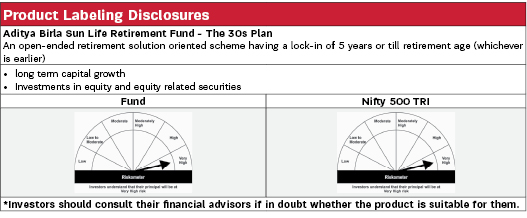

Aditya Birla Sun Life Retirement Fund - The 30s Plan |

|

| An open-ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier). |

| Data as on 31st October 2025 |

|

Fund Details |

|

Investment Objective |

|

| The primary investment objective of the Scheme is income generation and capital appreciation for its investors which will be in line with their retirement goals by investing in a mix of equity, equity related instruments along with debt and money market instruments. The Scheme does not guarantee/indicate any returns. There is no assurance that the objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Mr. Jonas Bhutta |

| Managing Fund Since | |

|---|---|

| November 01, 2024 |

| Experience in Managing the Fund | |

|---|---|

| 1.1 years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Upon completion of lock-in period of minimum 5 years from the date of allotment of units or Retirement Age of Unit holder (i.e. completion of 60 years, whichever is earlier): Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 2.41% |

| Direct | 1.16% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 423.14 Crores |

| AUM as on last day | 427.16 Crores |

| Date of Allotment | |

|---|---|

| March 11, 2019 |

| Benchmark | |

|---|---|

| NIFTY 500 TRI |

| Other Parameters | |

|---|---|

| Standard Deviation | 13.19% |

| Sharpe Ratio | 0.71 |

| Beta | 0.95 |

| Portfolio Turnover | 0.89 |

| Treynor Ratio | 0.10 |

| Note: Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using 3 years history of monthly returns. Risk Free Rate assumed to be 5.69(FBIL Overnight MIBOR as on 31 October 2025) for calculating Sharpe Ratio | |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly/Weekly: Minimum ₹ 500/- and in multiples of ₹ 1/- thereafter |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 20.5140 | 22.7110 |

| IDCW$: | 16.7010 | 18.4880 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Banks | 16.57% | |

| ICICI Bank Limited | 4.03% | |

| HDFC Bank Limited | 2.56% | |

| AU Small Finance Bank Limited | 2.51% | |

| State Bank of India | 2.18% | |

| Axis Bank Limited | 1.80% | |

| Kotak Mahindra Bank Limited | 1.34% | |

| City Union Bank Limited | 1.08% | |

| The Federal Bank Limited | 1.06% | |

| IT - Software | 7.90% | |

| Infosys Limited | 2.04% | |

| Tech Mahindra Limited | 1.89% | |

| Rategain Travel Technologies Limited | 1.77% | |

| Coforge Limited | 1.12% | |

| Persistent Systems Limited | 1.08% | |

| Consumer Durables | 5.97% | |

| Kajaria Ceramics Limited | 1.71% | |

| Greenply Industries Ltd | 1.43% | |

| Titan Company Limited | 1.42% | |

| Eureka Forbes Ltd | 0.80% | |

| Metro Brands Limited | 0.61% | |

| Pharmaceuticals & Biotechnology | 5.89% | |

| Cipla Limited | 1.81% | |

| Sun Pharmaceutical Industries Limited | 1.70% | |

| Emcure Pharmaceuticals Ltd | 1.01% | |

| IPCA Laboratories Limited | 0.71% | |

| Shilpa Medicare Ltd | 0.65% | |

| Finance | 4.65% | |

| Aptus Value Housing Finance India Ltd | 1.55% | |

| Bajaj Finserv Limited | 1.41% | |

| Poonawalla Fincorp Limited | 0.79% | |

| HDB Financial Services Limited | 0.59% | |

| CreditAccess Grameen Limited | 0.31% | |

| Auto Components | 4.48% | |

| SJS Enterprises Pvt Limited | 1.97% | |

| Sona BLW Precision Forgings Limited | 1.43% | |

| Craftsman Automation Ltd | 1.08% | |

| Industrial Products | 4.15% | |

| Kirloskar Oil Eng Ltd | 1.80% | |

| APL Apollo Tubes Limited | 1.11% | |

| Shivalik Bimetal Controls Ltd | 0.84% | |

| Supreme Industries Limited | 0.41% | |

| Construction | 3.99% | |

| Larsen & Toubro Limited | 2.76% | |

| M&B Engineering Ltd | 1.23% | |

| Insurance | 3.51% | |

| ICICI Lombard General Insurance Company Limited | 1.87% | |

| SBI Life Insurance Company Limited | 1.65% | |

| Retailing | 3.42% | |

| Eternal Limited | 2.41% | |

| Avenue Supermarts Limited | 1.01% | |

| Automobiles | 2.94% | |

| Ather Energy Ltd | 1.70% | |

| TVS Motor Company Limited | 1.22% | |

| TVS Motor Company Limited | 0.01% |

| Issuer | % to Net Assets |

Rating |

| Realty | 2.88% | |

| Prestige Estates Projects Limited | 1.86% | |

| Sobha Limited | 1.02% | |

| Chemicals & Petrochemicals | 2.59% | |

| Vinati Organics Limited | 1.81% | |

| Atul Limited | 0.78% | |

| Personal Products | 2.32% | |

| Godrej Consumer Products Limited | 2.32% | |

| Gas | 2.27% | |

| GAIL (India) Limited | 1.43% | |

| Mahanagar Gas Limited | 0.84% | |

| Ferrous Metals | 2.07% | |

| Jindal Steel & Power Limited | 2.07% | |

| Petroleum Products | 2.03% | |

| Bharat Petroleum Corporation Limited | 1.04% | |

| Reliance Industries Limited | 0.98% | |

| Non - Ferrous Metals | 1.98% | |

| Hindalco Industries Limited | 1.98% | |

| IT - Services | 1.75% | |

| L&T Technology Services Limited | 0.93% | |

| Cyient Limited | 0.82% | |

| Diversified FMCG | 1.67% | |

| Hindustan Unilever Limited | 1.67% | |

| Transport Infrastructure | 1.63% | |

| Adani Ports and Special Economic Zone Limited | 1.63% | |

| Healthcare Services | 1.61% | |

| Fortis Healthcare Limited | 1.61% | |

| Capital Markets | 1.38% | |

| Computer Age Management Services Limited | 0.86% | |

| Nippon Life India Asset Management Limited | 0.52% | |

| Electrical Equipment | 1.29% | |

| Thermax Limited | 1.29% | |

| Industrial Manufacturing | 1.23% | |

| Aditya Infotech Ltd | 0.73% | |

| Praj Industries Limited | 0.50% | |

| Commercial Services & Supplies | 1.07% | |

| Firstsource Solutions Limited | 1.07% | |

| Transport Services | 0.96% | |

| VRL Logistics Limited | 0.96% | |

| Agricultural Food & other Products | 0.89% | |

| Balrampur Chini Mills Limited | 0.89% | |

| Power | 0.85% | |

| NTPC Limited | 0.85% | |

| Food Products | 0.65% | |

| Bikaji Foods International Ltd | 0.65% | |

| Beverages | 0.60% | |

| United Breweries Limited | 0.60% | |

| Fertilizers & Agrochemicals | 0.57% | |

| PI Industries Litmited | 0.57% | |

| Government Bond | 0.24% | |

| 7.17% GOVERNMENT OF INDIA 17APR30 | 0.24% | SOV |

| Cash & Current Assets | 3.99% | |

| Total Net Assets | 100.00% |

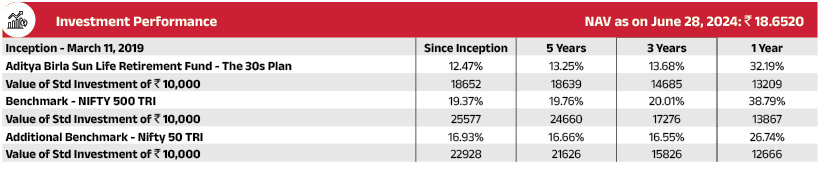

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 1. Total Schemes managed by Mr. Jonas Bhutta is 2. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

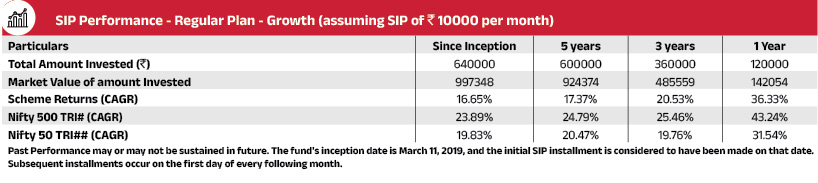

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.