Aditya Birla Sun Life Medium Term Plan* |

|

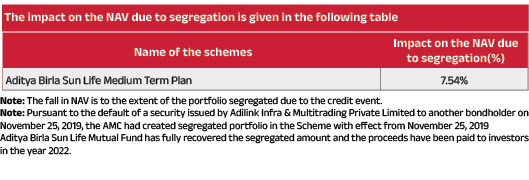

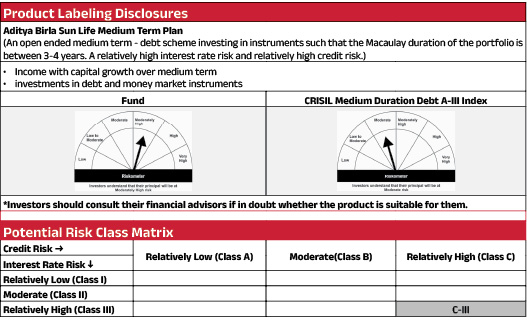

| An open ended medium - term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3-4 years. A relatively high interest rate risk and relatively high credit risk. Number of Segregated Portfolios – 1 |

| Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate regular income and capital appreciation by predominantly Investment Objective investing in a portfolio of debt securities with medium term maturity. The Scheme does not guarantee/indicate any returns. There is no assurance that the objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Ms. Sunaina Da Cunha & Mr. Mohit Sharma |

| Managing Fund Since | |

|---|---|

| September 1, 2014, August 06, 2020 |

| Experience in Managing the Fund | |

|---|---|

| 11.6 years & 5.7 years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | In respect of each purchase/switch-in of Units, upto 15% of the units may be redeemed / switched out without any exit load from the date of allotment.Any redemption in excess of the above limit shall be subject to the following exit load: For redemption/switch-out of units on or before 1 year from the date of allotment - 2.00% of applicable NAV. For redemption / switch-out of units after 1 year but on or before 2 years from the date of allotment - 1.00% of applicable. NAV For redemption / switch-out of units after 2 years - Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.56% |

| Direct | 0.81% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 2964.74 Crores |

| AUM as on last day | 2981.71 Crores |

| Date of Allotment | |

|---|---|

| March 25, 2009 |

| Benchmark | |

|---|---|

| CRISIL Medium Duration Debt A-III Index |

| Other Parameters | |

|---|---|

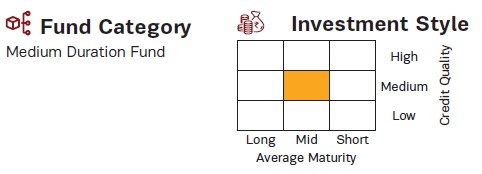

| Modified Duration | 3.25 years |

| Average Maturity | 4.30 years |

| Yield to Maturity | 8.01% |

| Macaulay Duration | 3.42 years |

| Portfolio Turnover | 0.94 |

| Calculation of YTM doesn't include Stressed Assets (ITPCL). Refer the Annexure for Update on Stressed Assets. | |

|

|

||

|---|---|---|

Regular Plan |

Direct Plan |

|

| Growth | 41.9547 |

45.8165 |

| Quarterly IDCW$: | 13.5157 |

14.2119 |

| Half Yearly IDCW$: | 13.9106 |

14.8239 |

| IDCW$: | 16.9429 |

18.5665 |

| $Income Distribution cum capital withdrawal | ||

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Weekly/Monthly: Minimum ₹ 1,000/- | |

| *Revised Maximum Subscription Limit : Rs. 10 crore per investor per day across all subscription transactions (i.e. fresh purchases, additional purchases, switch-in and trigger transactions such as SIP, STP as available) |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Fixed rates bonds - Corporate | 65.12% | |

| National Bank For Agriculture and Rural Development | 3.80% | ICRA AAA |

| Hinduja Leyland Finance Limited | 3.62% | CRISIL AA+ |

| Nuvama Wealth Finance Ltd | 3.22% | CARE AA |

| GMR Airport Ltd | 2.74% | CRISIL A+ |

| Jubilant Bevco Ltd | 2.67% | CRISIL AA |

| Jtpm Metal Traders Pvt Ltd | 2.65% | CRISIL AA |

| Kogta Financial India Ltd | 2.40% | CARE A+ |

| Power Grid Corporation of India Limited | 2.28% | ICRA AAA |

| Adani Power Limited | 2.27% | CRISIL AA |

| Gaursons India Pvt Ltd | 2.26% | ICRA A- |

| Sk Finance Ltd | 2.17% | ICRA AA- |

| Narayana Hrudayalaya Limited | 2.02% | ICRA AA |

| Vedanta Limited | 2.02% | ICRA AA |

| JSW Energy Limited | 2.02% | ICRA AA |

| Hero Housing Finance Ltd | 2.01% | ICRA AA+ |

| Security and Intelligence Services (India) Limited | 1.93% | CRISIL AA- |

| Small Industries Development Bank of India | 1.65% | CRISIL AAA |

| Housing & Urban Development Corporation Limited | 1.65% | ICRA AAA |

| Power Finance Corporation Limited | 1.63% | ICRA AAA |

| Hinduja Housing Finance Ltd | 1.55% | CARE AA+ |

| 360 ONE Prime Ltd | 1.52% | ICRA AA |

| IKF Finance Ltd | 1.50% | CARE A+ |

| Power Finance Corporation Limited | 1.30% | ICRA AAA |

| Adani Airport Holdings Ltd | 1.30% | CRISIL AA- |

| NTPC Limited | 1.13% | ICRA AAA |

| Bharti Telecom Limited | 1.00% | CRISIL AAA |

| JSW Energy Limited | 0.99% | ICRA AA |

| IndInfravit Trust | 0.93% | ICRA AAA |

| Power Finance Corporation Limited | 0.85% | ICRA AAA |

| Aditya Birla Housing Finance Limited | 0.84% | ICRA AAA |

| National Bank for Financing Infrastructure and Dev | 0.84% | ICRA AAA |

| Avanse Financial Services Ltd | 0.84% | CARE AA- |

| Eris Lifesciences Limited | 0.81% | IND AA |

| Eris Lifesciences Limited | 0.81% | IND AA |

| Delhi International Airport Ltd | 0.68% | ICRA AA |

| Adani Power Limited | 0.67% | CRISIL AA |

| Issuer | % to Net Assets |

Rating |

| Indian Railway Finance Corporation Limited | 0.59% | ICRA AAA |

| Vedanta Limited | 0.50% | CRISIL AA |

| Phillips Carbon Black Ltd | 0.47% | CRISIL AA |

| Highways Infrastructure Trust | 0.42% | CRISIL AAA |

| Sk Finance Ltd | 0.33% | ICRA AA- |

| REC Limited | 0.17% | CRISIL AAA |

| REC Limited | 0.04% | CRISIL AAA |

| IL&FS Tamil Nadu Power Company Limited | 0.00% | |

| IL&FS Tamil Nadu Power Company Limited | 0.00% | |

| IL&FS Tamil Nadu Power Company Limited | 0.00% | |

| Government Bond | 26.81% | |

| 6.79% INDIA GOV BOND 07OCT2034 GSEC | 9.42% | SOV |

| 7.10% GOVT 08-Apr-2034 | 7.61% | SOV |

| 7.18% GOVERNMENT ON INDIA 14AUG2033 GSEC | 6.37% | SOV |

| 6.48% GOI 06Oct2035 | 2.15% | SOV |

| 7.54% GOVERNMENT OF INDIA 23MAY2036 GSEC | 1.23% | SOV |

| 7.17% GOI (MD 08/01/2028) | 0.01% | SOV |

| 07.26% GOI (MD 14/01/2029) | 0.01% | SOV |

| 7.27% GOI 08APR26 | 0.00% | SOV |

| Transport Infrastructure | 1.87% | |

| IRB InvIT Fund | 1.09% | |

| Bharat Highways Invit | 0.78% | |

| REITS | 1.64% | |

| Nexus Select Trust | 0.94% | |

| Embassy Office Parks REIT | 0.70% | |

| State Government bond | 0.63% | |

| 7.63% ASSAM 03SEP35 SDL | 0.51% | SOV |

| 6.97% KARNATAKA 26FEB2028 SDL | 0.06% | SOV |

| 8.08% MAHARASHTRA 26DEC28 SDL | 0.04% | SOV |

| 6.97% MAHARASHTRA 18FEB2028 SDL | 0.01% | SOV |

| 6.35% ANDHRA 06MAY2027 SDL | 0.01% | SOV |

| 8.73% UTTAR PRADESH - 24OCT28 SDL | 0.01% | SOV |

| Power | 0.49% | |

| India Grid Trust | 0.49% | |

| Alternative Investment Funds (AIF) | 0.27% | |

| Corporate Debt Market Development Fund | 0.27% | |

| Cash & Current Assets | 3.17% | |

| Total Net Assets | 100.00% |

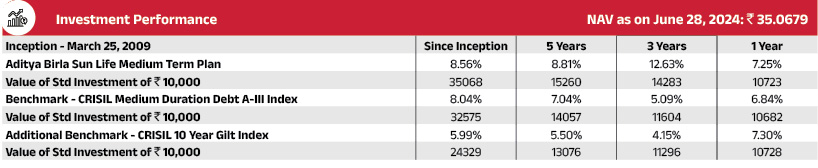

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 2. Total Schemes managed by Mr. Mohit Sharma is 15. Total Schemes managed by Ms. Sunaina Da Cunha is 5. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.