% |

| Retailing | 1.93% |

| FSN E-Commerce Ventures Limited | 1.93% |

| Chemicals & Petrochemicals | 1.36% |

| Navin Fluorine International Limited | 1.36% |

| Cement & Cement Products | 1.01% |

| JK Cement Limited | 1.01% |

| Auto Components | 0.98% |

| Asahi India Glass Limited | 0.57% |

| Gabriel India Ltd | 0.41% |

| Industrial Products | 0.54% |

| PTC Industries Limited | 0.46% |

| GALLANTT ISPAT LTD | 0.07% |

| Beverages | 0.18% |

| ALLIED BLENDERS & DISTILLERS LTD | 0.18% |

| Construction | 0.18% |

| ITD Cementation India Limited | 0.18% |

| Cash & Current Assets | -0.39% |

| Total Net Assets | 100.00% |