Last week, the Monetary policy Committee decided to leave the repo rate unchanged at 5.25% in a unanimous move while keeping the stance as 'neutral'. However, one member dissented on the unchanged stance believing that the stance should be changed from neutral to accommodative.

The growth estimate was upgraded by RBI with H1FY27 growth now forecasted at 7% vs 6.75% earlier. However, this excludes the impact of the trade deal with the US. The RBI Governor sounded more positive on growth in his press conference given the announcement of multiple trade deals including with the all-important one with the US which has now resulted in removing a downside risk to the previous growth outlook. On inflation, H1FY27 inflation forecasts remained close to the target at 4.1% with the RBI Governor highlighting that excluding precious metals, inflation remained muted. Full year estimates for both inflation and growth were held back in light of the new series which will be released later in February for both growth and inflation.

RBI Governor said that he remained committed to remain proactive in liquidity management. However, since no new liquidity measures were announced as expected by many market participants, bonds sold off.

The market is in a tentative mood given the larger gross borrowing calendar announced by the Finance Minister in the budget versus expectations coupled with the large supply of State Development Loans this quarter. Bank's Certificate of Deposits spreads have also increased given the elevated Loan to Deposit Ratio and high credit growth witnessed early in the credit busy season. Yields are going up with every auction and unless RBI steps in yields may keep inching higher. Interest Payments for the Centre as a % of total expenditure is at the highest in last 2 decades with more than a quarter of total spending now used for servicing debt.

The RBI seems amenable to keeping the overnight rate at lower levels which has persisted since over two weeks now and the RBI Governor also highlighted that rates can remain low for a long time. RBI has been aggressive in infusing last week's OMO saw the old 10Y accepted a good 6 bps below market levels.

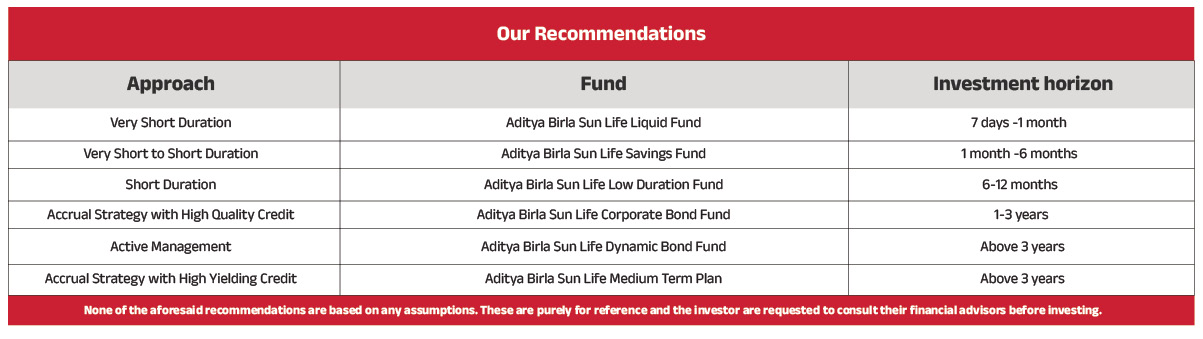

Proactive RBI intervention is necessary to prevent a further rise in yields. Volatility has picked up and it is important for investors to stick to their investment horizon to avoid getting whipsawed in both directions. We recommend investors with 1 month+ horizon to invest in our 3-6M Financial Services Index fund, 3 months+ to invest in our ultra short or low duration fund and 1 year+ to invest in our short-term funds (Short term / Corp Bond / BPSU category). Investors having a 2Y+ horizon should look at our Aditya Birla Sun Life Income plus Arbitrage Active FOF given tax efficiency.

Source: ABSLAMC Research

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.