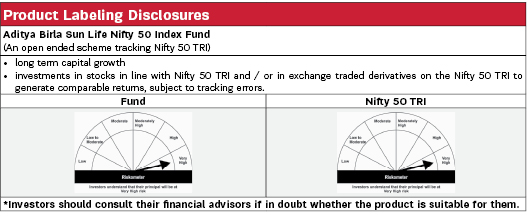

Aditya Birla Sun Life Nifty 50 Index Fund |

|

| An open ended scheme tracking Nifty 50 TR Index |

| Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| The objective of the scheme is to generate returns that are commensurate with the performance of the Nifty, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There is no assurance that the objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Ms. Priya Sridhar |

| Managing Fund Since | |

|---|---|

| December 31, 2024 |

| Experience in Managing the Fund | |

|---|---|

| 1.3 years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.48% |

| Direct | 0.21% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 1283.66 Crores |

| AUM as on last day | 1274.91 Crores |

| Date of Allotment | |

|---|---|

| September 18, 2002 |

| Benchmark | |

|---|---|

| Nifty 50 TRI |

| Other Parameters | |

|---|---|

| Standard Deviation | 11.33% |

| Sharpe Ratio | 0.70 |

| Beta | 1.00 |

| Portfolio Turnover | 0.08 |

| Tracking Error (3 year) | 0.05% |

| Treynor Ratio | 0.08 |

| Note:Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using 3 years history of monthly returns. Risk Free Rate assumed to be 5.53(FBIL Overnight MIBOR as on 30 January 2026) for calculating Sharpe Ratio | |

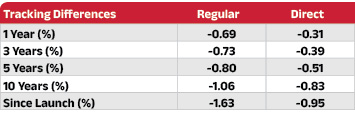

| Tracking Error | |

|---|---|

| Regular | 0.05% |

| Direct | 0.05% |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 100/- and in multiples of ₹ 1/- thereafter. |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 256.6276 | 262.6315 |

| IDCW$: | 26.2250 | 27.1518 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| Banks | 30.49% |

| HDFC Bank Limited | 12.28% |

| ICICI Bank Limited | 8.36% |

| State Bank of India | 3.86% |

| Axis Bank Limited | 3.39% |

| Kotak Mahindra Bank Limited | 2.59% |

| IT - Software | 10.81% |

| Infosys Limited | 4.97% |

| Tata Consultancy Services Limited | 2.76% |

| HCL Technologies Limited | 1.55% |

| Tech Mahindra Limited | 0.96% |

| Wipro Limited | 0.58% |

| Petroleum Products | 8.14% |

| Reliance Industries Limited | 8.14% |

| Automobiles | 6.70% |

| Mahindra & Mahindra Limited | 2.65% |

| Maruti Suzuki India Limited | 1.66% |

| Bajaj Auto Limited | 0.92% |

| Eicher Motors Limited | 0.85% |

| Tata Motors Passenger Vehicles Limited | 0.63% |

| Finance | 5.05% |

| Bajaj Finance Limited | 2.13% |

| Shriram Finance Ltd | 1.23% |

| Bajaj Finserv Limited | 0.96% |

| Jio Financial Services Limited | 0.72% |

| Telecom - Services | 4.74% |

| Bharti Airtel Limited | 4.74% |

| Diversified FMCG | 4.50% |

| ITC Limited | 2.68% |

| Hindustan Unilever Limited | 1.82% |

| Construction | 3.99% |

| Larsen & Toubro Limited | 3.99% |

| Pharmaceuticals & Biotechnology | 2.74% |

| Sun Pharmaceutical Industries Limited | 1.46% |

| Cipla Limited | 0.64% |

| Dr. Reddys Laboratories Limited | 0.64% |

| Power | 2.46% |

| NTPC Limited | 1.46% |

| Power Grid Corporation of India Limited | 1.00% |

| Issuer | % to Net Assets |

| Retailing | 2.42% |

| Eternal Limited | 1.70% |

| Trent Limited | 0.73% |

| Consumer Durables | 2.37% |

| Titan Company Limited | 1.42% |

| Asian Paints Limited | 0.95% |

| Ferrous Metals | 2.36% |

| Tata Steel Limited | 1.38% |

| JSW Steel Limited | 0.99% |

| Cement & Cement Products | 2.23% |

| UltraTech Cement Limited | 1.30% |

| Grasim Industries Limited | 0.93% |

| Insurance | 1.45% |

| SBI Life Insurance Company Limited | 0.78% |

| HDFC Life Insurance Company Limited | 0.68% |

| Aerospace & Defense | 1.39% |

| Bharat Electronics Limited | 1.39% |

| Healthcare Services | 1.23% |

| Apollo Hospitals Enterprise Limited | 0.62% |

| Max Healthcare Institute Limited | 0.61% |

| Non - Ferrous Metals | 1.20% |

| Hindalco Industries Limited | 1.20% |

| Transport Infrastructure | 0.90% |

| Adani Ports and Special Economic Zone Limited | 0.90% |

| Oil | 0.90% |

| Oil & Natural Gas Corporation Limited | 0.90% |

| Transport Services | 0.90% |

| InterGlobe Aviation Limited | 0.90% |

| Consumable Fuels | 0.86% |

| Coal India Limited | 0.86% |

| Food Products | 0.85% |

| Nestle India Limited | 0.83% |

| Kwality Wall's India Ltd | 0.03% |

| Agricultural Food & other Products | 0.64% |

| Tata Consumer Products Limited | 0.64% |

| Metals & Minerals Trading | 0.45% |

| Adani Enterprises Limited | 0.45% |

| Cash & Current Assets | 0.19% |

| Total Net Assets | 100.00% |

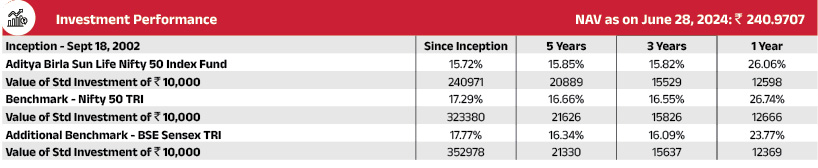

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes managed by Ms. Priya Sridhar is 20. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

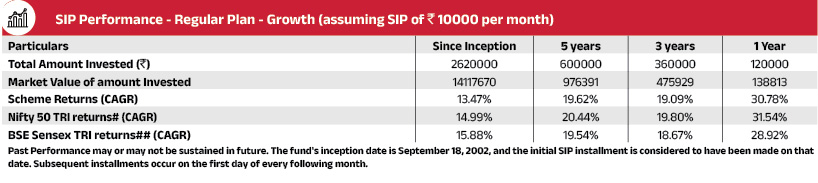

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.