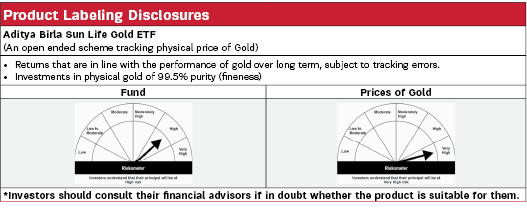

Aditya Birla Sun Life Gold ETF |

|

| An open ended scheme tracking physical price of Gold BSE Scrip Code: 533408 | Symbol: BSLGOLDETF |

| Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate returns that are in line with the performance of gold, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There is no assurance that the objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Mr. Sachin Wankhede |

| Managing Fund Since | |

|---|---|

| February 23, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 4.1 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.47% |

| Including additional expenses and goods and service tax on management fees. | |

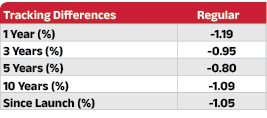

| Tracking Error | |

|---|---|

| Regular | 0.30% |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 1781.47 Crores |

| AUM as on last day^ | 2172.86 Crores |

| ^Net assets excludes aggregate investments by other schemes of Aditya Birla Sun Life Mutual Fund amounting to ₹738.01 Crs as on January 30, 2026. | |

| Date of Allotment | |

|---|---|

| May 13, 2011 |

| Benchmark | |

|---|---|

| Domestic Price of Physical Gold |

| Other Parameters | |

|---|---|

| Standard Deviation | 17.82% |

| Sharpe Ratio | 1.96 |

| Beta | 0.98 |

| Tracking Error (3 year) | 0.32% |

| Treynor Ratio | 0.36 |

Note: Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using 3 years history of monthly returns. Risk Free Rate assumed to be 5.53(FBIL Overnight MIBOR as on 30 January 2026) for calculating Sharpe Ratio |

|

| Minimum Application Amount: | |

|---|---|

| For Transactions Directly with the Fund: | |

| For Market Makers: | The Creation Unit size for the scheme shall be 1,20,000 units and in multiples thereof. |

| For Large Investors: | Min. application amount shall be Rs. 25 Crores and in multiples of Creation Unit Size |

| For Transactions on Stock Exchanges: | |

|---|---|

| Units of ETF scheme can be traded (in lots of 1 Unit) during the trading hours on all trading days on NSE and BSE on which the Units are listed. |

|

|

||

|---|---|---|

| 144.0452 | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| GOLD | 98.55% |

| Gold | 98.55% |

| Cash & Current Assets | 1.45% |

| Total Net Assets | 100.00% |

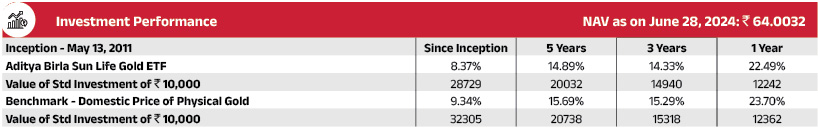

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes managed by Mr. Sachin Wankhede is 3. Click here to know more on performance of schemes managed by Fund Managers.

Standard deviation of daily tracking difference computed for a 1 year horizon. If the fund is non-existent for 1 year then since inception returns are considered.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

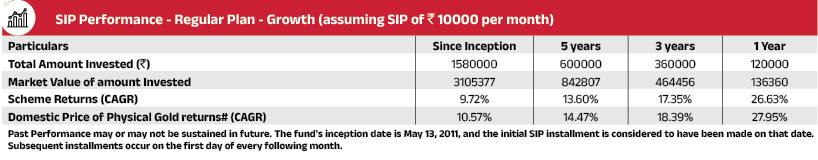

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.