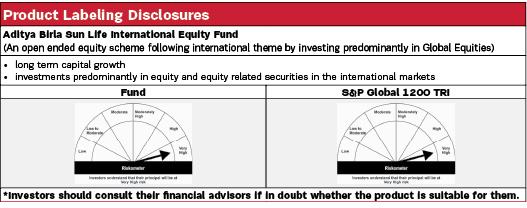

Aditya Birla Sun Life International Equity Fund |

|

| An open ended equity scheme following international theme by investing predominantly in Global Equities. |

| *Fresh subscriptions/ switch-in application(s) including fresh registrations for subscriptions under systematic transactions are limited to Rs. 1 crore per investor per day at PAN level w.e.f February 14, 2024 Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| Aditya Birla Sun Life International Equity Fund seeks to generate long-term growth of capital, by investing predominantly in a diversified portfolio of equity and equity related securities in the international markets. The Scheme does not guarantee/indicate any returns. There is no assurance that the objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 3.4 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switch-out of units on or before 30 days from the date of allotment: 1% of applicable NAV. For redemption /switch-out of units after 30 days from the date of allotment: Nil. |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 2.53% |

| Direct | 2.06% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 288.09 Crores |

| AUM as on last day | 303.29 Crores |

| Date of Allotment | |

|---|---|

| October 31, 2007 |

| Benchmark | |

|---|---|

| S&P Global 1200 TRI |

| Other Parameters | |

|---|---|

| Portfolio Turnover | 1.48 |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 1,000/- (in multiples of ₹ 1/- thereafter) |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 48.9211 | 52.8703 |

| IDCW$: | 22.3930 | 52.9016 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

| United States of America | 73.75% |

| NVIDIA Corp | 6.83% |

| Alphabet Inc A | 4.51% |

| Apple Inc. | 4.32% |

| MICROSOFT CORPORATION | 3.78% |

| Amazon Com Inc | 2.83% |

| Eli Lilly & Co | 2.51% |

| Broadcom Inc | 2.41% |

| Western Alliance Bancorp | 2.27% |

| Webster Financial Corp | 2.19% |

| Equitable Holdings Inc | 2.10% |

| Taiwan Semiconductor Manufacturing Co Ltd | 2.00% |

| Walmart Inc | 1.66% |

| Coherent Corp | 1.61% |

| Coca-Cola Co. | 1.56% |

| PHILIP MORRIS INTERNATIONAL INC | 1.52% |

| FTAI Aviation Ltd | 1.49% |

| Raytheon Technologies Corp | 1.34% |

| Five Below Inc | 1.34% |

| GE Vernova Inc | 1.32% |

| Otis Worldwide Corp | 1.32% |

| Facebook Inc | 1.30% |

| Constellation Energy Corp | 1.28% |

| Seagate Technology Holdings PLC | 1.24% |

| Burford Capital Ltd | 1.23% |

| Boston Scientific Corp | 1.13% |

| Oracle Corp | 1.05% |

| Freeport-McMoRan Inc | 1.00% |

| Cigna Corporation | 1.00% |

| Shift4 Payments Inc | 0.98% |

| Lowes Cos Inc | 0.97% |

| Sherwin-Williams Co/The | 0.97% |

| McDonald's Corporation | 0.95% |

| ITT Inc | 0.94% |

| Reddit Inc | 0.93% |

| Dover Corp | 0.92% |

| Tesla Inc | 0.91% |

| Ferrari NV | 0.91% |

| Danaher Corp | 0.86% |

| Issuer | % to Net Assets |

| CRH PLC | 0.85% |

| Alibaba Group Holding Limited | 0.82% |

| Snowflake Inc | 0.82% |

| Reinsurance Group of America Inc | 0.80% |

| McKesson Corp | 0.76% |

| Visa Inc | 0.68% |

| Linde PLC | 0.55% |

| Abbott Laboratories | 0.53% |

| XP Inc | 0.44% |

| FRANCE | 9.08% |

| UCB SA | 2.22% |

| Shell PLC | 1.60% |

| Iberdrola SA | 1.37% |

| Adyen NV | 1.36% |

| Rheinmetall AG | 1.29% |

| BAWAG Group AG | 1.24% |

| United Kingdom | 5.70% |

| Prudential PLC | 2.38% |

| ASTRAZENECA PLC | 1.70% |

| Compass Group PLC | 1.00% |

| Conduit Holdings Ltd | 0.62% |

| Canada | 2.16% |

| Suncor Energy Inc | 1.13% |

| Celestica Inc | 1.03% |

| Japan | 1.67% |

| SoftBank Group Corp | 1.04% |

| Nintendo Co Ltd | 0.63% |

| France | 1.23% |

| Schneider Electric SA | 1.23% |

| Denmark | 1.11% |

| DSV A/S | 1.11% |

| Brazil | 1.01% |

| Embraer SA | 1.01% |

| Mexico | 0.79% |

| Grupo Financiero Banorte SAB de CV | 0.79% |

| Indonesia | 0.01% |

| Bank Mandiri Persero Tbk PT | 0.01% |

| Cash & Current Assets | 3.49% |

| Total Net Assets | 100.00% |

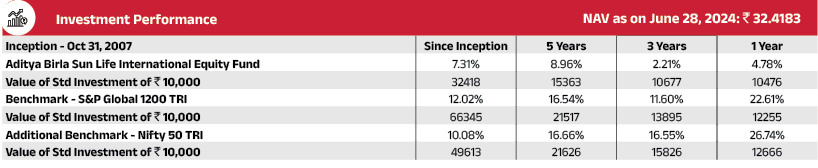

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes managed by Mr. Dhaval Joshi is 6. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

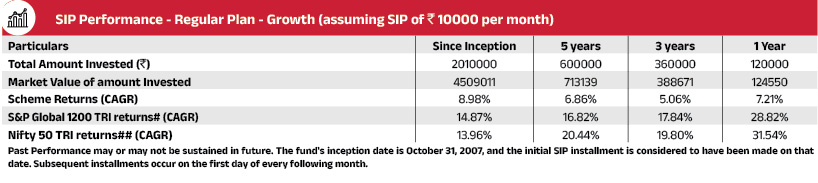

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.