Aditya Birla Sun Life Arbitrage Fund |

|

| An open ended scheme investing in arbitrage opportunities |

| Data as on 30th January 2026 |

|

Fund Details |

|

Investment Objective |

|

| The Scheme seeks to generate income by investing predominantly in equity and equity related instruments. Scheme intends to take advantage from the price differentials /mis-pricing prevailing for stock / index in various market segments (Cash & Future). The Scheme does not guarantee/indicate any returns. There is no assurance that the objective of the Scheme will be achieved. | |

Fund Category |

Investment Style |

||

| Arbitrage Fund |  |

||

| Fund Manager | |

|---|---|

| Mr. Lovelish Solanki, Mr. Mohit Sharma & Ms. Krina Mehta |

| Managing Fund Since | |

|---|---|

| December 15, 2014 & September 24, 2021 |

| Experience in Managing the Fund | |

|---|---|

| 11.3 years & 4.5 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switch out of units within 15 days from the date of allotment: 0.25% of applicable NAV. For redemption/switch out of units after 15 days from the date of allotment: Nil. |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.03% |

| Direct | 0.31% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 26189.99 Crores |

| AUM as on last day | 26735.75 Crores |

| Date of Allotment | |

|---|---|

| July 24, 2009 |

| Benchmark | |

|---|---|

| Nifty 50 Arbitrage TRI |

| Other Parameters | |

|---|---|

| Modified Duration | 0.53 years |

| Average Maturity | 0.64 years |

| Yield to Maturity | 6.99% |

| Macaulay Duration | 0.54 years |

| Portfolio Turnover | 10.55 |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Daily/Weekly/Monthly: Minimum ₹ 100/- and in multiples of ₹ 1/- thereafter |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 27.4755 | 29.7395 |

| IDCW$: | 11.1110 | 11.5136 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Futures |

| Equity & Equity Related | ||

| Banks | 16.72% | |

| HDFC Bank Limited | 3.66% | -3.65% |

| ICICI Bank Limited | 3.21% | -3.22% |

| Axis Bank Limited | 2.96% | -2.97% |

| Kotak Mahindra Bank Limited | 1.64% | -1.64% |

| State Bank of India | 1.24% | -1.24% |

| RBL Bank Limited | 0.54% | -0.55% |

| Yes Bank Limited | 0.46% | -0.46% |

| Bank of Baroda | 0.45% | -0.45% |

| IDFC First Bank Limited | 0.44% | -0.44% |

| Union Bank of India | 0.42% | -0.43% |

| Bandhan Bank Limited | 0.39% | -0.39% |

| Punjab National Bank | 0.33% | -0.34% |

| Bank of India | 0.28% | -0.29% |

| AU Small Finance Bank Limited | 0.26% | -0.26% |

| IndusInd Bank Limited | 0.24% | -0.24% |

| The Federal Bank Limited | 0.09% | -0.09% |

| Indian Bank | 0.07% | -0.07% |

| Canara Bank | 0.03% | -0.03% |

| INVESTMENT FUNDS/MUTUAL FUNDS | 15.79% | |

| Aditya Birla Sun Life Money Manager Fund - Growth - Direct Plan | 9.79% | |

| Aditya Birla Sunlife Floating Rate Fund - Direct Plan - Growth | 3.90% | |

| Aditya Birla Sun Life Liquid Fund - Growth - Direct Plan | 1.41% | |

| ADI BI SU LI CRI-IB FS 6M-DG | 0.69% | |

| Finance | 6.10% | |

| Bajaj Finance Limited | 1.37% | -1.37% |

| Jio Financial Services Limited | 0.72% | -0.72% |

| Shriram Finance Ltd | 0.71% | -0.71% |

| Bajaj Finserv Limited | 0.68% | -0.68% |

| REC Limited | 0.59% | -0.58% |

| Aditya Birla Capital Limited | 0.51% | -0.50% |

| Sammaan Capital Limited | 0.38% | -0.38% |

| PNB Housing Finance Limited | 0.32% | -0.32% |

| LIC Housing Finance Limited | 0.27% | -0.27% |

| Housing & Urban Development Corporation Limited | 0.19% | -0.19% |

| Muthoot Finance Limited | 0.18% | -0.18% |

| Manappuram Finance Limited | 0.09% | -0.10% |

| Bajaj Holdings & Investments Limited | 0.04% | 0.00% |

| Cholamandalam Investment and Finance Company Limited | 0.02% | -0.02% |

| Indian Railway Finance Corporation Limited | 0.02% | -0.02% |

| SBI Cards & Payment Services Limited | 0.01% | -0.01% |

| Power Finance Corporation Limited | 0.00% | 0.00% |

| Petroleum Products | 4.50% | |

| Reliance Industries Limited | 3.95% | -3.96% |

| Hindustan Petroleum Corporation Limited | 0.38% | -0.38% |

| Indian Oil Corporation Limited | 0.13% | -0.13% |

| Bharat Petroleum Corporation Limited | 0.04% | -0.04% |

| Telecom - Services | 4.20% | |

| Vodafone Idea Limited | 1.89% | -1.90% |

| Indus Towers Limited | 1.37% | -1.37% |

| Bharti Airtel Limited | 0.77% | -0.95% |

| Bharti Airtel Limited | 0.16% | -0.03% |

| Automobiles | 4.00% | |

| Mahindra & Mahindra Limited | 1.95% | -1.96% |

| Maruti Suzuki India Limited | 1.20% | -1.20% |

| TVS Motor Company Limited | 0.48% | -0.49% |

| Eicher Motors Limited | 0.20% | -0.20% |

| Hero MotoCorp Limited | 0.10% | -0.10% |

| Tata Motors Passenger Vehicles Limited | 0.06% | 0.00% |

| Bajaj Auto Limited | 0.00% | 0.00% |

| TVS Motor Company Limited | 0.00% | -0.49% |

| Ferrous Metals | 2.81% | |

| Steel Authority of India Limited | 0.99% | -1.00% |

| JSW Steel Limited | 0.94% | -0.94% |

| Tata Steel Limited | 0.77% | -0.78% |

| Jindal Steel & Power Limited | 0.11% | -0.11% |

| Pharmaceuticals & Biotechnology | 2.52% | |

| Aurobindo Pharma Limited | 0.68% | -0.68% |

| Sun Pharmaceutical Industries Limited | 0.41% | -0.41% |

| Glenmark Pharmaceuticals Limited | 0.41% | -0.41% |

| Alkem Laboratories Limited | 0.24% | -0.24% |

| Biocon Limited | 0.21% | -0.21% |

| Divi's Laboratories Limited | 0.20% | -0.20% |

| Cipla Limited | 0.17% | -0.17% |

| Laurus Labs Limited | 0.10% | -0.10% |

| Lupin Limited | 0.05% | -0.05% |

| Zydus Lifesciences Limited | 0.02% | -0.02% |

| Mankind Pharma Ltd | 0.02% | -0.02% |

| Dr. Reddys Laboratories Limited | 0.02% | -0.02% |

| Capital Markets | 2.28% | |

| Multi Commodity Exchange of India Limited | 1.03% | -1.03% |

| BSE Limited | 0.87% | -0.87% |

| HDFC Asset Management Company Limited | 0.16% | -0.16% |

| ANGEL ONE LIMITED | 0.09% | -0.09% |

| Computer Age Management Services Limited | 0.06% | -0.06% |

| Central Depository Services (India) Limited | 0.06% | -0.06% |

| NUVAMA WEALTH MANAGEMENT LTD | 0.01% | -0.01% |

| Retailing | 2.27% | |

| Eternal Limited | 2.00% | -2.00% |

| Trent Limited | 0.26% | -0.26% |

| FSN E-Commerce Ventures Limited | 0.02% | -0.02% |

| Aerospace & Defense | 2.05% | |

| Bharat Electronics Limited | 0.98% | -0.98% |

| Hindustan Aeronautics Limited | 0.84% | -0.84% |

| Bharat Dynamics Limited | 0.22% | -0.22% |

| Power | 1.87% | |

| NTPC Limited | 0.48% | -0.48% |

| Tata Power Company Limited | 0.41% | -0.41% |

| Power Grid Corporation of India Limited | 0.31% | -0.31% |

| JSW Energy Limited | 0.30% | -0.31% |

| Adani Energy Solutions Limited | 0.22% | -0.22% |

| Adani Green Energy Limited | 0.14% | -0.14% |

| Consumer Durables | 1.78% | |

| Titan Company Limited | 0.68% | -0.68% |

| Dixon Technologies (India) Limited | 0.28% | -0.28% |

| Crompton Greaves Consumer Electricals Limited | 0.24% | -0.25% |

| KALYAN JEWELLERS INDIA LTD | 0.24% | -0.24% |

| Amber Enterprises India Limited | 0.11% | -0.11% |

| Asian Paints Limited | 0.10% | -0.10% |

| Havells India Limited | 0.06% | -0.06% |

| Voltas Limited | 0.05% | -0.05% |

| PG Electroplast Ltd | 0.02% | -0.02% |

| Diversified Metals | 1.56% | |

| Vedanta Limited | 1.56% | -1.57% |

| IT - Software | 1.52% | |

| Infosys Limited | 0.59% | -0.60% |

| Tata Consultancy Services Limited | 0.25% | -0.26% |

| HCL Technologies Limited | 0.23% | -0.23% |

| Tech Mahindra Limited | 0.16% | -0.16% |

| Tata Elxsi Limited | 0.10% | -0.10% |

| Persistent Systems Limited | 0.06% | -0.06% |

| MphasiS Limited | 0.06% | -0.06% |

| Coforge Limited | 0.03% | -0.03% |

| LTIMindtree Limited | 0.02% | -0.02% |

| Oracle Financial Services Software Limited | 0.01% | 0.00% |

| Wipro Limited | 0.00% | 0.00% |

| Cement & Cement Products | 1.52% | |

| Grasim Industries Limited | 0.71% | -0.72% |

| Issuer | % to Net Assets |

Futures |

| UltraTech Cement Limited | 0.58% | -0.58% |

| Ambuja Cements Limited | 0.20% | -0.21% |

| Dalmia Bharat Limited | 0.02% | -0.02% |

| Construction | 1.41% | |

| Larsen & Toubro Limited | 1.17% | -1.17% |

| NBCC (India) Limited | 0.24% | -0.24% |

| Realty | 1.34% | |

| Godrej Properties Limited | 0.43% | -0.43% |

| DLF Limited | 0.40% | -0.40% |

| Lodha Developers Limited | 0.33% | -0.33% |

| Prestige Estates Projects Limited | 0.11% | -0.11% |

| Phoenix Mills Limited | 0.07% | -0.07% |

| Oberoi Realty Limited | 0.01% | -0.01% |

| Diversified FMCG | 1.21% | |

| ITC Limited | 1.04% | -1.05% |

| Hindustan Unilever Limited | 0.17% | -0.17% |

| Healthcare Services | 1.06% | |

| Apollo Hospitals Enterprise Limited | 0.57% | -0.57% |

| Max Healthcare Institute Limited | 0.35% | -0.35% |

| Fortis Healthcare Limited | 0.11% | -0.11% |

| Syngene International Limited | 0.02% | -0.02% |

| Food Products | 0.97% | |

| Britannia Industries Limited | 0.74% | -0.75% |

| Nestle India Limited | 0.22% | -0.22% |

| Agricultural Food & other Products | 0.93% | |

| Patanjali Foods Limited | 0.54% | -0.54% |

| Marico Limited | 0.33% | -0.33% |

| Tata Consumer Products Limited | 0.06% | -0.07% |

| Industrial Products | 0.84% | |

| APL Apollo Tubes Limited | 0.55% | -0.56% |

| POLYCAB INDIA Limited | 0.25% | -0.25% |

| Cummins India Limited | 0.03% | -0.03% |

| Supreme Industries Limited | 0.00% | 0.00% |

| Electrical Equipment | 0.81% | |

| Bharat Heavy Electricals Limited | 0.41% | -0.41% |

| Suzlon Energy Limited | 0.19% | -0.19% |

| CG Power and Industrial Solutions Limited | 0.15% | -0.15% |

| Siemens Limited | 0.02% | -0.02% |

| Inox Wind Limited | 0.02% | -0.02% |

| Hitachi Energy India Limited | 0.01% | 0.00% |

| WAAREE Energies Ltd | 0.00% | 0.00% |

| Insurance | 0.81% | |

| SBI Life Insurance Company Limited | 0.33% | -0.33% |

| HDFC Life Insurance Company Limited | 0.19% | -0.19% |

| Max Financial Services Limited | 0.15% | -0.15% |

| ICICI Prudential Life Insurance Company Limited | 0.09% | -0.09% |

| Life Insurance Corp of India | 0.05% | -0.05% |

| ICICI Lombard General Insurance Company Limited | 0.01% | -0.01% |

| Auto Components | 0.81% | |

| Exide Industries Limited | 0.23% | -0.23% |

| Sona BLW Precision Forgings Limited | 0.21% | -0.21% |

| Samvardhana Motherson International Limited | 0.14% | -0.15% |

| Tube Investments of India Limited | 0.09% | -0.09% |

| Minda Industries Ltd | 0.08% | -0.08% |

| Bosch Limited | 0.05% | -0.05% |

| Bharat Forge Limited | 0.01% | -0.01% |

| Minerals & Mining | 0.74% | |

| NMDC Limited | 0.74% | -0.74% |

| Beverages | 0.74% | |

| United Spirits Limited | 0.53% | -0.53% |

| Varun Beverages Limited | 0.21% | -0.21% |

| Transport Infrastructure | 0.68% | |

| GMR Airport Ltd | 0.35% | 0.00% |

| Adani Ports and Special Economic Zone Limited | 0.33% | -0.33% |

| Non - Ferrous Metals | 0.62% | |

| Hindustan Zinc Limited | 0.59% | -0.59% |

| Hindalco Industries Limited | 0.04% | -0.04% |

| Gas | 0.62% | |

| GAIL (India) Limited | 0.47% | -0.47% |

| Petronet LNG Limited | 0.15% | -0.15% |

| Chemicals & Petrochemicals | 0.57% | |

| SRF Limited | 0.29% | -0.29% |

| Solar Industries India Limited | 0.17% | -0.17% |

| Pidilite Industries Limited | 0.11% | -0.11% |

| Financial Technology (Fintech) | 0.56% | |

| One 97 Communications Limited | 0.40% | -0.40% |

| PB Fintech Limited | 0.16% | -0.16% |

| Transport Services | 0.55% | |

| InterGlobe Aviation Limited | 0.40% | -0.40% |

| Delhivery Ltd | 0.08% | -0.08% |

| Container Corporation of India Limited | 0.06% | -0.06% |

| Oil | 0.46% | |

| Oil & Natural Gas Corporation Limited | 0.46% | -0.46% |

| Metals & Minerals Trading | 0.35% | |

| Adani Enterprises Limited | 0.35% | -0.46% |

| Adani Enterprises Limited | 0.00% | -0.46% |

| Industrial Manufacturing | 0.29% | |

| Mazagon Dock Shipbuilders Limited | 0.26% | -0.26% |

| Kaynes Technology India Ltd | 0.03% | -0.03% |

| Leisure Services | 0.21% | |

| The Indian Hotels Company Limited | 0.21% | -0.21% |

| Jubilant Foodworks Limited | 0.00% | 0.00% |

| Fertilizers & Agrochemicals | 0.20% | |

| UPL Limited | 0.20% | -0.20% |

| Personal Products | 0.04% | |

| Dabur India Limited | 0.02% | -0.02% |

| Colgate Palmolive (India) Limited | 0.01% | -0.01% |

| Godrej Consumer Products Limited | 0.01% | -0.01% |

| IT - Services | 0.04% | |

| Tata Technologies Ltd | 0.04% | -0.04% |

| Consumable Fuels | 0.01% | |

| Coal India Limited | 0.01% | -0.01% |

| Money Market Instruments | 8.21 | |

| National Bank For Agriculture and Rural Development | 1.22 | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 1.05 | ICRA A1+ |

| Punjab National Bank | 1.02 | CRISIL A1+ |

| Small Industries Development Bank of India | 0.96 | CRISIL A1+ |

| Canara Bank | 0.87 | ICRA A1+ |

| National Bank For Agriculture and Rural Development | 0.70 | ICRA A1+ |

| Union Bank of India | 0.36 | ICRA A1+ |

| Punjab National Bank | 0.28 | ICRA A1+ |

| Cholamandalam Investment and Finance Company Limited | 0.26 | ICRA A1+ |

| Bank of Baroda | 0.19 | IND A1+ |

| Standard Chartered Capital Limited | 0.19 | ICRA A1+ |

| Axis Securities Limited | 0.19 | ICRA A1+ |

| Export Import Bank of India | 0.19 | ICRA A1+ |

| ICICI Securities Limited | 0.19 | ICRA A1+ |

| Punjab National Bank | 0.19 | ICRA A1+ |

| Union Bank of India | 0.18 | ICRA A1+ |

| ICICI Securities Limited | 0.09 | ICRA A1+ |

| Cholamandalam Investment and Finance Company Limited | 0.09 | ICRA A1+ |

| Fixed rates bonds - Corporate | 1.24 | |

| Muthoot Finance Limited | 0.38 | ICRA AA+ |

| HDB Financial Services Limited | 0.37 | CRISIL AAA |

| HDB Financial Services Limited | 0.21 | CRISIL AAA |

| Muthoot Finance Limited | 0.19 | CRISIL AA+ |

| LIC Housing Finance Limited | 0.09 | CRISIL AAA |

| Cash & Current Assets | 75.13 | |

| Total Net Assets | 100.00% |

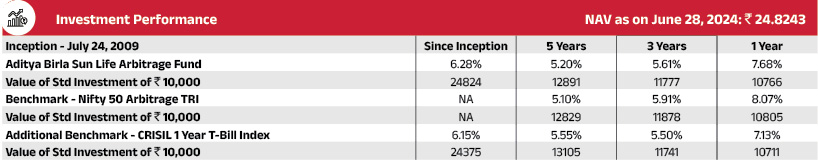

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes managed by Mr. Lovelish Solanki is 3. Total Schemes managed by Mr. Mohit Sharma is 15. Total Schemes managed by Ms. Krina Mehta is 1. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

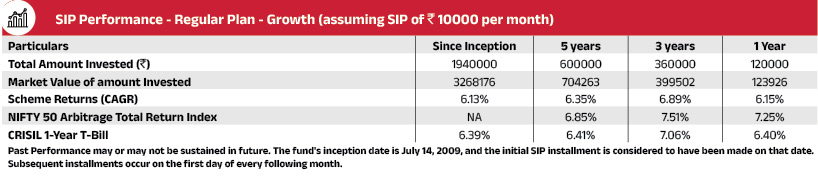

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.

This page is a part of the February 2026 Factsheet of Aditya Birla Sun Life Mutual Fund. Click on https://mutualfund.adityabirlacapital.com/empower/ for the digital factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.