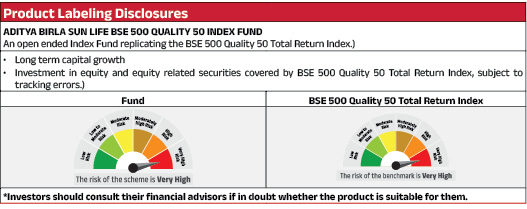

Aditya Birla Sun Life BSE 500 Quality 50 Index Fund |

|

| An open ended Index Fund replicating the BSE 500 Quality 50 Total Return Index |

| Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the scheme is to provide returns that, before expenses, closely correspond to the total returns of the securities as represented by the BSE 500 Quality 50 Total Return Index, subject to tracking errors. The Scheme does not guarantee/ indicate any returns. There is no assurance or guarantee that the investment objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Ms. Priya Sridhar |

| Managing Fund Since | |

|---|---|

| August 08, 2025 |

| Experience in Managing the Fund | |

|---|---|

| 0.6 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switch out of units on or before 15 days from the date of allotment - 0.10% of applicable NAV |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.04% |

| Direct | 0.26% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 71.32 Crores |

| AUM as on last day | 71.67 Crores |

| Date of Allotment | |

|---|---|

| August 08, 2025 |

| Benchmark | |

|---|---|

| BSE 500 Quality 50 Total Return Index |

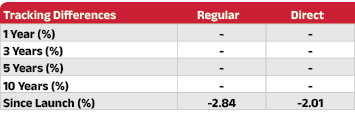

| Tracking Error | |

|---|---|

| Regular | 0.13% |

| Direct | 0.13% |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 100) |

| Min. Addl. Investment | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 100) |

| SIP | |

|---|---|

| Daily/Weekly/Monthly: Minimum ₹ 500/- and in multiples of ₹ 1/- thereafter |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 10.3747 | 10.4137 |

| IDCW$: | 10.3747 | 10.4137 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| IT - Software | 15.08% |

| Infosys Limited | 4.06% |

| HCL Technologies Limited | 3.99% |

| Tata Consultancy Services Limited | 3.85% |

| Oracle Financial Services Software Limited | 1.15% |

| KPIT Technologies Limited | 1.02% |

| Tata Elxsi Limited | 1.01% |

| Capital Markets | 14.31% |

| Multi Commodity Exchange of India Limited | 5.03% |

| HDFC Asset Management Company Limited | 3.68% |

| Computer Age Management Services Limited | 1.40% |

| Anand Rathi Wealth Limited | 1.15% |

| Nippon Life India Asset Management Limited | 1.08% |

| Indian Energy Exchange Limited | 0.86% |

| Kfin Technologies Ltd | 0.77% |

| Aditya Birla Sun Life AMC Ltd | 0.33% |

| Electrical Equipment | 9.10% |

| Suzlon Energy Limited | 3.63% |

| GE Vernova T&D India Ltd | 3.27% |

| ABB India Limited | 1.65% |

| Premier Energies Ltd | 0.55% |

| Food Products | 8.27% |

| Nestle India Limited | 4.32% |

| Britannia Industries Limited | 3.95% |

| Aerospace & Defense | 4.71% |

| Hindustan Aeronautics Limited | 4.22% |

| Garden Reach Shipbuilders & Engineers Limited | 0.49% |

| Consumable Fuels | 4.52% |

| Coal India Limited | 4.52% |

| Pharmaceuticals & Biotechnology | 4.46% |

| Torrent Pharmaceuticals Limited | 2.38% |

| Abbott India Limited | 1.15% |

| GlaxoSmithKline Pharmaceuticals Limited | 0.92% |

| Chemicals & Petrochemicals | 4.37% |

| Pidilite Industries Limited | 2.38% |

| Solar Industries India Limited | 1.99% |

| Non - Ferrous Metals | 4.29% |

| National Aluminium Company Limited | 2.34% |

| Hindustan Zinc Limited | 1.96% |

| Issuer | % to Net Assets |

| Automobiles | 4.27% |

| Hero MotoCorp Limited | 3.65% |

| FORCE MOTORS LTD FORCE MOTORS LTD | 0.62% |

| Personal Products | 3.61% |

| Colgate Palmolive (India) Limited | 2.35% |

| Emami Limited | 0.66% |

| Gillette India Limited | 0.60% |

| Industrial Products | 3.56% |

| Cummins India Limited | 3.56% |

| Agricultural Food & other Products | 3.24% |

| Marico Limited | 3.24% |

| Diversified FMCG | 3.14% |

| ITC Limited | 3.14% |

| Consumer Durables | 2.84% |

| Dixon Technologies (India) Limited | 2.84% |

| Textiles & Apparels | 1.93% |

| Page Industries Limited | 1.93% |

| Finance | 1.53% |

| Authum Investment & Infrastructure Ltd | 0.81% |

| CRISIL Limited | 0.72% |

| Industrial Manufacturing | 1.30% |

| Mazagon Dock Shipbuilders Limited | 1.30% |

| Leisure Services | 1.24% |

| Indian Railway Catering & Tourism Corporation Limited | 1.24% |

| Auto Components | 0.79% |

| Motherson Sumi Wiring India Limited | 0.79% |

| Petroleum Products | 0.72% |

| Castrol India Limited | 0.72% |

| Healthcare Services | 0.64% |

| Dr. Lal Path Labs Limited | 0.64% |

| Construction | 0.63% |

| NBCC (India) Limited | 0.63% |

| Diversified | 0.56% |

| 3M India Limited | 0.56% |

| Retailing | 0.43% |

| Indiamart Intermesh Limited | 0.43% |

| Cash & Current Assets | 0.46% |

| Total Net Assets | 100.00% |